Why falling investment bodes well for renewables

Total investment going into clean energy in 2013 was $US254 billion, down 12 per cent on 2012 levels, and the second year running that investment has declined, according to a wrap of numbers by Bloomberg New Energy Finance.

No doubt those who think global warming is a hoax will crow that this the second year decline in investment signals that the globe has finally woken up to the hopelessness of renewable energy. But when you delve into the numbers you come to realise that the drop in investment is, to a large extent, a function of declining costs of renewable energy, not a decline in the amount of renewable energy being installed.

In our charts of the week we’ll go through some of the key figures behind BNEF’s assessment.

The first chart details all the investment by quarter broken down between three regions 1) Europe, Middle East and Africa 2) Americas – North and South; and 3) Asia and Oceania.

Annual global investment in clean energy and annual change ($US billions)

Source: Bloomberg New Energy Finance (2014) Global Trends in New Energy Investment

Essentially, Asia continues to power on with investment and – thanks in large part to China but also a rapid rise in Japanese investment this year – is now the dominant investor in clean energy. Interestingly, Chinese total investment declined by a modest 3.8 per cent in 2013 to $US61.3 billion. This is the first fall in more than a decade even though it also emerged as a major buyer of solar PV. Yet this fall was more than made up for by a surge in Japanese investment, which increased 55 per cent to $US35.4 billion in 2013, due largely to an increase in solar PV installations.

However, clean energy has been unable to escape the general economic malaise which has gripped Europe due to the southern European governments’ debt crisis. Spain in particular has introduced the most savage cuts to renewable energy support. Unlike Germany, Spain’s feed-in tariffs were funded from government consolidated tax revenue rather than via an electricity levy. With the Spanish government hitting severe difficulties paying its debts, it has had to slash expenditure across the board and renewable energy feed-in tariffs were one of the many victims.

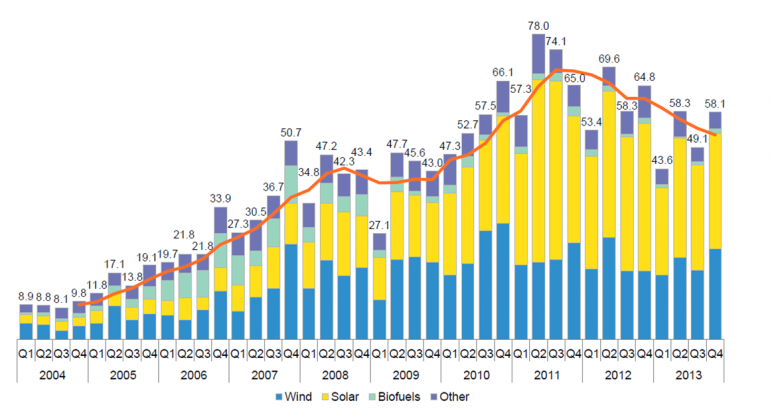

Once we delve down into investment by technology (shown below) and examine installed capacity numbers we can appreciate the silver lining in the second year decline in investment.

Investment by technology sector per quarter ($US billions)

Source: Bloomberg New Energy Finance (2014) Global Trends in New Energy Investment

Wind investment actually held pretty steady in 2013 at $US80.3 billion versus $US80.9 billion in 2012. While this investment is well down on the peak levels seen in 2010, wind power capacity installed in 2012 was 15 per cent higher than 2010. While there will be a dip in installations in 2013, Bloomberg expects installed capacity in 2014 to recover to levels slightly up on 2012. Wind turbine price drops essentially mean that capacity is growing while investment levels are declining.

Where the big decline in investment occurred was solar PV, which dropped to $US114.7 billion from $US142.9 billion the prior year. Yet actual capacity installed in 2013 is up about a fifth on 2012 levels and is forecast to be up another third this year versus 2013. Essentially, this is a good news story – solar PV installations are up substantially but cost is down.

Michael Liebreich, founder of Bloomberg New Energy Finance, commented:

In addition, stock market investors are now beginning to see brighter prospects for clean energy after an exodus from these more speculative stocks during the GFC and European Debt Crisis. The WilderHill New Energy Global Innovation Index, or NEX, which tracks the performance of 102 clean energy stocks worldwide, rose almost 54 per cent, beating wider market indices such as the S&P500 and the FTSE100 – although it's still a long way short of its peak back in 2008, before the GFC.

Relative performance of NEX vs NASDAQ and S&P 500 over 2013

Source: Bloomberg New Energy Finance (2014) Global Trends in New Energy Investment