Why car sales might not stay on course for long

The motor vehicle sector bounced back in December, following a couple of poor months, but the underlying trend remains quite weak and is consistent with a household sector that continues to tighten its belt.

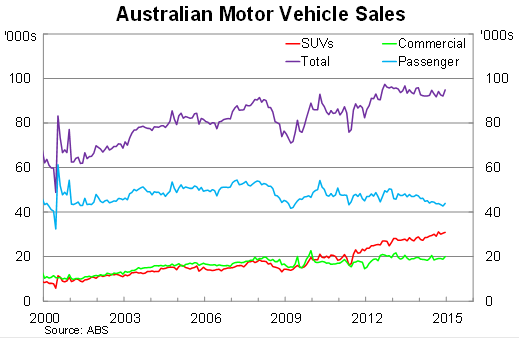

Motor vehicle sales rose by 3 per cent in December, to be 1 per cent lower over the year. Growth was mainly driven by passenger vehicles (which are mostly purchased for households but also have a business component) and commercial vehicles.

Passenger vehicles rose by 2.8 per cent in December but remain 7.1 per cent lower over the year. This segment is down 1.5 per cent in the December quarter, which indicates that it could subtract a modest amount from household consumption growth in the December national accounts.

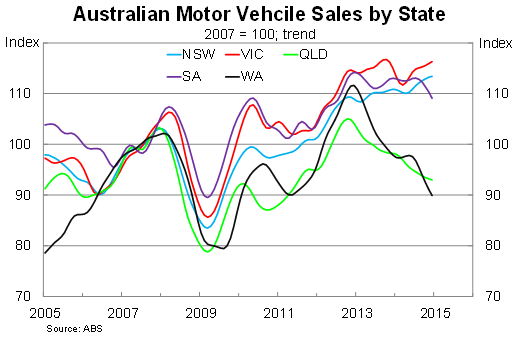

Sales of commercial vehicles surged by 6.5 per cent in December and are now up modestly over the year. Growth in commercial vehicle sales was fairly broadbased across the states, climbing by around 10 per cent in Queensland and Western Australia and by between 5 and 7 per cent in the other mainland states.

The bigger picture at the state level shows an economy that is beginning to rebalance. Sales continue to climb in Victoria and New South Wales but are well down on their peak in the mining states. On a trend basis, motor vehicle sales in Western Australia have fallen by around 20 per cent over the past two years.

At first glance it seems that the depreciation in the Australian dollar may have contributed to the ongoing slowdown in sales, since around 90 per cent of new Australian motor vehicles are imported from abroad. But this proposition doesn't stand up to scrutiny, with CPI data indicating that motor vehicles became more affordable over the year to the September quarter.

However, it is reasonable to believe that a weaker dollar will eventually weigh on Australian purchases. As a result, don't be surprised if this month's outcome is more of a one-off and the market resumes its downward trend in early 2015.

Motor vehicle sales account for a relatively small share of household consumption -- typically around 2.5 per cent each quarter -- so we shouldn't read too much into the data itself. Motor vehicles are one of the biggest discretionary purchases a household will make; when the going gets tough and consumers begin to tighten their belts, motor vehicle sales are often one of the first areas to take a hit.

The ongoing weakness in trend motor vehicle sales highlights the challenge facing Australian households. Soft income growth and rising unemployment have clearly weighed on household spending over the past year and, increasingly, growth in real household spending has reflected population growth rather than improving living standards.

Lower oil and fuel prices will be a welcome reprieve for Australian households and should support spending in the first half of this year. It may even provide a boost to motor vehicle sales due to the decline in operational costs. These gains, however, will be offset by a lower Australian dollar and it is not yet clear which factor will dominate.