Why Australians may soon turn sour on their beloved banks

Australians save differently to rest of the world -- we love banks. So today, with the help of Reserve Bank Deputy Governor Philip Lowe, I will detail the ‘bank love affair’ and then show how that love affair could eventually turn sour.

Even though interest rates have been falling, we have lifted our bank deposits and we have increased our buying of bank shares and hybrids.

In other countries, particularly the US and Europe, they have seen bank solvency in jeopardy. Therefore banks are far less important to savers, with corporate bonds taking a bigger role. Thanks to good regulation and bank management -- plus some luck -- our banks have been safe. That’s not likely to change, so we feel comfortable investing in them.

For most Australians, superannuation is the main form of savings outside of the family home.

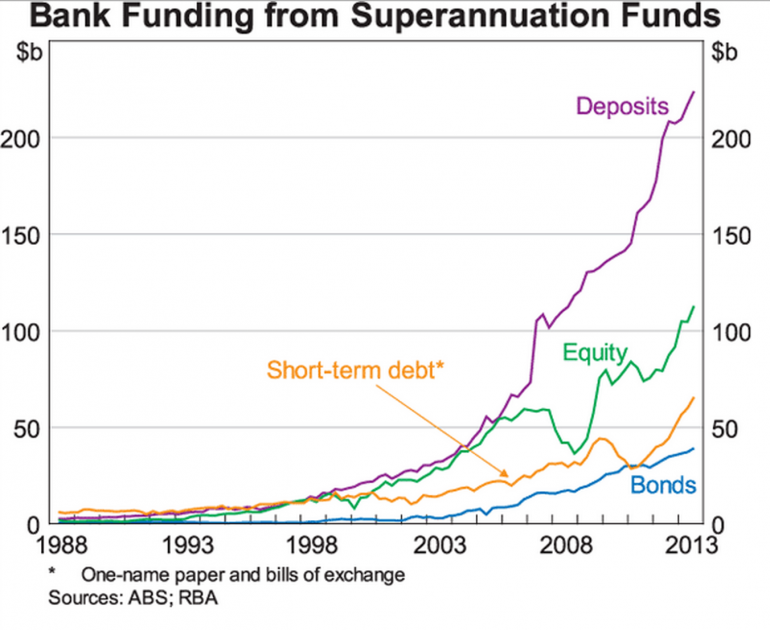

Lowe has plotted some fascinating trends in the way our superannuation funds invest and uses a graph to describe the love affair.

Australian superannuation funds have poured money into bank deposits because it is the best form of government guaranteed security around (the guarantee is up to $250,000).

Much of that money has come from self-managed funds. The professionally-run funds don’t use bank deposits as much because they do not get commissions.

We have invested in banks hybrids because we think banks are safe, and so we take the risk to gain another 2-3 per cent above bank deposits.

As the Lowe graph shows, our superannuation funds are increasingly becoming buyers of bank shares. Banks are able to distribute big portions of their profits in dividends, and so bank shares are high yielding. This has attracted substantial superannuation support and, as a result, our bank shares are more expensive than other countries.

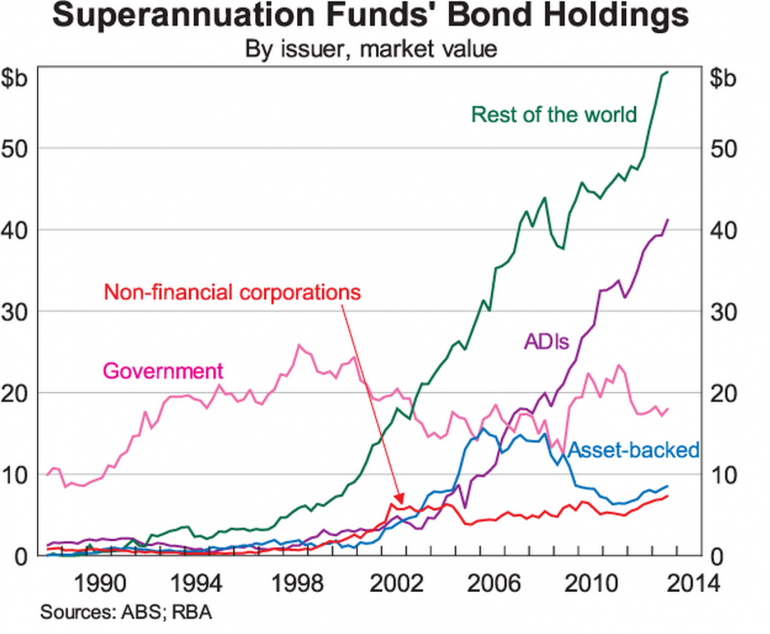

Now let’s look at how funds in other countries support corporate bonds, rather than bank deposits. Lowe’s graph sets it out.

Why is Australia different and how could the love affair end?

If the proposals that came before the ADC Australian Infrastructure Summit are embraced, then Australia will have a large amount of secure income infrastructure securities which will rival bank deposits (A new way to fund rail, roads and hospitals, March 17; Rising unemployment: self-managed funds to the rescue, March 24).

All the central planners in Canberra and the banks are pressing for a different model that benefits the institutions, but I believe that the Summit model is the only way major infrastructure investment can work, given government funding restraints. In the process, the retirement annuities created will be better than bank deposits for many superannuation funds.

I remember investing in Telstra and BHP bonds in the 1960s and 1970s. Along with other big companies, both ran major fixed interest-raising departments.

Today major companies like Telstra borrow overseas because the strong demand for the Australian dollar means that they can borrow at very low global interest rates and then hedge back into Australian dollars, providing much lower interest rate costs than issuing Australian currency bonds, given competition from bank deposit rates.

Australian bank regulators require much more equity for bank loans to small and medium-sized business than housing loans. And so most of that big rise in bank superannuation investment goes into housing.