Why Australia isn't banking on corporate bonds

Is Australia’s undeveloped corporate bond market a concern? Reserve Bank of Australia Deputy Governor Philip Lowe doesn’t think so.

Lowe, speaking at the Australian Securities and Investments Commission Annual Forum, discussed the development and role of market-based financing in comparison to bank financing. He concludes that although Australia’s bond market is undeveloped, “we do have the infrastructure that could support a strong and very active bond market in times of stress or inadequate competition”.

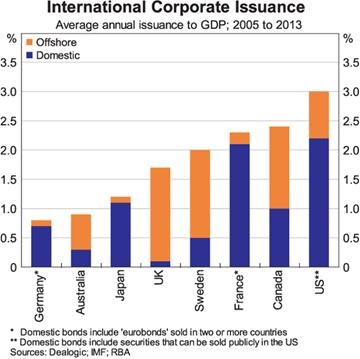

By international standards, Australian non-financial corporations rarely access bond markets to finance investment and operations. When they do issue bonds, they primarily do so through international markets. The outstanding value of corporate bonds issued domestically is largely unchanged over the past decade.

As a share of GDP, corporate bond issuances in Australia compare unfavourably with other developed countries. Corporate bond issuances in Australia are under 1 per cent of nominal GDP, compared with 3 per cent in the United States.

It is difficult to pinpoint precisely why this is the case, but two driving factors could be bank relationships and company size.

Banking is all about relationship building and, if a business relied upon a bank at its inception or the bank supports them through difficult times or helps them expand, then they are likely to persist with this relationship.

Evidence suggests that for large loans, Australian businesses would prefer to use syndicated lending -- headed by their chosen domestic bank -- rather than access bond markets.

Corporate bonds also tend to be quite large. They are an alternative form of business finance to bank loans or issuing equities. But Australia has very few businesses that are large on an international scale -- a few banks and a few mining firms and that’s about it. It is possible that the scale simply doesn’t exist in Australia to create a deep corporate bond market with sufficient liquidity when there are perhaps better alternative for small and medium-size organisations.

Superannuation was set to be the major driver of market financing, but that has yet to eventuate. Superannuation funds currently hold around $7 billion of domestically-issued corporate bonds -- around 15 per cent of the total value outstanding.

However, superannuation funds have always had a strong preference for equities and Australian corporate bonds only account for around 1 per cent of total superannuation assets.

Interestingly, superannuation funds are more than happy to hold international bonds of the government or business variety. Lowe argues that this suggest “that the issue is not so much a lack of appetite for bonds, but rather the relative risk-return and liquidity characteristics of the corporate bonds on offer”.

Superannuation funds also purchase significant volumes of non-bond bank liabilities. Instead of financing the corporate sector directly, superannuation funds have effectively helped finance the banks, which in turn have financed the corporate sector.

Bond markets are important to the efficiency of a country’s financial system and even though Australia’s corporate bond market is small, Lowe believes it is sufficient to fulfill its role as an alternative to bank finance.

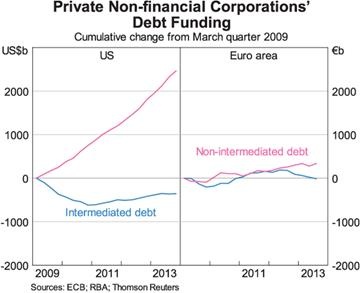

In terms of financial stability, a vibrant corporate bond market can be important alternative to bank finance if the banking system gets into trouble.

International experience suggested that this happened to some extent during the global financial crisis but the transition was far from seamless: in Australia, corporate bond markets completely froze up during the crisis. Nevertheless markets seem to recover more quickly than banks during severe financial crises.

A healthy bond market can also provide valuable competition for the banking sector. This is particularly important in Australia, where so much financial activity is concentrated among the major four banks.

Lowe argues that it is not necessary for the market to be deep and vibrant at all times -- which Australia’s obviously isn’t -- but “what is needed is that we have the general infrastructure that would allow the market to respond if necessary”. Effectively, the threat of competition might be enough to keep the banks in line.

The Australian corporate bond market will continue to grow, but it unlikely to ever be a major driver of corporate finance. Most Australian firms are simply too small by international standards to regularly utilise market financing and, for many, the close relationship formed with their bank is the best option for debt financing.

But as Lowe mentions, it is important that bond markets exist as competition for bank lending, particularly in a market that is dominated by the four major banks. However, the domestic bond market found itself wanting during the global financial crisis and I’m not convinced that it would provide an adequate alternative to bank financing if our banks found themselves in difficulty.