Who pays for demand drop errors?

The Australian Energy Market Operator on Friday revised downwards their forecast for electricity demand across Australia. Again. Not that you can blame them; whether you expect a death spiral or not, demand forecasting at a time of market upheaval and changing climate is a tough gig, and no one else is getting it right either.

Due to changes to industrial loads, reduced residential and commercial consumption and warm weather, energy used in the first quarter of the 2013-14 financial year was 3.5 per cent lower than predicted in AEMO’s 2013 National Electricity Forecasting Report released only two days before the start of the quarter.

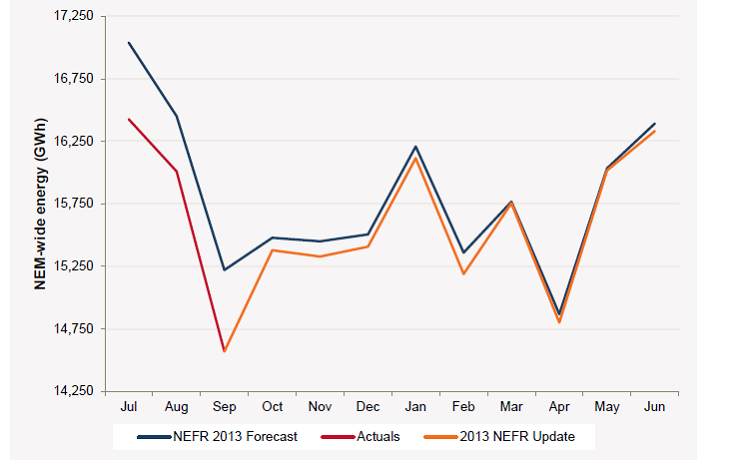

The red and blue lines below show the difference between the forecast and actual energy during that period.

This dramatic variation spurred them to revise their forecast for the remainder of the 2013-14 year.

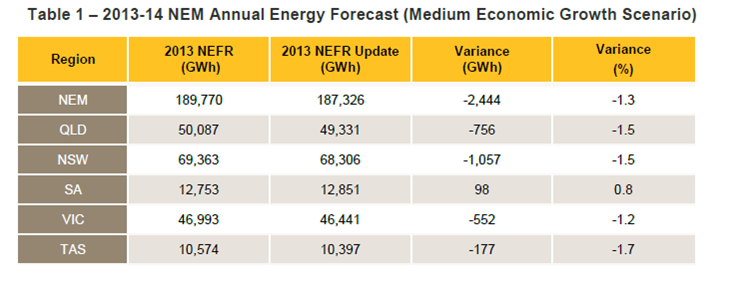

The revised forecast shaves a further 1.3 per cent (2444 GWh, or 2,444,000,000 kWh) off the previous forecast for the 2013-14 year, with each state except South Australia – which experienced an unanticipated increase in large industrial loads – seeing a reduction of 1.2-1.7 per cent.

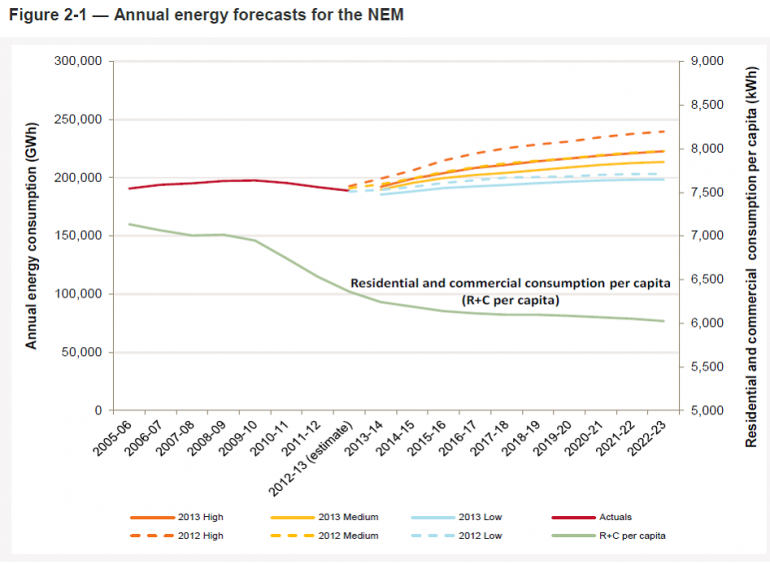

While Friday's announcement only alters the forecast for the 2013-14 year, it follows successive years of energy demand falling below expectations, continues the resultant trend of revising forecasts downwards, and obviously raises questions about the reliability of current longer term (10-year) forecasts that remain predicated on growing demand in spite of the continuing reduction of the recent years.

Considering the below figure from the original 2013 National Electricity Forecasting Report, the demand in the first quarter of 2013-14 clearly followed the trend of observed reductions since 2009-10, rather than the projected steady increase in demand from 2013.

Will AEMO change its approach to forecasting to give more weight to recent trends and place less emphasis on growth? We’ll know when it publishes an independent review of the 2013 National Electricity Forecasting Report later this month, along with an action plan that details planned improvements for the 2014 NEFR.

Impacts of reduced demand and forecasting error on energy prices

There have been recent deliberations about the impacts of forecasting error in the NEM.

The Australian Energy Market Commission recently provided COAG's Standing Council on Energy and Resources with advice about the impact and possible treatment of forecasting errors made by the regulated network businesses, after years of erroneous forecasting that repeatedly erred in favour of the businesses. Naturally, the favour of the businesses came at the expense of consumers, and the regulator had limited opportunity to prevent the error and no means of redress after the fact.

Aside from the discussion about forecasting accuracy, the reduced demand already observed in the latest quarter and the altered forecast will further enliven a number of other debates currently raging in the Australian energy market.

It will amplify the tremors of energy generators (and retailers) who are already anxious about dropping demand at a time of surplus capacity in a competitive environment. In the near term, this should place downward pressure on wholesale and retail prices through improved competition – though no doubt Tony Abbott will claim any difference as an outcome of ‘tax-axing’ – and, provided governments do not bend to pressure to protect the profits of these businesses, then this benefit should persist. Should.

But in spite of the drop in energy consumption, the forecast for peak demand remains unchanged. And because peak demand (MW, kW) is a driver of investment in network infrastructure, while costs for the same are recovered mainly through regulated energy-based (MWh, kWh) charges, this will temporarily reduce revenue for price-capped (i.e. non-Queensland) network businesses as well.

So without doubt this will feature in the discussion on network charges as the networks clamour to improve the certainty of cost recovery through measures such as increased fixed charges to consumers.

And finally, there is always the demand death spiral.

Craig Memery is ATA’s energy consumer advocate.