Which LICs are prepared for leaner times?

Summary: Listed investment companies can retain earnings to pay out dividends, compared to managed funds which typically pay out all income generated for the year. This allows LIC managers to set aside funds to continue paying dividends in difficult years. Consistent dividend payers such as AFI, BKI and ARG have increased dividends steadily over the years, while more active managers like CDM are able to pay higher dividends but this will vary. |

Key take-out: Profit reserves are made up of both realised and unrealised capital gains and the latter can evaporate quickly. Keep an eye on profit reserves but also look at a LIC's performance. |

Key beneficiaries: General investors. Category: LICs. |

When it comes to income there is a reason why I favour LICs over managed funds and it can be found in the name. They are companies. This means just like every other company listed on the market they are able to retain earnings to pay out as a dividend. They pay tax on the profits they make and pass this on as franking credits. Like any other listed company the board and management will set a dividend policy. They will decide what is reinvested into the portfolio for NTA growth and what is distributed to shareholders.

This differs to a managed fund which typically has a trust structure. In this structure the fund does not pay tax. The unit holders pay tax and because of this all income generated for the year, dividends accrued and realised capital gains must be paid out. The tax needs to be paid by someone. If a unit trust has a very good year investors will receive a big distribution, while if it has a lean year investors will receive a small distribution.

When it comes to income investing this is where the company structure has its advantages over a trust. It then comes down to the manager to make sure there are enough retained earnings and franking credits to smooth out the ride and be consistent with the dividend policy. Inevitably a manager will have a tough year either due to the stocks they hold cutting dividends or not performing. It will happen no matter how good the manager is. Shareholders want to know that when these lean times come along the manager has been a diligent squirrel, putting away dividends for the winter of lesser returns.

Reading into profit reserves

LIC managers book realised and unrealised profits into the profit reserves on a monthly basis. For example, if a manager makes 4 per cent in the month of July and books it, then makes a negative return the following month, they will book the negative too. They then need to make up the loss.

A manager wants to have positive returns so they can book as much as they can into the profit reserves. If the manager has a negative year the reserves will still allow them to keep shareholders happy and pay a dividend but have if they have too many negative years they won't have anything left to pay out.

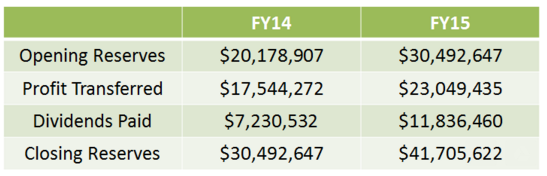

Profit reserves for LICs are the same as retained earnings for standard stocks and can be found on the LICs' balance sheets. Take LIC model portfolio holding WAM Research (WAX) for example. WAX's annual report shows that on July 1, 2013, it had profit reserves of $20,178,907. WAX booked $17,544,272 into the profit reserves by June 30, 2014 and paid total dividends of $7,230,532. This brought the closing balance in the profit reserves to $30,492,647.

The following year WAX booked $23,049,435 and paid out $11,836,460 in dividends. Closing balance for the profit reserves as at June 30, 2015 was $41,705,622.

Using round numbers if WAX had flat years returns-wise from here forward the company could maintain its current dividend of 8 cents per share for the next three and a half years. Pretty handy for shareholders to have this kind of buffer in place. As the saying goes, the share market can remain irrational longer than you can remain solvent.

Sustainability of dividends

An LIC manager's ability to sustain a dividend depends on the quality of the portfolio, the execution of the investment strategy and the management of the reserves. The trick to it? Don't pay out more than you earn. Right now it is fairly common to see companies stretching themselves to please shareholders' current demands for income. Fair enough if the managers of listed companies cannot adequately redeploy those funds within the business to generate a return.

Of the 10 LICs surveyed for this piece two had negative earnings per share for fiscal 2015: Contango Microcap (CTN) and Australian Leaders Fund (ALF). CTN cut the dividend by more than half from 8.6c per share to 4c, while ALF reduced its dividend marginally from 12c per share to 10c.

CTN paid a total of $13.6 million in dividends last year leaving the small cap manager with a reserve balance of $24m. This leaves CTN with 1.7 years of dividend coverage in the reserves if it maintains the previous dividend and makes no return in this market.

ALF paid a total of $27.9m in dividends last year leaving reserves of $11.8m. Either ALF will have to perform well during this difficult FY16 or shareholders will have to prepare themselves for a hefty cut to the dividend. So far for the three months to the end of September ALF has been able to increase NTA from $1.33 per share to $1.36.

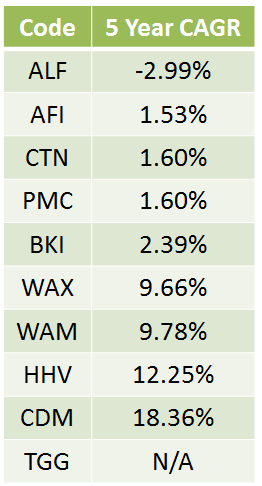

Who has cash to spare and who's flying close to the sun? Consider the following table:

This is why it is important to know the investment process and philosophy behind the LIC you look to invest in. If you are holding an LIC with a more passive approach like BKI it's important to be comfortable with the buy and hold investment approach the team takes. Tom Millner of BKI says his ability to continue to pay an ever increasing stream of dividends no matter the circumstances comes down to the quality of businesses he is investing in. “When times get tough you want to have invested in companies with strong balance sheets; servicing higher levels of interest can put pressure on dividends paid out by companies,” Millner says. “This is where investing in quality companies comes into play.”

When investing in an LIC with more moving parts like ALF which can invest in international stocks and Australian equities both long and short you need to have confidence in the manager to use the tools at their disposal effectively to make profit in all types of markets.

Know what you are getting

When reading the dividend policy of an LIC it is typical to see the following words: “the board is committed to paying an increasing stream of fully franked dividends”. But who has actually done it?

The consistent dividend payers like AFI, BKI and ARG have stuck to their mandate and have increased dividends steadily over the years. These LICs tend to have a high payout ratio and will tend to pay out a yield closer to the market average as it predominantly comes from dividends the portfolios receive.

The more active managers like CDM are able to pay higher dividends due to realised gains and the income the portfolio receives but this will vary. It is also prudent to be wary of the value trap when looking at yield. The running yield for HHV and CTN is more a reflection of a decreasing share price rather than increasing dividend. Investors should always look for total return and not chase yield at the cost of capital.

Let's not get too carried away

Let's not get caught up in the name profit reserves. There are no formal rules stating the profit reserves are purely to be used for dividends. They are generally destined for dividends and indicate the board's intent to pay. The profit reserves are made up of both realised and unrealised capital gains and as the last few months in the market have shown us unrealised gains can evaporate very quickly.

While the name profit reserves is a good selling point for LIC managers, investors need to look through to the performance. Once performance starts to decline (best measured month by month via the NTA) and the reserves run low, the dividends will be cut. In a yield-hungry market the share price of the LICs that find themselves in trouble will come under a lot of pressure.

While the profit reserves aren't the be all and end all I still prefer to see a manager with a nice amount stashed away. Yield is already a vital component to investors' returns and maintaining yield is going to be vital for LIC managers. Keep an eye on those reserves and don't over pay for yield. Total return is what counts.