Where to get the best cash returns

| Summary: With interest rates so low, getting a good return from interest-bearing securities is no easy task. Here are the best rates available on term deposits, hybrids and some other options to consider. |

| Key take-out: It’s important to have interest-bearing securities as part of your portfolio, however it is important to shop around and remember that higher returns generally equates to higher risk. Also consider that longer-term securities offer higher returns, but you must be prepared to lock up your money for the duration of the term. |

| Key beneficiaries: General investors. Category: Fixed interest. |

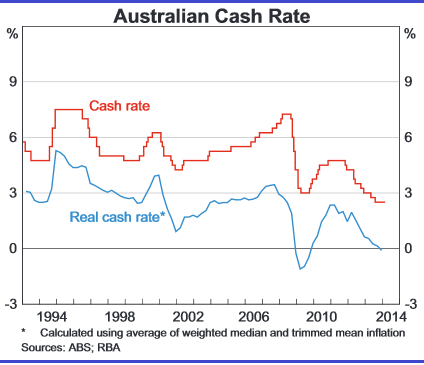

Around the world the sniff of higher interest rates is becoming more widespread. That particularly applies in the US, but closer to home New Zealand became the first developed country to reverse the cycle of lower interest rates.

The current firmness in the Australian dollar partly reflects a belief we may have turned the interest rate corner. I don’t think higher interest rates are likely in the medium term, but it is a good time to have a look at what is around the interest-bearing securities market.

Those that have put a large percentage of their funds in interest-bearing securities have had a pretty tough time. I know a number of people who invested in longer-term deposits with banks and those deposits are now maturing. They now need to find places to invest the money. And it is really hard to duplicate the sort of returns that were available on term deposits a few years back.

In particular, once you invest in term deposits below 4% (and some would argue 5%) then, assuming a 15% tax rate, you are barely keeping up with inflation. If your tax rate is any higher (i.e. you are investing personally), then you are into negative returns.

A few weeks ago I had friends from Switzerland in Australia. In Switzerland interest rates are at only token levels, and they are simply living on their capital plus the income they get from the share and real estate markets. While we haven’t reached that stage, interest rates below 4% head us in that direction. One strategy is to take the lower rates and wait for an upturn, but let’s look at what we can get in the current market aiming for at least 4% with an aim to go closer to 5%. And then some measured risk to take us higher.

This is not a commentary about the sharemarket, where clearly the banks and Telstra are the stand-out investments to gain income. In most superannuation portfolios these stocks are important parts of the equity mix, particularly if there is a hankering towards income. I’m particularly fond of Telstra.

Term deposits

In term deposits, the stand-out one-year bank term deposit is clearly the National Australia Bank’s 4%. To get that 4% you have to bank electronically via Ubank, which is backed by NAB. If you are not familiar with this process it is a bit of a hassle, but it is the best value in town in terms of one-year bank deposits and at least we have reached the 4% target mark. If you think rates are going to rise later in 2014 or 2015 a one-year UBank investment is a reasonable strategy

UBank cuts off at one year, so if you want better rates in terms of other bank deposits you have to go out into two years. Both Bank of Melbourne and St George offer 4% for two years, but it is not until the three-year term mark that most conventional banks offer 4%.

If you can go a little longer, CUA offers 4.15% for three years. CUA is a credit union but, like all credit unions, its deposits are guaranteed by the Commonwealth government up to $250,000, which makes the investment secure. Where you are investing outside the conventional banking system, but within government guarantees, limit your deposits to $250,000. The Commonwealth guarantee means you are perfectly safe with your money. If you want returns a lot higher than 4% from term deposits you’ve got to go into four and five-year deposits. The Police Bank is offering 4.6% for five years, but the king of five-year rates is Rabo bank with a 5% return for five years, Commonwealth government guaranteed up to $250,000. That Rabo rate has recently been increased, indicating Rabo clearly believes that in the longer term there will be an interest rate rise.

And, of course, when you invest into three, four and five-year term deposits you need to understand that if interest rates rise you will be frustrated. Make sure that these are part of your interest-bearing portfolio and are not likely to be called on to meet pensions and/or other payments. There are heavy penalties for cashing in too early, so this is a very important proviso. But having said that, rates around 4.5% to 5% are at least giving you some sort of reasonable return in the current environment.

If you invest below 3% then interest rates have to rise by more than 2% to get you to the 5% level. An interesting non-guaranteed long-term alternative is RACV Finance, which offers 4.8% for four years. Here there is no government guarantee, but the RACV is Australia’s largest mutual organisation with about $2 billion to $3 billion in market value of members’ funds. The only debt is in the finance company, which has low leverage and a huge spread of car loans.

I have used its long-term debentures as part of my interest-bearing securities portfolio and if you happen to be a member of the RACV Club (that’s different from the road service association ) you get an extra 0.25% – a total of 5.05%.

Hybrid securities

If you’re prepared to take a little more risk there are hybrids. As I have written on previous occasions I have been burned on industrial company hybrids and have vowed not to invest in them again. That might be harsh, but I tend to find the industrial companies that need hybrids tend to be the very companies you don’t want to have a security in that ranks after all creditors. Similarly, I have a view about insurance companies and their hybrids. The hybrids in insurance companies are there to protect policy owners in case of a catastrophic event. Given the high levels of storms and other damage that is taking place I prefer not to be part of an insurance risk hedging process given that the rewards are not all that great. That may be harsh, but that’s how I feel.

So let’s concentrate on the bank hybrids, and I am assuming there will not be a bank calamity in Australia. In the case of calamity there is some risk, but I really don’t think it is a likelihood given the very high level of bank shareholders’ funds. In addition, we have strong regulations and overall good management in Australian banks. Hybrids usually give you the chance to earn above 6% after franking credits. Given the nature of the security this is not exactly a very high rate of return, but on the other hand compared to bank term deposits below 4% it provides a worthwhile income and I certainly have included hybrids in the big four banks as part of my interest-bearing securities portfolio. And if rates rise, income increases.

Talk to your advisor to pick out specific hybrids in the big four banks, but my low-risk suggestion is Commonwealth Bank Perls VI (CBAPC. Another alternative is to go to an interest-bearing securities broker. At recent Eureka seminars the FIIG Group has presented and I have used them to buy some corporate interest-bearing securities. Have a look carefully at the income stream that you are relying on and the security of that income stream plus capital repayment situation. There are some really interesting inflation securities that sometimes come up, and I have been able to invest at over 6% assuming a 2.5% inflation rate.

Solicitor mortgages

Another area that is available is solicitor mortgages. Be really careful in this area. Make sure that the group you are dealing with has been around for a long time and make sure that it is all above board. Well negotiated solicitor mortgages of one and two years can be a good interest-bearing security investment, but there are a lot of stories of bad practices amongst solicitors.

There is no government guarantee and there will be no-one to help you if it goes bad. But if you know the solicitors involved and you are confident about them then it is a very safe way to earn over 6% on your money. But there are no magic puddings and as you move up the track into higher interest rates, so the risk level increases.

Summary

The essence of the process is to have interest-bearing securities as part of your portfolio as a properly constituted segment. If your financial planner simply says that half your money should be in cash in perpetuity then I would think about a different advisor. Of course, if you have a particular plan and it’s a waiting game then high amounts of cash make sense.

But if there is no plan you can get better rates of interest by taking longer security periods. Interest-bearing securities should be a part of many portfolios, particularly amongst older people and usually at-call or short-term rates are not the way to maximise returns unless rates are about to rise.

Short-term deposits are fine if you have something else in mind. And most funds need to keep a small degree of liquidity, but usually 50% is too high.

You are much better to have say 10-20% in cash and 40% in longer-term securities. Alternatively, you should have more in equities. I hope the above conversation will help you establish a proper interesting-bearing securities portion of your portfolio – if that’s what suits your long-term objectives.