Where the real recession risk lies

Summary: Some commentators are expressing concerns about a housing recession and risks to bank stocks. But although house prices are rising, a fall in prices alone doesn't cause recessions – what's also needed is a slump in housing construction, or bank insolvencies. Falls in residential construction do happen, but this call is extremely premature. Plus, every recession in an advanced economy in modern times has been caused by tighter economic policy, on the back of rising inflation, which is not a risk for Australia now. |

Key take-out: The chances of a downturn have risen due to confidence taking a belting, but it's premature to be talking about a housing-induced recession. There is no evidence to date that risks to either the property or the banking sector have increased materially at this point. |

Key beneficiaries: General investors. Category: Economy, bank stocks. |

A key issue for investors is whether the risks to bank stocks – and the property sector more generally – have risen. Reading the papers you'd be forgiven for thinking they had – it's natural, when you're bombarded with a particular view, to start having doubts. That's no bad thing. We should always question our investment strategies or allocation.

This time around, newspapers have run a number of headlines proclaiming a 1 in 3 or even a 50% chance of a recession over the next 12 to 18 months. As readers are aware, the recession call is not new in a post-GFC Australia. Indeed it has gone out every year since. Goldman Sachs in particular is obsessed by one, having called or at the least discussed one in nearly every (if not every) year since the GFC.

While it's had a number of incarnations – the non-mining recession, the east coast recession, the mining recession – this time it's a little more ominous. Analysts are concerned that Australia's booming housing market poses serious risks that could cause a recession: The housing recession. Ominous because this call actually has some basis in fact, unlike the previous versions, so I do have some sympathy it as it correctly identifies a key driver of recession. Added to that, house prices are growing strongly in some cities and construction has picked up sharply. It all adds.

Having said this, there are a few things we need to be careful of. Firstly, while housing prices are rising, there are only three cities that have solid-strong price growth – Sydney, Brisbane and Melbourne. Should that momentum run out of puff, I don't think anyone should be concerned about a recession. A fall in prices doesn't cause recessions per se – never has. We've seen a number of episodes of moderating or falling house prices which weren't associated with a recession or even a downturn. Sydney, for example, from 2004 to 2006.

What you need to see is a slump in housing construction as well, or bank insolvencies. Yes, construction has picked up sharply and there is a fear that this lift, alongside strong house price growth, will spark an ‘irrational exuberance': Construction will surge further, leading to a glut or a bubble and then collapse – a stock standard housing-induced recession. Indeed readers may remember that the 1980s recession saw a huge slump in residential construction. They happen, they're real and worth watching.

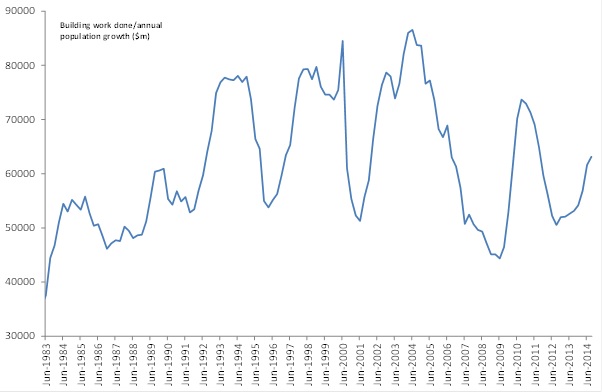

Chart 1 shows why the call is extremely premature though. Construction has surged, this is true, yet it is nowhere near the peaks that we saw during the mid-noughties, the late 90s/early noughties and again back in the mid 90s – when adjusted for population growth. Just noting the supply of new housing, that construction has surged is irrelevant, because population growth has been strong as well. Chart 1 tells us that residential construction really isn't threatening when you compare it to population growth. Note also in chart 1 that a recession didn't always follow the peaks. In fact our last recession in the early 90s seems to have had nothing to do with housing.

Chart 1: Housing construction still below population growth

This highlights the fact that a glut of housing may be a necessary condition for a housing recession, but it's not sufficient. The missing link is tighter monetary policy. In fact every recession, or every advanced economy recession in modern economic times has been caused by tighter economic policy, all on the back of rising inflation – and that quite simply is not a risk for Australia at the moment.

The chances of a downturn have risen: I don't dispute that but not for the reasons that many seem to think. My concerns relate to confidence and how it is being belted around by political and policy ineptitude across the spectrum: Monetary, fiscal policy and the antics of politicians (on both sides). Australia is quite simply being mismanaged in my view. But this type of downturn if it does eventuate poses no threat to long-term investors. On the contrary, it creates opportunities.

But I'm not a buyer of this idea that imbalances have developed to a threatening stage yet. It bears watching certainly, but we are a long way from the point where housing construction could cause a recession in Australia.

Note also on the lending and banking side of the ledger, the RBA doesn't appear to be concerned at this stage. They noted some risks in the recent Financial Stability Review to do with investors only – and only in some instances. One of the key things investors need to take out of it, is that regulators are in no way concerned about a near-term, broad-based threat to property or the banking sector. They can't even see one developing, noting that they have not seen a drop in lending standards so far. The lack of action taken by regulators illustrates this perfectly.

So if we are some years away from a glut of construction and a drop in lending standards hasn't even started – then I think it's extremely premature to be talking about a housing-induced recession. I think it would be more sensible to actually see these signs develop – and they might – rather than just blindly claiming a recession is due in a year. I often wonder whether the true underlying rational for the repeated downturn mantra is simply because we haven't had one in nearly three decades – and we're just due for one.

The bottom line is that I think we need to be alert to imbalances developing, that is sensible. But there is no evidence to date that the risks to either the property or the banking sector have increased materially at this point.