What Nintendo tells us about tech stocks

Summary: A surge in Nintendo's (JPY:7974) share price this week has prompted headlines after the release of the Pokemon GO app – analysts who have watched the augmented reality tech sector for some time believe it has a lot to offer investors, but how this plays out is yet to be seen. |

Key take out: Augmented reality is likely to be an investment thematic to watch for the long term. |

Key beneficiaries: Home owners. Category: International investing. |

A new frontier appears to have opened in the tech world this week after Nintendo's share price rocketed more than 50 per cent – adding $12.2 billion – from Friday through Tuesday on the Japanese exchange.

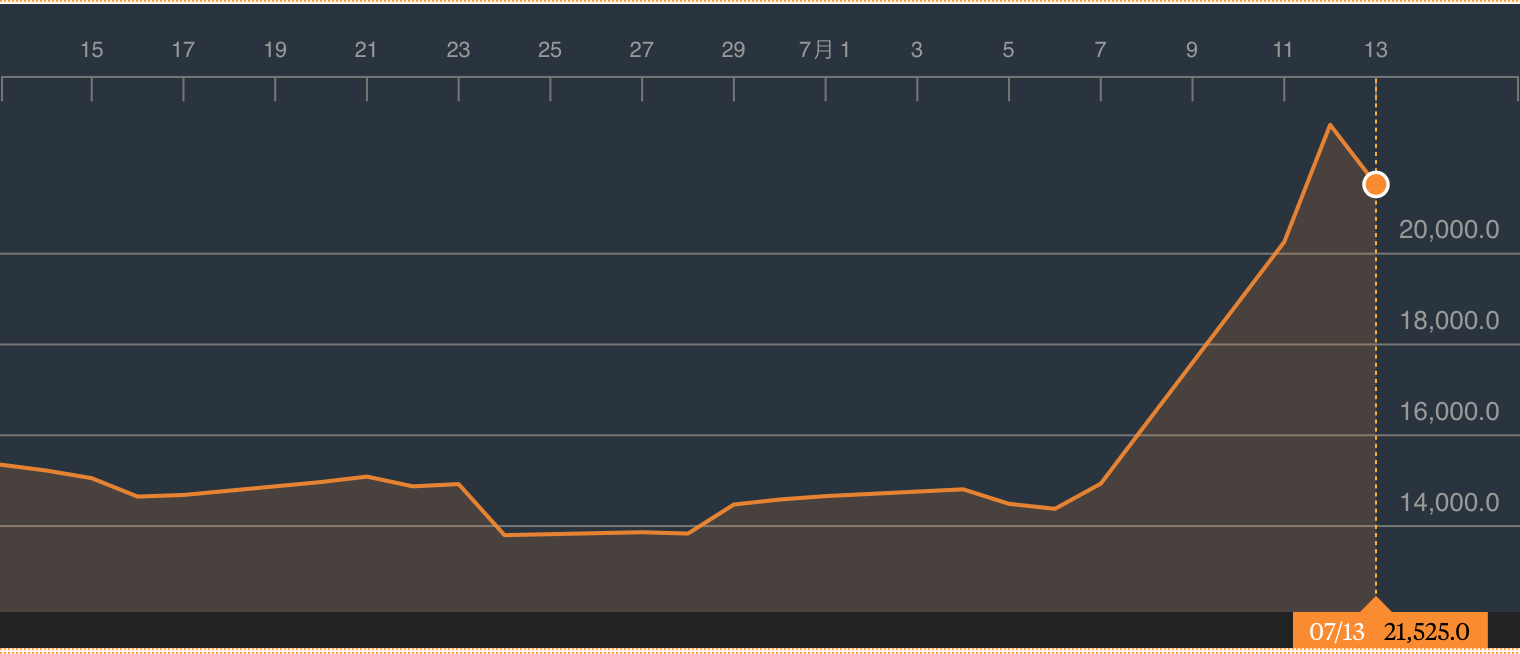

Nintendo (JPY:7974) share price, past month:

Source: Bloomberg.

The spike was driven the company's Pokemon GO app, an augmented reality game for smartphones combining the real world with computer generated animated characters which has seen massive take-up.

Deloitte risk advisory partner Dennis Moth says the investor appeal for Pokemon GO is threefold: It combines nostalgia for a pop culture icon, a large user base made possible by mobile gaming's “freemium” model and the ability for augmented reality, geo-location centric games to secure untold marketing “tie-ups.”

In the game, phone users wander cities – the app has so far only be released in the US, Australia and New Zealand – looking for characters from the hit 1990s franchise, which have been ‘geo-placed' around cities using Google Maps technoglogy.

Pokemon GO marks the coming of age for augmented reality, which experts say will become a larger industry than virtual reality – kicking off with the gaming world, and then extending its reach into most sectors. Research firm Digi-Capital says augmented reality could expand out into a $120 billion industry by 2020, dwarfing virtual reality's expected $30bn value.

It's the kind of news item that makes investors sit up and take note, but does that mean you should dive into any tech stock with exposure to mobile gaming or augmented reality?

Analysts say both areas are in their commercial infancy and are facing the usual tech-challenge of ‘monetisation' – but the potential is there longer term.

Gartner personal technology analyst Brian Blau said this type of gaming could quickly expand what users – and the market – expect from mobile phone app games going forward.

“If it gets wide adoption, and even if it just wakes up game players and game developers, that may be enough of a push to get these types of game serious consideration…I actually think [it] could cement AR games as a popular genre,” he says.

But Moth at Deloitte cautions that the mobile gaming space is still risky territory, with the reliance on internal “game micro-payments” making revenues unpredictable.

“Eighty if not 90 per cent of revenue is and will be earnt by a small number of highly successful mobile games,” he says.

“The reliance on the ‘freemium' model, where there is only scope for micro-payments within games, mean [that] many never turn a dollar.”

Deloitte says compared to the other two main gaming platforms – consoles and PCs – revenues will be paltry per game: $40,000 on average compared to $2.9m for PC games and $4.8m for consoles.

Nevertheless, Deloitte predicts smartphone and tablet apps will become the number one games platform by software revenue this year, usurping PC and console.

“It's better having that large user base, but you must keep them engaged. Longevity is going to be key,” he says.

“You might need to be top of the download list for a number of weeks if not months to get that return on investment.”

Michael Hayes, investment research manager at listed fund Bailador (BTI), which invests in unlisted technology firms internationally and has an admittedly small, but growing interest in gaming, says Nintendo had been late to mobile gaming and its share price was likely benefiting from a large degree of pent-up demand. Hayes believes a lot of the share price spike could be put down to an abstract notion “that reflects the future opportunity on mobile”, rather than hard economics.

But he says the Nintendo success follows the recent development of mobile success stories like Call of Duty and Candy Crush from gaming giant Activision, which built its fortune on traditional console games, indicating that the mobile gaming platform was becoming more lucrative.

“We're still only a few innings in, but it demonstrates mobile games are becoming more mainstream,” he says.

Yet Bailador boss David Kirk says the segment was likely to remain hit-and-miss for investors for some time to come.

“It's a bit like drilling for oil, sometimes you just hit a big one and it can be a massive return," he says.

Meanwhile, the view from Macquarie Wealth Management on augmented reality's potential has been rosy for some time, with its analysts writing in January that the technology was here to stay. Macquarie's internet team said then they were “very bullish” on the potential for augmented reality – and its cousin, virtual reality – to become the next major computing platforms.

“The timing is uncertain and there will be many setbacks and lots of doubters...[yet] it has the potential to have a much bigger impact than even the shift from desktop to mobile,” analysts wrote.

In particular, the view was that the initial application of the AR and VR technologies would be around gaming “which is likely to drive a near term boost in retailer sales”. But that the technologies could quickly spread to just about every industry.

“Augmented Reality is about much, much more than games,” they wrote.

“There will be AR uses in virtually every industry, and while it will take time, 10 years plus, in many instances, we believe that the impact will be significant and in many cases revolutionary.”

For Australians investors, beyond the challenge of predicting the trajectory of mobile gaming and any turbo-charge it might get from augmented reality, keep in mind that there's little direct Australian share exposure to a lot of these marquee tech brands. Many are US based, with some big names also in North and East Asia. We know that Australians are increasingly satisfying their demand for the omnipotent tech giants – Facebook, Apple, etc – by buying overseas shares directly (you can read about that here). But there's always the danger of basing stock choices on news media and hype alone. The surge in Nintendo this week is just one example of a rally prompted, in part, by a new type of gaming experience – and it's one that analysts watching the sector say they have been monitoring some time. By all accounts, this has much longer to play out.

Investors know that technology stocks have taken huge leaps before, and there are no doubt further huge leaps ahead – for now, augmented reality gaming is one thematic to watch for the longer term.