What is unfair about power pricing?

The Electricity Network Association is pushing the view that the current structures for how we price power are “unfair”. In particular they are keen to point the finger at solar PV systems as the major driver of creating outcomes that are ‘unfair’ because they suggest solar allows households to avoid paying for the proportion of electricity network capacity which they use.

The Networks Association is keen to have us focus on the fairness of how we divide up the pie of the costs associated with electricity provision among consumers. This is important and legitimate.

But there is another more important fairness issue that we need to keep an eye on – this is whether the overall size of the pie of costs which power companies are claiming from consumers is fair and justified.

It seems just about everyone now accepts that the electricity network companies for the most part got away with murder (although it took the Energy Market Commission and the Federal Department of Industry far too long to acknowledge) in the first round of determinations on their regulated revenues under the national regulatory regime set-up in 2007.

The justifications given for the price rises over the prior five-year regulatory period included soaring peak demand, the need to catch-up on past underinvestment to address what we were told was aging equipment, excessively high reliability standards set by NSW and Queensland state governments and the financial crisis which had driven up the cost of obtaining finance.

One would have thought that we should see network charges actually go down given peak demand did not soar, reliability standards have been relaxed, and the cost of finance has markedly declined to infrastructure assets with steady regulated returns. Indeed NSW Government ministers have told us they’ve stopped their network companies from making regulator authorised expansions in capacity which can’t be justified based on actual demand.

We’ve also been told that the Australian Energy Market Commission, in spite of its protestations that there was nothing awry, has moved to solve the problem by giving the Australian Energy Regulator more teeth.

Yet in the new proposals to the regulator, network companies are still claiming they aren’t able to reduce charges and indeed need to increase them.

ActewAGL, the network provider for the ACT, recently put forward its revenue proposal for the next regulatory period – it wants annual increases of an average 2.5 per cent over the next five years.

The Australian Energy Regulator chair, Andrew Reeves, in his usual understated manner observed in relation to this claim for price rises:

“ActewAGL is seeking a higher return on its assets, despite investment conditions improving and the costs of financing infrastructure businesses decreasing. ActewAGL is also proposing substantial capital expenditure for the replacement of assets.”

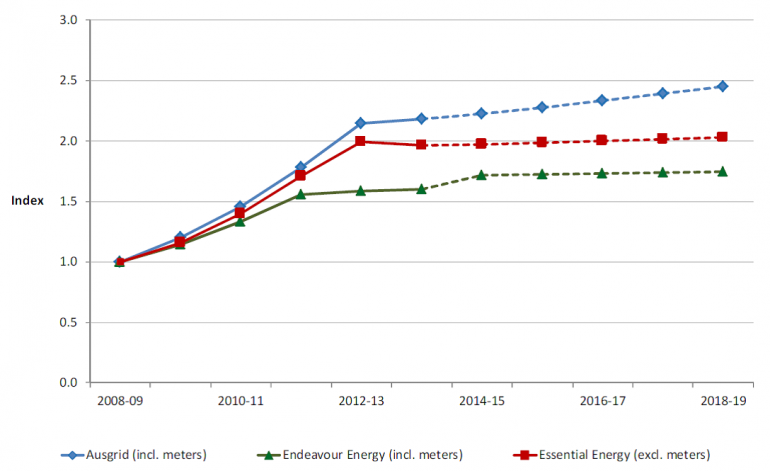

ActewAGL is not alone. In addition the other NSW distribution network businesses are also putting forward claims to hang on to price rises they managed to game from the prior regulatory regime (see below).

Figure 1: The NSW distribution network companies proposed price paths (nominal)

Source: Australian Energy Regulator

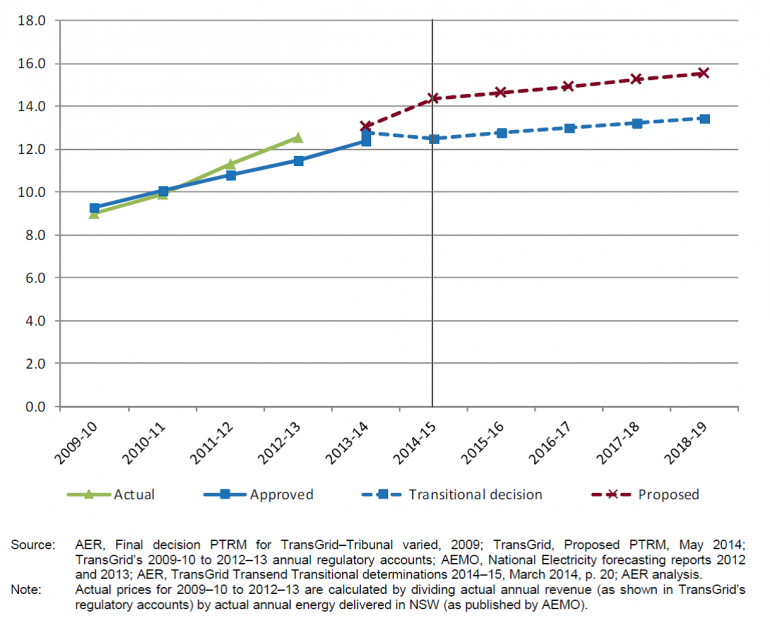

Also the NSW transmission operator, Transgrid, is demanding that they be allowed to increase their prices by around 20 per cent over the next five years. This is in spite of the company having been shown to have repeatedly overegged their previous demand forecasts, and who had to be publicly shamed before pulling back from line expansions based on illusory electricity demand growth.

Figure 2: TransGrid-Indicative transmission price path from 2009-10 to 2018-19 ($/MWh, nominal). Red line is Transgrid’s proposal that is under review.

Source: Australian Energy Regulator

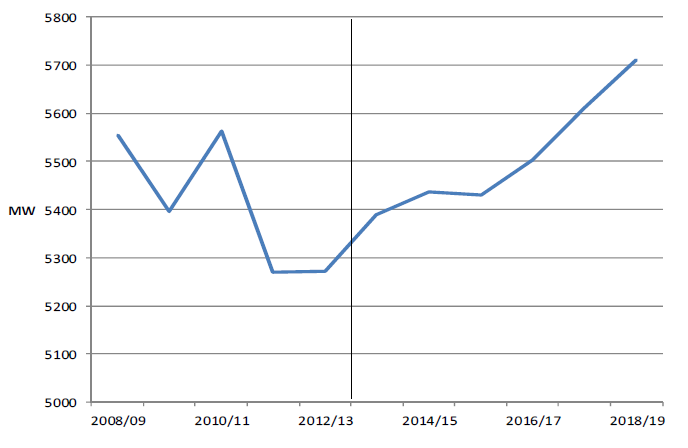

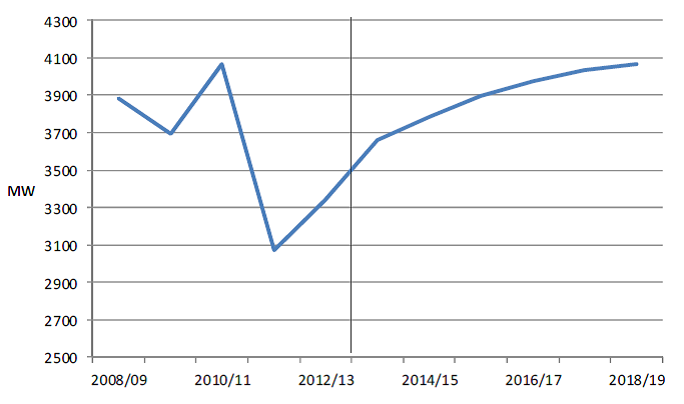

In 2007 these network businesses said the rise of air conditioners meant they should be allowed to significantly expand their revenue and prices. In the end it wasn’t quite the problem they made it out to be (charts below show peak demand did not grow over the prior regulatory period in spite of very hot summers and population growth over this time). The price society paid for failing to thoroughly scrutinise network businesses that time around makes arguments around renewable energy seem incredibly petty.

It’s important that in engaging debates around fairness we don’t take our eye off the main game, that we make decisions based on provision of detailed and comprehensive data of electricity demand rather than anecdotes and theories, and most definitely do not take network companies on their word or their own forecasts.

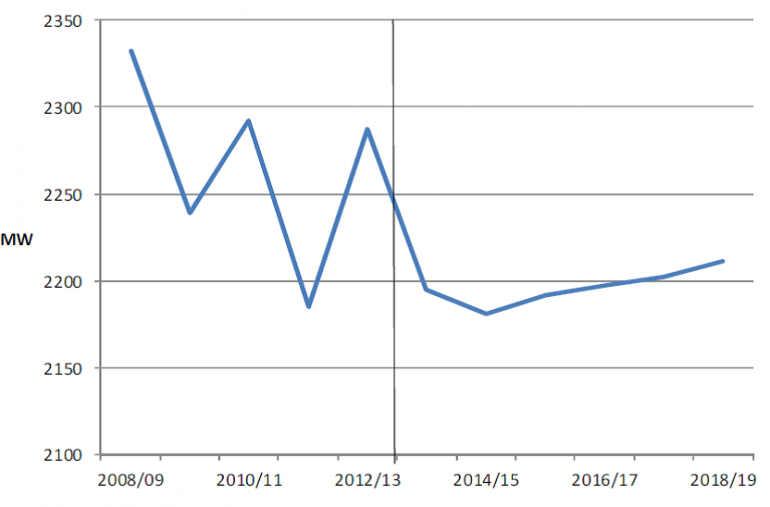

Figure 3: Ausgrid network – historical peak demand, and their projected peak demand

Source: Australian Energy Regulator

Figure 4: Endeavour network – historical peak demand, and their projected peak demand

Source: Australian Energy Regulator

Figure 5: Essential network – historical peak demand, and their projected peak demand

Source: Australian Energy Regulator