What Abbott will see in Asia's clean energy triangle

Prime Minister Tony Abbott’s visit to Japan, China and South Korea this week offers the opportunity for the government to witness the changing circumstances in regional climate leadership and the accelerating Asian action on carbon and clean energy.

These have seen Asia become the epicentre of clean energy investment and seen Asian nations the biggest movers in a range of indicators, such as last year’s TCI/GE G20 Low-Carbon Competitiveness Index.

– China is continuing to ramp up efforts to clean up its energy supply and improve its energy efficiency. Last year the country launched five regional carbon markets, invested $54 billion in renewable energy, and set limits on coal use. This year sees further developments in all these areas.

– South Korea, home to the Global Green Growth Institute and the Green Climate Fund, is developing its national carbon market, which will launch at the beginning of 2015.

– Japan, recognising that its ability to rely on nuclear power is challenged by public and political opposition, is encouraging investment in solar and wind and boosting efforts to increase its energy productivity.

China: air pollution adds urgency to carbon reduction efforts

China recognises the significant threat posed by climate change and has committed to reducing its carbon emissions per unit of GDP by 40-45 per cent by 2020. Provinces have their own emissions goals: for example Guangdong is required to improve its carbon intensity by 19.5 per cent compared with 2010 levels, by 2015.

However, the urgency of addressing pollution from fossil fuels has increased as China’s air pollution has worsened. China’s recent economic growth has been propelled by massive increases in coal-fired generation (the country is now the largest coal consumer in the world, burning 3.9 billion tonnes annually), but the costs of this are now undermining further growth. Coal, along with emissions from vehicles and industrial processes, has contributed to deadly air pollution that has blanketed many Chinese cities and sometimes spread to neighbouring countries.

In 2012, less than 1 per cent of China’s 500 major cities met air pollution standards, while recent analysis by the World Health Organisation found China’s smog to be the biggest single factor behind the deaths of 7 million people killed by air pollution globally.

Chinese Premier Li Keqiang said in March that the government will “‘declare war’’ on air pollution. Total new build of coal plants has now been falling for a number of years.

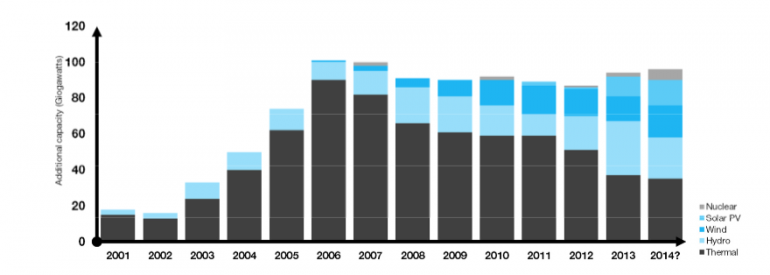

Figure 1. China's annual electricity capacity additions

Sources: China Electricity Council, Global Wind Energy Council. 2014 data is based on CEC projections.

China’s efforts to boost its clean energy supply and cut down on energy use are also aimed at modernising its industrial sector, tackling water scarcity and improving energy security. This last is a key concern:

China, like other energy importers, recognises the geopolitical implications as well as the cost of dependence on fuel imports, and the superior security offered by self-generated renewable power.

China now leads the world in investments in renewable energy and energy efficiency

Renewables – particularly hydro, wind and solar – now make up about 20 per cent of China’s electricity. The country aims to get 30 per cent of its electricity from renewables by 2020, which requires an ambitious ongoing program of investment in clean technologies. In 2013, China was the world leader in investment in new solar capacity (11,300 MW, 30 per cent of global total 5),wind (16,100 MW, 45 per cent of global total 6) and smart grid technologies ($4.3 billion, 29 per cent of global total). This year along, it is expected to install another 14,000 MW of solar PV, and 18,000 MW of wind. This is equivalent to nearly five times Australia’s total solar PV capacity and about two-thirds of Australia’s total wind capacity.

China’s carbon markets are rapidly developing

China now has six emission trading schemes operating in two provinces – Guangdong and Hubei – and four cities – Beijing, Shanghai, Shenzhen and Tianjin. Another ETS in Chongqing will launch in the next few months.

Combined, these carbon markets cover some 700 million tonnes of carbon, more than the emissions of South Korea, the world’s seventh largest carbon emitter. Australia’s carbon market covers less than 350 million tonnes. All seven markets require mandatory participation from eligible companies and set absolute limits on emissions.

These markets will inform the development of a national carbon market, expected to commence around 2016. Other Chinese cities and provinces are interested in carbon trading.

– Qingdao city (pop. 3 million) is working on plans for a carbon market covering up to 300 major companies, to be launched next year.

– Hangzhou (pop. 9 million) is developing a carbon market.

– The provinces of Shanxi (pop. 36 million), Anhui (pop. 60 million), and Jiangxi (pop. 45 million) have agreed to explore carbon trading with Hubei.

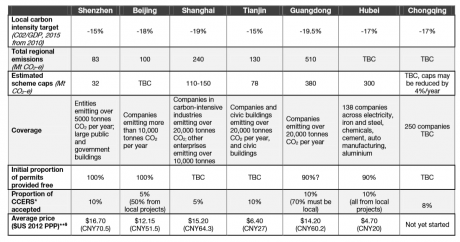

Table 1. Parameters of China’s seven pilot emission trading schemes

*CCERS are China-originated offsets generated through the Kyoto Clean Development Mechanism

**Average prices as of 28 February 2014 ($US 2012 PPP), apart from Hubei, which launched on April 2.

Japan faces nuclear question, boosts support for renewables

Following the Fukushima Daiichi nuclear disaster, Japan is reconsidering its nuclear strategy, which was previously central to its emission reduction goals. For this reason Japan has wound back its emission reduction target, previously a 25 per cent cut below 2005 levels by 2020, to a cut of 3.8 per cent.

With none of its nuclear reactors currently in operation, Japan has become more reliant on costly imported fossil fuels. The government is considering restarting at least some nuclear plant. Any new fossil plant must comprise “best available technology” (BAT), and new coal must offset all emissions above the level of BAT gas plant.

Reducing import dependence and cutting carbon pollution are drivers for Japan’s increased support for renewables: the country introduced a generous solar feed-in tariff in 2012 and last year became the second-largest investor in solar PV, installing 6,900 MW. This year, Japan is expected to increase that by 50 per cent, to install over 10,000 MW.

Japan is also investing in off-shore wind. At present the country gets about 10 per cent of its power from renewable sources, and is aiming for at least 20 per cent renewable electricity generation by 2030.

Japan has put significant effort into maximising it s energy productivity through such policies as its highly successful Top Runner program, which sets rising energy efficiency standards for a wide range of products based on the performance of the most efficient product in each class. In recent months, Top Runner has been expanded to include a range of building products. Japan is also accelerating the roll-out of residential smart meters.

South Korea prepares to launch a national emission trading scheme

Korea’s carbon market, starting on January 1, 2015, is the country’s main mechanism for achieving its goal of reducing emissions 30 per cent below business-as-us ual levels by 2020. This is broadly comparable to Australia’s 15 per cent by 2020 emission reduction target.

The Korean emission trading scheme will cover roughly 60 per cent of the country’s emissions. Companies required to participate – those emitting more than 25,000 tonnes of carbon dioxide annually – are currently involved in the national Target Management System, a “cap-but-no-trade” scheme that acts as a precursor to the carbon market.

South Korea also has a renewable energy target, which began in 2012. Under the target 10 per cent of electricity must come from renewable sources by 2022. Korea is also establishing a Low Carbon Green Fund to support research and development of renewable energy technologies. Revenue from the carbon market will contribute to this fund.

Recent policy developments in China, Japan and South Korea

December:

– China’s Guangdong and Tianjin launch their carbon markets. Beijing and Tianjin launch a study with the northern provinces of Hebei, Inner Mongolia, Shandong and Shanxi on cross-provincial markets for carbon and air pollutants. China, Japan and South Korea agree to work together to combat air pollution. Japan expands its Top Runner energy saving program to in clude building materials.

January:

China brings forward to 2014 its target of limiting coal to less than 65 per cent of energy use (last year it set 2017 as the deadline). China says it is developing a nation-wide trading system of pollution permits over the next three years, to help clean up its environment. Eligible pollutan ts are likely to include nitrous oxide and sulphur dioxide. China’s Hubei invites the five neighbouring provinces of Anhui, Henan, Hunan, Jiangxi and Shanxi to join its emissions trading scheme on a voluntary basis.

February:

– China announces plans for a 10 billion yuan ($1.65 billion) fund to fight air pollution. State news reports that Beijing will shut 300 polluting factories this year and pu blish a list of industrial projects to be halted or suspended by the end of April.

– China and the United States agreed on implementation plans for their five joint initiatives (vehicle emissions, smart grids, carbon capture utilisation and storage, managing emissions data, energy efficiency in buildings and industry). The plans identify specific agencies in each country to lead various tasks, as well as deadlines for each task. They also agree to share information on new post-2020 emission targets due internationally by April 2015.

– China’s Qingdao city (pop. 3 million) says it is developing plans t o launch its own carbon market next year, capping emissions of 300 of its largest companies.

March:

– Japan, China and South Korea begin a working-level policy dialogue on combatting air pollution.

– Chinese Premier Li Keqiang says the government will “declare war’’ on air pollution by removing high-emission cars from the road, closing coal-fired furnaces and capping energy use.

– The Chinese government promises that 60 per cent of its cities will meet national pollution standards by 2020. The Chinese government announces that companies emitting over 13,000 tonnes of CO2e annually will be required to start reporting their emissions, ahead of a national carbon market and cap on emissions.

– A draft plan for Chongqing’s carbon market proposes that 250 of its biggest companies be required to cut their carbon emissions by more than 4 per cent per year starting in 2014.

– Guangdong announces plans to increase carbon costs for power generators within its carbon market, to speed up emission cuts. Guangdong’s carbon market expands coverage to buildings and transport sectors. Hubei issues 324 million carbon permits ahead of its car bon market launch on April 2, signs carbon trading agreements with provinces Shanxi, Anhui, Jiangxi and Guangdong.

– Shanghai announces plans to get its citizens driving more than 10,000 electric or hybrid cars by 2015,by offering subsidies and installing charging stations.

April:

– China, the US and the European Union agree to cooperate on the global emissions reduction agreement to be finalised in 2015.

Olivia Kember is national policy and research manager at The Climate Institute.