What a rising dollar means for US growth

The path towards policy normalisation continued overnight with the US economy expanding at a solid pace during the September quarter. The biggest near-term risk appears to be a stronger dollar, which may begin to weigh on export growth in the next few quarters.

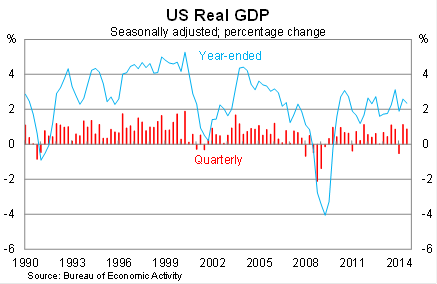

In the US, real GDP rose by 0.9 per cent in the September quarter, beating market expectations, to be 2.3 per cent higher over the year. This follows growth of 1.1 per cent during the June quarter.

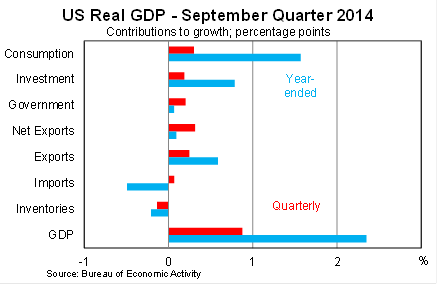

Growth in the September quarter was fairly broad-based across categories. Net exports and consumption led the way but there were also solid contributions from business investment and for the first time in two years, federal government spending.

Growth was broadly consistent with recent improvements in the labour market. The four week average for initial jobless claims -- a timely measure of labour market conditions -- has now declined to its lowest level since 2000.

Furthermore, the labour market itself is on track for its strongest year since 1999. Non-farm payrolls have increased at a strong pace during 2014 and the unemployment rate has declined by 1.3 percentage points over the year.

But there is also some concern that the growth balance is unsustainable, particularly given the renewed strength in the US dollar, and that does pose a risk for export-orientated businesses.

Household spending rose by 0.4 per cent in the September quarter, to be 2.3 per cent higher over the year. That result was broadly in line with monthly indicators of spending but remains somewhat disappointing given the strong employment numbers.

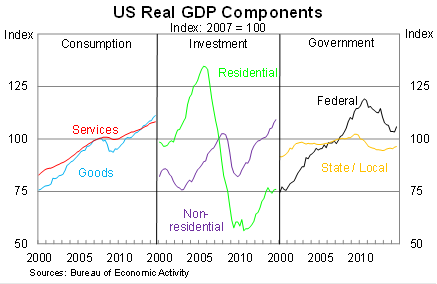

Consumption was led by durable goods -- such as motor vehicles and household goods -- which is usually a good sign of a cyclical upswing. But spending on services and non-durable goods remains underwhelming.

A key issue is real wages -- that is wages adjusted for annual inflation -- which have been in decline for some time. This should correct itself in time, particularly as spare capacity and the US dollar climbs, but in the near-term it will continue to weigh on household activity.

The same cannot be said about business investment, which continues to post strong gains. Non-residential investment rose by 1.3 per cent in the quarter, to be 6.7 per cent higher over the year. Spending on new equipment led the way (up by 1.8 per cent) while non-residential structures investment rose at a solid pace.

Unfortunately the residential property sector continues to disappoint. Residential investment rose by just 0.5 per cent in the September quarter and has declined by 1.0 per cent over the year. Residential investment is 43.5 per cent below its pre-crisis peak.

The property market is obviously a source of risk for the US economy -- on both the upside and the downside. A prolonged period of subpar investment is no more sustainable than the construction boom of the mid-2000s, which points to a strong recovery in residential investment over the next few years. However, that doesn't mean that there won't be some near-term weakness in the quarters ahead.

Government spending rose by 1.1 per cent in the September quarter -- its fastest pace in five years -- marking the end of five years of fiscal austerity. Federal government spending led the way (up by 2.4 per cent) which reflected strong defence spending and a modest rise in non-defence spending. State and local government spending rose by 0.3 per cent in the quarter.

Net exports contributed 0.3 percentage points to growth in the September quarter, partially offsetting weakness in the March and June quarters. This reflected a strong rise in export volumes, while imports declined modestly.

The gradual narrowing of the US trade deficit should prove fairly short-lived however, with a much stronger US dollar set to weigh on export industries and boost the demand for cheaper foreign alternatives.

US growth in the September quarter was a little stronger than market expectations but not sufficiently stronger to change views at the Federal Reserve. As I noted yesterday, the outlook for rates remains data dependent and a period of particularly strong data could prove the impetus for an early rate rise.

But for that to happen, this level of growth needs to persist and carry on into next year. The US economy will face its fair share of challenges between now and then -- mostly due to a stronger dollar -- but the economy appears to be well placed and has sufficient momentum to succeed even with a less favourable currency.