What a difference 20 days make!

Summary: As what might come as a surprise to many, since the start of FY15 Australian equities have actually performed well – making a total return of 11.4 per cent compared to the US market's 10.8 per cent. What's even more astonishing is that our market has done this amid a number of negative influences including the end of the mining boom and concerns over China's growth. |

Key take-out: Investors should take heart, not only over the local market's performance but also over its attractive valuation metrics at current levels. |

Key beneficiaries: General investors Category: Shares. |

With the Greek crisis apparently at another hiatus, it's time to take stock. Notionally, our equity market is one of the key underperformers.

Indeed for the financial year just gone, Aussie stocks (ASX 200) are only up 1.5 per cent, which compares to gains in the US of 4.5 per cent, Germany of over 10 per cent and 35 per cent in Japan. Even across the Tasman, Kiwi stocks are doing much better – up 11 per cent – well and truly outperforming the Australian market.

The Aussie market is a perennial underperformer it seems.

Except that since the end of the financial year – just 20 days ago – the Australian market has actually managed to get a bit of wind into its sails. It's outperformed many of the major markets, rising by 3.6 per cent – stronger than Japan, the US and NZ, but weaker than in Europe.

Still, not a bad result. Taken from June 30, 2014, the market is up 5 per cent on price, and 11.4 per cent on a total return basis (including dividends). Not so shabby all up and much better than financial year results suggest.

Indeed, looking at performance on a total return basis, while the Australian market hasn't necessarily been a star performer (NZ up 15 per cent), its performance since June 30, 2014 has been better than the US (10.8 per cent). Importantly, it's been much better than cash or bonds and so investors have done well to hold their nerve and look through all the volatility.

That the Aussie market can offer returns like that with all the negative influences that the market faces, is actually a sign in itself. Investors haven't given up on Australia.

At the very least, noting that the Australian economy is doing much better than official forecasters had anticipated, investors should also take heart at a number of other factors that should act to support the market over the next financial year.

Firstly, we have Canada and New Zealand. Now you may not think that events in Canada or New Zealand would have too much impact over in Australia. Yet in this bizarre ultra-low rate world they do. Last week, the Bank of Canada cut rates by 25 basis points and the Reserve Bank of New Zealand is expected to cut as well this week.

While the link isn't necessarily clear – theoretically it shouldn't matter – the fact that these two central banks are still cutting has firmed up the idea in the market (that's already aggressively price for another cut) that the Reserve Bank will cut again as well. Indeed the Aussie dollar fell after the Bank of Canada cut its rates (admittedly there was already some solid selling action in place).

The idea goes something like this: Canada and New Zealand, like Australia, are relatively small commodity exporting economies. So if their central banks are cutting then ours will too. For what it's worth, market pricing suggests the RBA will cut on November.

Regardless of whether that is true or not, or ends up being the case, rate cutting central banks are equity friendly and expectations matter. When a central bank cuts, it boost the equity market. That's especially the case given the second point below.

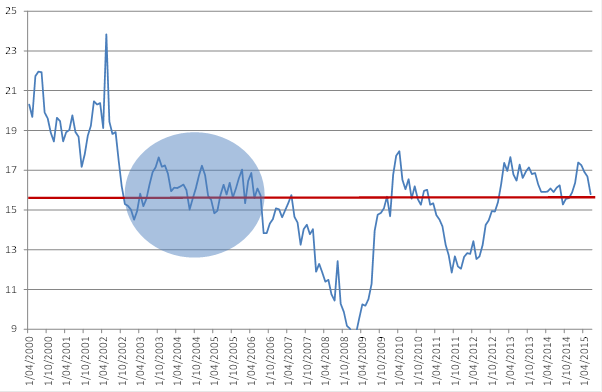

Which is that a bit of value has seeped back into the market. You can see this in chart 1 below which shows the trailing price-earnings ratio (PER) going back 15-years. Estimate of PERs always vary depending on how exactly it's calculated and who's calculating it, so you might see some different figures doing the rounds. The exact estimate doesn't matter though.

Chart 1: Aussie market has more value now

I'm using data from IRESS. What's important to note is that PERs are back towards average values. Now this is important, because it shows that on a trailing basis (that is on last year's earnings) the market as a whole is only on average multiples.

So our market is not expensive on that figure. Now that doesn't scream cheapness on traditional measures. But don't forget that there is every reason to expect that PERs should be well above average in an ultra-low rate world amid the hunt for yield, etc. and when cash and bonds are not viable investment alternatives.

As you can see from the chart, a PER over 17 isn't at all unusual – historically. Even prior to the GFC, PERs spent much of their time above 17, and that was without the benefit of ultra-low rates. That should provide a measure of valuation support. Of course, when you add in earnings forecasts for this year and next, that's when the apparent cheapness of the market becomes much more evident.

Price to book ratios too don't look especially worrisome. At 2.06 it's actually quite low compared to the pre-GFC average (an average of 2.34 from 2000-2007).

Investors should take heart then. The Aussie market hasn't done too badly compared to global equities to date and it is still very attractive compared to other domestic alternatives investments. It may not always seem that way given the news-flow but the numbers are clear.

What's truly exciting about that is that this performance has occurred against some very serious headwinds such as China, the end of mining boom and attacks on the banks. It's well worth keeping these facts and the attractive valuations in mind when considering your investment plan for the next financial year.