WEEKEND ECONOMIST: The inflation equation

We confirm our call for a 25 basis point rate cut from the Reserve Bank on August 6 with rates eventually reaching a 2 per cent low by the March quarter next year.

The all important June Inflation Report showed a slightly higher print (0.6 per cent versus 0.5 per cent forecast) for average underlying inflation for the quarter than our forecast. Annual underlying inflation held at 2.4 per cent, slightly below the middle of the 2-3 per cent target band.

The trimmed mean measure printed 0.5 per cent for the June quarter and 2.2 per cent for the year while the weighted median printed 0.7 per cent for 2.6 per cent annual growth. Both the measures were 'soft' to the second decimal place with trimmed mean at 0.49 per cent and weighted median at 0.68 per cent.

While there has never been any official recognition that the Reserve Bank values the trimmed mean signals more than the weighted median we have always assessed that the trimmed provides a more reliable measure of inflation than the weighted median.

Certainly other private sector measures of core inflation favour a trimmed mean concept over a weighted median concept. The print, while above our forecast, is not so high that the RBA would feel constrained by inflation at its August 6 meeting.

With the softer activity data prints since the Reserve Bank released its GDP forecasts in May we expect that the bank will lower its forecast for GDP growth through 2014 from 3 per cent to 2.75 per cent. That move is significant.

The previous forecast of 3 per cent is around trend. If a central bank is forecasting trend growth and inflation is forecast to remain around the middle of the 2-3 per cent target band, then there is no pressing need to adjust policy.

If however, it is forecasting below trend growth in the 'policy' year (monetary policy acts with a lag so a policy move in August 2013 can be expected to have its impact in 2014) arguably it has an obligation to further ease policy.

There is speculation that the federal government may call an election for August 31.

Political considerations should not impact the rate decision. The current RBA governor, in only his second year in the chair, surprised many by raising rates in the midst of the 2007 Federal election campaign. A rate hike should be unambiguously unwelcome to a sitting government.

That decision emphasised the independence of the Reserve Bank. In my view a rate cut is not unambiguous from a political perspective. On the one hand the government might argue that such action is evidence of good management – 'making room for lower rates'.

On the other hand, the Opposition might explain the move as indicating the poor state of the economy. Both positions would have their supporters neutralising any significant political fallout. Note that the forecast which we formally released in early May for rates to fall to 2 per cent came after a period of pointing out that our previous low rate call of 2.75 per cent had clear downside risks.

We noted in May that the move to 2 per cent would be over an extended period with cuts being delayed to the December and March (2014) quarters. We stand by that view. The fall in the Australian dollar and some aspects of the June Inflation Report will signal the need, after the August cut, to keep rates on hold until further information is available on the inflation front.

In the May Statement on Monetary Policy the bank released some analysis that highlighted that the prices of a range of imported goods had fallen by significantly more than would have been expected from the fall in import prices. The implication was that there were other structural changes afoot in the Australian economy, particularly around online shopping, that were holding down inflation. That was a particularly encouraging sign for a central bank seeking to contain inflationary pressures.

However, the June Inflation Report showed a 'snap back' in the prices of a number of these items. Clothing and footwear (up 2.7 per cent) reversed much of the fall in March (down 3.9 per cent); Household contents rose 1 per cent (versus down 1.3 per cent in March); car prices fell only 0.2 per cent compared to a 1.3 per cent decline in March; audio visual prices (-1.9 per cent versus -2.6 per cent in March). The bank will be interested in evidence around the significance of the expected structural changes which will emerge from the September Inflation report. Our view is that the structural adjustment theory is sound.

Further, we expect that importers will be unable to pass on much of the currency effect in their retail prices due to soft demand and price resistance from buyers. Recall further that in last week's note I pointed out that we expect modest increases in the Australian dollar through to years end as global markets reassess the likelihood of Fed tapering. As discussed last week that expectation is around our view that economic growth in the US falls well short of the threshold required by the Fed to begin tapering.

The June Inflation Report also showed some tentative evidence that prices pressures are increasing in housing. Rent rose by 1.1 per cent in June up from 0.8 per cent in recent quarters. After adjusting for some unusual 'one-offs' there was also some modest upward pressure on house purchase costs (excluding the land component). These 'tweaks' on inflation compared with the historically low levels for rates will cause the bank to be cautious. However, we expect it to maintain its easing bias.

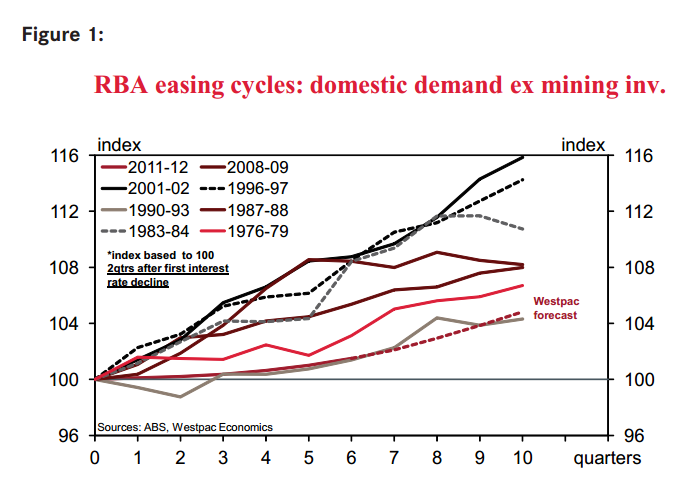

The dominant story is that the economy has been more insensitive to rate cuts than in any previous cycle. It shows that with the exception of the deep recession in 1990-93 this current cycle has had the most muted response in domestic demand of all eight easing cycles. Household deleveraging; soft business confidence; fiscal tightening; and a high Australian dollar are all explanations.

Possible responses form the central bank could be to abandon its only policy instrument; wait longer; or go even harder. I would be surprised if a central bank abandoned its only policy instrument. I expect a combination of 'wait longer' and 'go harder' will be the policy of choice.

Our other key reason for expecting more cuts, which will be over an extended period, is around the global growth environment. The IMF has recently formally accepted that global growth will slow to a modest 3.1 per cent in 2013. That has been our forecast for some time. But the official families are still too optimistic around 2014.

We expect world growth in 2014 to be 2.9 per cent compared to the IMF forecast of 3.8 per cent, recently downgraded from 4 per cent. Our forecasts envisage ongoing recession in Europe; US growth remaining below 2 per cent (compared to Fed forecast of 3.2 per cent) and China slowing from 7.4 per cent in 2013 to 7.1 per cent in 2014. Eventual recognition of a deteriorating world outlook, along with ongoing evidence of a muted response of domestic demand to rate cuts, is likely to lay the foundation in both November and February (2014).

Bill Evans is Westpac's chief economist.