Weekend Economist: Gloom looms

One of the critical outcomes from the Reserve Bank's move to lower the overnight cash rate from 4.75 per cent to 2.5 per cent over the last two years has been the response of business to these lower rates. The slowdown in mining investment is mainly a function of large, lumpy projects in the gas sector, which are approaching completion over the next few years.

The Access /DL construction monitor lists the value of oil and gas projects currently under construction as $200 billion compared to $12 billion in iron ore and $14.4 billion in coal. Committed new projects in oil and gas total only $3.7 billion compared to only $6.3 billion in iron ore and $15.2 billion in coal.

We estimate that mining investment will fall as a proportion of GDP over the next five years from 8 per cent to 3 per cent. RBA estimates "3 percentage points or more".

Even after adjusting for the imported component of this investment, it is still a significant drag on an already fragile economy over the next few years. Reserve Bank deputy governor Lowe discussed prospects for non-mining investment in a speech to the CFA Australia Investment Conference on October 24.

He listed the recent boost to business confidence; low interest rates; and the 8 per cent fall in the Australian dollar since April as reasons for optimism. Note that following the September RBA Board meeting that depreciation was estimated as 15 per cent. However, on business confidence he did note that "a fair amount depends on international events".

Governor Lowe also noted "the profile of non-mining investment in Australia is not dissimilar to the profile for overall investment in many of the developed economies". A key theme supporting our view that interest rates are in need of further reduction revolves around our more downbeat view of the world economy in 2014.

We forecast growth in the world economy in 2014 of 2.8 per cent compared to 3.6 per cent for the IMF and the Reserve Bank. Such a weak growth environment is likely to be associated with ongoing weakness in business investment in the developed economies.

Our view of domestic non-mining investment is likely to be considerably more downbeat than the Reserve Bank and the IMF. If the global economy is a key determinant of domestic business investment, it is also likely to be a key driver of the decision by businesses to raise employment plans.

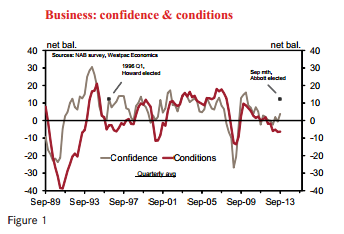

Figure 1 highlights the current challenges facing the Australian economy. It tracks current measures of business confidence and business conditions. Not surprisingly, the recent boost to business confidence is not yet reflected in business conditions, which are measured by actual new orders: employment and profits.

The recent boost to confidence has been inspired by the change of federal government. What we do not know is whether this boost to confidence is an accurate precursor to a boost in conditions. Consistently, strong conditions will be associated with a lift in investment and employment plans.

The Australian economy experienced a similar situation from March 1996. With the Coalition being returned after 13 years in opposition, we saw a spike in business confidence from 0.7 to 12.4. Unfortunately business conditions did not follow through with conditions averaging -4.7 over the next 12 months. At that time, the survey was a quarterly survey whereas we now receive monthly updates.

A good reason for the Reserve Bank to defer any decisions around further rate relief is to see whether business conditions demonstrate a much more sustained boost than we saw in 1996. Another key indicator on business investment will be the survey of capital expenditure, which will print on November 28. The attraction of this survey is that it will have been conducted in October and November – clearly after the election result – and the early impressions of the new government have been delivered.

Recall that the August survey was particularly weak with mining investment plans in 2013/14 being downgraded from 8 per cent to –6 per cent; services down from 11 per cent to 0 per cent; and manufacturing from –4 per cent to –12 per cent.

With more certainty around the political landscape and approval of the new government, a very solid boost should be expected from this survey. If, however, disturbing global events overwhelm domestic issues, there will be an important message for those folks who are anticipating a major lift in non-mining investment on the basis of the election result.

The evidence from 1996 is also not encouraging.

Despite the huge boost to business confidence following the March 1996 election, the Capex survey, which was released in May 1996 from a survey in April/May 1996, showed a modest downward revision in investment plans. The second estimate for investment in 1996/97 was 14 per cent above the comparable estimate in May 1995 whereas the first estimate – a survey conducted before the election – was up by 16 per cent. For services, these estimates were 8.5 per cent and 11 per cent respectively.

Business investment is clearly a key focus for the Reserve Bank. Issues discussed above – the importance of the global investment scene for Australia's own non-mining investment profile and the evidence from the 1996 election period – do not engender much confidence for a marked boost in investment following the recent election result.

Bill Evans is Westpac's chief economist.