Weekend Economist: Disoriented doves

The balance of partial indicators suggest that growth momentum in the Australian economy has slowed markedly over the last three months since the lead up to the federal budget.

Because most high frequency data is around the consumer and housing, most evidence in that regard can be found in that sector. House price inflation (6-month annualised) has slowed markedly in all of the major cities - Sydney (17 per cent (to March)) to 12 per cent (to June)); Melbourne (13 per cent to 8 per cent); Brisbane (6 per cent to 4 per cent); and Perth (6 per cent to flat). New housing finance approvals have slowed from 33 per cent in February to 2.2 per cent in May (6-month annualised growth rate).

Between March and May, nominal retail sales actually contracted by 0.5 per cent. We estimate that the 6-month annualised growth rate for retail sales will slow from 6.5 per cent in March to 2 per cent in June (based on a reasonable estimate for retail sales in June).

In the three months to March, we added 91,000 jobs, while in the last three months only 20,000 new jobs were added.

Not surprisingly, market pricing around the Reserve Bank's potential action has changed markedly. In late April, before the budget was released and before the market became aware of the lost momentum in the data, market pricing pointed to a 75 per cent probability of a rate hike by mid 2015 and a near 100 per cent probability of two rate hikes by year's end.

Now markets are pricing in a 50 per cent probability of a rate cut by mid 2015 and a zero probability of a rate hike by end 2015.

Current pricing stands in sharp contrast with our own expectations of rates firmly on hold over the next 12 months, with two rate hikes in August and November next year. This view is predicated on a number of key observations on the state of the economy.

On housing investment, a distinction needs to be made between marginal momentum and the absolute level of activity. After rapid growth through 2013, annualised dwelling approvals are at a high level relative to history, just below 200,000. As this activity comes on line, it will provide critical support to activity and the labour market, most notably in key eastern states. On the labour market, forward indicators remain more positive than the labour force survey; the implication here is that more robust employment growth is anticipated in coming months. While it will likely not be enough to arrest the slow rise in the unemployment rate until year end,

stronger jobs growth will support household incomes and affirm their expectations over the labour market. Coupled with continued house price growth, greater confidence in the labour market should be a positive for household demand through 2014 and into 2015.

This will provide a broadening of the demand base for Australian businesses. Australian firms have remained more sanguine on the outlook following the budget than consumers; and, as at June, conditions and confidence were both modestly above long-run average levels, according to the NAB business survey. To further reinforce the outlook for the consumer, we need to see the recent improvement in trading conditions and profitability translate into stronger employment demand. Global conditions should become increasingly supportive of this trend going forward. Currently, we anticipate world growth will strengthen from 3.0 per cent in 2014 to 3.7 per cent in 2015. This improvement will be a function of stronger developed world demand as well as stronger momentum in China, key for both the price level and volume demand of Australian exports.

This then leaves us to consider the likely longevity of the apparent confidence impact of the federal budget, arguably the key risk to the outlook.

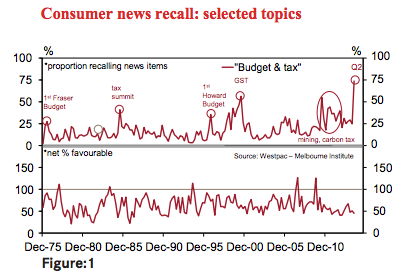

In Figure 1, we show the proportion of respondents in the Westpac Melbourne Institute consumer sentiment survey who recalled news items on the budget. June 2014 recorded the highest level of recollection for budget/taxation in the history of the survey.

Consistent with the run of weak economic data has been the weakness in the Westpac Melbourne Institute index of consumer sentiment. In the wake of the budget announcement, the index fell by 7 per cent to be 16.5 per cent below the recent peak in November 2013. The key to a recovery in momentum in the economy will be a solid recovery in the index as concerns around the budget dissipate. In that regard, there are a number of issues to consider:

1. By recent historical standards, the 2 per cent lift in confidence since the 7 per cent fall post budget has been modest. In 2013, the 7 per cent fall following the budget was largely offset by a 5 per cent lift in June. The index was back above the pre-budget level by August. In 2010, controversy around the mining tax and the carbon tax sparked a 7 per cent fall in confidence, with a near full recovery by July. Of course, the results of both those years were complicated by imminent elections and changes in the stance of policy (rate hikes in 2010 and cuts in 2013).

In other years, a 10 per cent drop in the wake of the 1978 budget was fully recovered in 3 months; in 1998, an 8.4 per cent drop saw a 6.4 per cent recovery in the following month. In the lead up to the introduction of the GST, the index fell by 7.8 per cent between March and May but had fully recovered by June. The exception to this "quick bounce back" phenomenon was 1995, when confidence fell by 7.3 per cent in the wake of the budget and did not show any recovery until the election in March 1996.

2. Households have been overestimating the near term severity of this budget. Total savings in the first 3 years of the budget are expected to be around 1 per cent of GDP compared to 3 per cent of GDP in savings from the first Howard-Costello budget. Surprisingly, confidence only fell by 0.3 per cent in the wake of that budget.

3. Media estimates suggest that the new Senate will oppose around $24bn of the $36bn (over 4 years) in budget savings. Of course, these policies include most of the less popular initiatives, including the $7 co-payment for visits to the doctor.

The political uncertainty around the Senate is likely to be considerable. On the basis that Labour (25 seats) and the Greens (10 seats) consistently oppose the budget policies, the government (33 seats) will need the support of Palmer United (3 seats plus 1 aligned independent) and 2 of the 4 remaining minor party/independent Senators to pass legislation.

With the government determined to act on its mandate, we may be facing a considerable period of political uncertainty. It is a difficult call as to whether consumers will respond positively to news that some of the more unpopular initiatives will be abandoned, or negatively to an extended period of political turmoil and uncertainty around their financial prospects.

On balance, we favour a gradual improvement in confidence and an associated recovery in marginal momentum for the consumer and housing. We expect households will look through the political turmoil whilst also appreciating that the severity of the Budget measures has been overestimated.

We expect that the Reserve Bank will be similarly patient, expecting the consumer to gradually lift its confidence and restore a more solid pace of spending, including a lagged boost to housing.

If that profile prevails, then business will lift employment and non mining investment, adding to the underlying support given by rising housing investment. In turn, market pricing is likely to move back towards its late April stance.

Bill Evans is chief economist with Westpac.