WEEKEND ECONOMIST: Confidence crisis

The Reserve Bank will have been disappointed with the results from the June quarter survey of private new capital expenditure.

Recall that a key objective behind the bank's decision to ease the cash rate from 4.75 per cent to 2.5 per cent since November 2011 has been to promote a rebalancing of business investment towards non-mining sectors to replace the expected contraction in mining investment over the next three to four years from its current peak of around 8.5 per cent of GDP to 3 per cent.

The capex survey allows us to analyse investment plans on an industry basis with the broad categories being mining, services and manufacturing.

However, it does not cover all investment. It excludes investment in intangible assets such as software, research and development and a number of industries including agriculture, health care and education.

All up, excluding intangibles, the capex survey covers 90 per cent of investment by industry with the aforementioned covering the remaining 10 per cent. The services sector of the capex survey includes construction, energy, trade, transport, telecommunications and business services. For the purposes of the survey these industries are grouped into the 'services' category.

Consequently, while not exhaustively covering all business investment, the survey does cover those key cyclical sectors as well as mining and manufacturing.

The June quarter capex survey showed a sharp drop in investment plans for 2013-14 in mining, manufacturing and services.

In the March quarter survey we estimated that investment plans for 2013-14 for mining were for an 8 per cent boost from 2012-13; for manufacturing a 4 per cent cut; and an 11 per cent increase for services. For the June quarter survey those estimates were reduced to -6 per cent for mining; -12 per cent for manufacturing and flat for services.

These numbers are very disappointing from the perspective of the Reserve Bank, although we suspect that the March quarter numbers were viewed with a degree of scepticism at the bank. In its August Statement on Monetary Policy the Bank noted: "Consequently, while the capex survey is helpful in assessing the state of mining and non-mining investment, it is important to supplement these data with analysis and information from a wide variety of other sources – such as the bank’s business liaison program, project-based databases, building approvals data and business surveys – in order to obtain a full picture of investment activity underway in the economy."

Clearly the bank's liaison work in particular had not been consistent with the rather bullish March quarter survey and the bank made a point of qualifying the capex result in anticipation of the June quarter report.

Westpac was expecting a weak result from the June quarter capex survey although there were a number of cross currents affecting the survey.

The survey was in the field during July and early August. That followed the change of leadership in the government which led to considerable changes in the opinion polls heightening political uncertainty.

However, it also followed the marked fall in the Australian dollar. The March survey was in April when the Australian dollar was averaging around $US1.05 compared to the July average of $US0.90.

A markedly lower dollar should have boosted confidence and investment plans. This intransigence of business confidence is at the heart of Australia's economic challenge.

To date, low business confidence has limited employment and investment plans. In turn, despite a solid recovery in consumer sentiment households are very concerned around job security. This concern constrains spending and feeds back into moderate sales which in turn affects businesses.

In previous cycles the 'circuit breaker' has been lower interest rates which have boosted business and consumer confidence; in turn boosting spending and employment; incomes and eventually investment. In this cycle business confidence has failed to respond; investment and employment plans are soft and households feel insecure around job prospects.

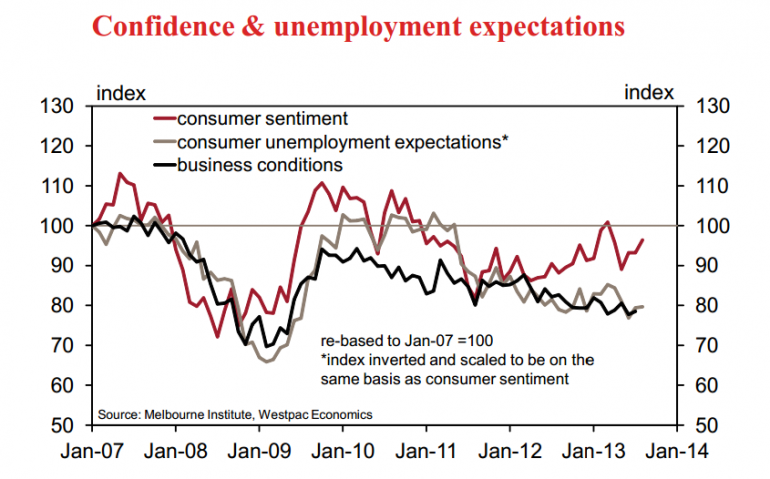

The chart below tracks business, consumer and employment confidence since before the GFC. It notes that consumer confidence has been responding to lower rates particularly as consumers have become more comfortable with the outlook for their finances and generally for the economy. But confidence around job security has not tracked the improvement in consumer confidence as has been the case in earlier cycles.

The weakness in job security is matched by the ongoing weakness in business confidence. Clearly households are detecting the reluctance from business to employ, undermining their sense of job security.

A more constructive attitude of business towards employment and investment appears to be the key to the current soft economy. With interest rates and, arguably, the currency (see results of June quarter capex survey) not providing that circuit breaker we probably have to look offshore. Some argue that a likely strong upswing in the US economy could boost not only confidence through equity markets but also provide that boost to the Asian region which has recently been faltering under the threat of Fed tapering and a slowdown in China.

Others might argue that political certainty will provide a major boost. Hopefully, there will also be a greater acceptance that fiscal policy and infrastructure investment in particular need to play more constructive roles going forward. A government freed from the constraints of a hung parliament should undoubtedly help.

We should not give up on the prospect of a return to above trend growth. Certainly it would be folly to deny the existence of the business cycle.

Bill Evans is Westpac's chief economist.