WEEKEND ECONOMIST: Back in balance

With consumer sentiment and jobs data pointing in the right direction, the macroeconomic balance is close to changing in Australia.

Following the print of the February Employment Report, markets have moved to effectively price out any rate cuts for the remainder

of 2013.

Readers will be aware that Westpac is forecasting a final cut of 25 basis points in June for a cycle low point of 2.75 per cent.

That has been our target since May last year when rates were 3.75 per cent although we have moved the target back from March to June.

We continue to hold that view. Adopting a 'no change' view is likely to imply to our customers that we see the next move as 'up'. Indeed, some will recall that when the last two easing cycles ended, the bank began tightening within six months. Our assessment of the global and domestic outlook favours the next move to be down, but we do recognise that June may now be a little 'early' for the next cut. The election in September is also likely to complicate the Reserve Bank's decision process during the second half of the year.

Over the course of the last two weeks, the market has priced out around two 25 basis point rate cuts for 2013. In the last week, the second of the two cuts was priced out. We accept that the information in the Consumer Sentiment report was unambiguously strong. The index increased by 2 per cent following a 7.7 per cent jump in January to be 15 per cent above its year-ago level, its highest read since December 2010. The index has now held above 100 for five consecutive months having been below 100 for 14 of the previous 16 months.

Recent prints on business confidence tell a different story. Businesses are concerned by the high Australian dollar (which was boosted in the aftermath of the labour force survey), while our customers point to political and regulatory uncertainty.

Consumers are clearly responding to the lower interest rates and the spectacular performance of global share markets. While most households will not be large direct investors in equities, they will associate a stronger equity market as a clear signal that global economic conditions are improving. Concerns, particularly around the rolling European financial crises, had been unnerving households. It is our view that disturbing European related news is likely to resurface over the next 12 months as markets reassesst he preparedness of the periphery to accept the reforms required to ensure ECB support for their funding tasks. Years of recession are likely to weigh heavily on the acceptance of more austerity.

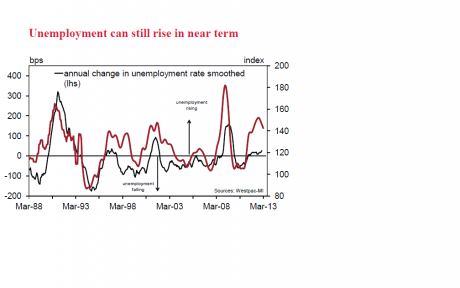

Supporting the boost to confidence was a 3.6 per cent improvement in respondents assessments of their job security. That index appearst o have 'rolled over', supporting a more constructive assessment of the labour market (Figure 1). However, it is only 6 per cent higher than a year ago, compared to a 15 per cent improvement in the Consumer Sentiment index.

For us, further evidence that households are becoming more confident around their job security is more convincing evidence than the spectacular 71,000 new jobs print for February. Our note yesterday pointed out that sample rotation issues may have explained up to 90 per cent of the increase. Essentially the sample used for the calculation of the unemployment rate and new jobs is 'refreshed' by replacing 12.5 per cent of the sample in the previous month with a new group. If the characteristics of the new group are quite different to the existing group, a sharp change in the jobs picture can result. Using the seasonally unadjusted gross flows data (the only data available), we used our seasonal adjustment process to estimate that the constant component of the sample could have explained only a small part of the total growth.

Sources indicate that the ABS itself estimates that around 50 per cent of the increase could have been explained in that way. In addition, an unusually large boost to population in the March quarter (after seasonal adjustment) might also have explained some additional part of the sizeable boost to jobs. Note that the unemployment rate did not change despite the large increase in jobs.

Meanwhile, a major source of concern for the Reserve Bank – the Australian dollar – was boosted by the labour force survey. The Trade Weighted Index now stands at its highest level since August last year when the Australian dollar stood at a threatening $US1.06 (versus $US1.038 today). We know that the Reserve Bank assesses monetary conditions in the context of the TWI rather than the US dollar, so it will be unnerved that a statistical anomaly has so boosted the Australian dollar.

In conclusion, despite the market's confident reaction, we assess that the better view is that the balance of risks still favours a further rate cut; however, we do recognise that our current target of June might be a little too early.

Bill Evans is Westpac's chief economist.

Share this article and show your support