We know what you're thinking

| Summary: We are always interested in the views of our subscribers, and this week’s Eureka Report conference in Sydney was a perfect opportunity for readers to air their opinions on the economy, taxes and the broad investment landscape. What stuck out for me were some interesting opinions on the tax-free status of pension fund income, and on the likelihood that interest rates will remain lower for longer than expected. That will prolong the hunt for yield. |

| Key take-out: If you believe that at some time in the future we are going to have a yield stock correction, and that rates will rise, then having a proportion of your funds in a bank term deposit makes sense. |

| Key beneficiaries: General investors. Category: Economics and investment strategy. |

When you bring together the Eureka Report audience and a series of experts together, there are always surprises that emerge.

In Sydney this week the first of my two biggest surprises came from an elderly lady – a Eureka reader, who came up to talk to me about tax. The second came via a new way of looking at what is happening in the stockmarket – more of that later.

Investment taxes

Most people on superannuation pensions are anxious that their tax-free status be maintained, but this Eureka reader felt guilty about receiving so much income and not paying tax. She was an advocate of the Shorten plan, which meant that the first $100,000 of a fund’s income would be tax-free but thereafter tax would be 15%. Arthur Sinodinos, when Minister for Superannuation, abandoned the Shorten proposal saying it was too complex. All those on superannuation pensions were delighted, but there remained a danger of a later more vicious attack. We know that Treasury has no idea of how superannuation works and what the costs are and like to put out false figures. It is always possible that a future Cabinet will believe them.

Whichever way it goes, tax and superannuation pensions is going to come up again and again. There are a great many people who rely on the tax-free status of pension payments to cover the fact that interest rates are low and they have not accumulated sufficient funds for a lengthy retirement.

But, of course, others are in a different position and the elderly lady’s feeling of guilt is probably duplicated, so future politicians may well pick up on it. I don’t think the current government will make significant changes to superannuation.

The yield boom

On the investment front my surprise was the fact that a number of speakers believed that we are experiencing a yield boom, which is similar to the dot com, mining and other booms that Australia has experienced.

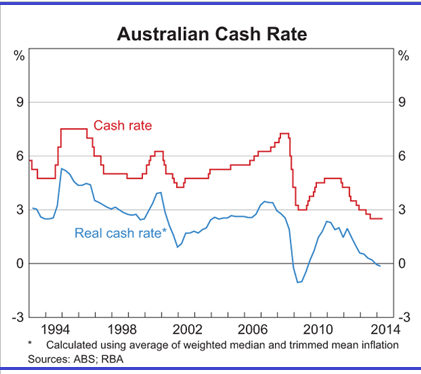

The quest for yield has caused the price of yield stocks to rise to a level where they may already be overpriced. But this is a boom, and so they could go a lot higher, in which case they will reach levels that will require a substantial correction when interest rates start to rise. It became clear at the seminar that most think interest rates will stay at present levels for an “extended time” given the fall in recent consumer confidence and that “extended time” could move well into 2015.

And if that happens, then our yield boom will be like all other booms and go much further than anyone believed.

But eventually interest rates start to rise because the current low levels are not sustainable. If income producing stocks have gone too high they will be subject to a considerable correction.

What can make interest rates rise? At some point the massive overseas central bank injections of funds overseas is likely to lift inflation, and if it does then that will trigger a movement up in global interest rates. In Australia we are likely to follow overseas and, of course, if inflation was to break out in Australia it would trigger higher rates.

Our cushion of course is that Australian interest rates are higher than overseas. In addition, it is becoming clear that the housing boom in Sydney and Melbourne has gone off the boil. If that continues it takes pressure off the Reserve Bank to lift interest rates.

The signals from the Australian and global bond markets indicate that interest rates could stay down for a lot longer than we expect. Indeed, this week in the USA we saw bond yields fall again. But every boom ends in this instance, which means we will develop a yield boom that will inevitably have a sad end. Like any boom you can play it, but look for higher inflation, which signals that the boom could end. And given that the next interest rate move is likely to be up, be wary of long-dated low-yielding securities.

In a yield boom boards are encouraged to distribute their surplus cash to shareholders. That sounds like a good idea, but in most businesses it is necessary to invest retained earnings to improve productivity and in many cases to develop growth momentum.

Last week I was yarning with Telstra CEO David Thodey and I mildly berated him for the fact that Telstra is not investing to develop its growth prospects and may be distributing too much to shareholders.

That triggered a statement that Telstra would indeed develop a series of growth opportunities, and in the August profit statement Telstra would set out its distribution of profits policy for coming years. Do not expect a dividend cut and there will be further increases over time, especially as the company has a very strong balance sheet. But Telstra is likely to invest money into growth, both in Australia and Asia. The next profit announcement will be of more importance than usual.

Given that inflation is the long-term danger for investors in yield stocks and longer-term deposit securities, it makes sense to have a portion of your interest-bearing deposits portfolio in inflation protected assets.

In this context the FIIG Group provided a series of alternatives including inflation bonds, where the current yield is low but the principal increases with inflation each year. I have purchased some of these inflation-linked corporate bonds as a hedge.

With corporate bonds it is important to look closely at the company you are investing in and where it gets its income from. Remember, in the case of shares, if the enterprise does well there is large upside. In the case of corporate bonds, there is no large upside but rather a return fixed by a series of rules.

Unlisted property trusts

One of the surprise suggestions that came to the seminar was that you should look at unlisted property trusts because they enable the purchase of property on a more favourable basis than listed property trusts that have been caught up in the yield boom. I will look at this down the track. Of course, we saw in the global financial crisis that where there was a run on unlisted property trusts that offered redemptions they had to close their doors, and so they went out of favour. If you invest in them, then realise that if in a crisis too many people want their money back the fund has to freeze. But property in normal circumstance is not a liquid asset, so these investments should not be classified liquid in all circumstances.

This is a difficult time for yield-conscious investors because global and Australian rates are very low. One point worth remembering is that while large institutions must invest in government bonds, smaller self-managed funds and individual investors can invest up to $250,000 in a bank or credit union and obtain a government guarantee. In most cases the term deposit rate is higher than the equivalent bond rate. Now, of course, bank deposit rates are currently not high but if you believe that at some time in the future we are going to have a yield stock correction and the next movement in interest rates is likely to be up and not down, then a portion of your portfolio can be in shorter currencies, bank term deposits.

But it doesn’t have to be at call, because the odds are that there are at least 12 months at the current rate and probably a lot longer.