WCB: All the way to $8.50?

| Summary: The takeover tussle for control of Victoria’s Warrnambool Cheese and Butter Factory is set to intensify, with experts tipping there’s more to come from bidders Bega, Saputo and Murray Goulburn. |

| Key take-out: Some analysts are predicting the final offer price for WCB could hit $8.50 a share, excluding franking credits. |

| Key beneficiaries: General investors. Category: Mergers and acquisitions. |

Investors have been stunned at the intense three-way takeover battle that has broken out over Victoria’s Warrnambool Cheese and Butter Factory (WCB). But professional investors are now suggesting bids for the dairy group may shoot as high as $8.50 after last week’s $7.50 bid from Murray Goulburn.

As WCB stock hovers around $8.10 on the ASX (October 23) the die is cast for one of the hottest significant takeover battles seen on the ASX for years.

Moreover, it could be the start of something a lot bigger: As John Abernethy, chief investment officer at Clime Asset Management suggests, “you’ve got an international player, Saputo, going into China … they need Australian or New Zealand supply lines, you’ve got local players who have let the global market drift away … you are now seeing a rush to build critical mass.”

Abernethy explains that in an intensely contested global takeover battle, fundamental valuations are overridden: “That’s why these bidders are willing to buy on a cash negative basis, at least for the first couple of years.”

Meanwhile, Mark Topy from Canaccord Genuity says: “Above $8 here you are paying 20 times earnings before interest, tax, depreciation and amortisation (EBITDA) … in terms of Australia, once you go beyond 13 times you are in pretty stretched territory.”

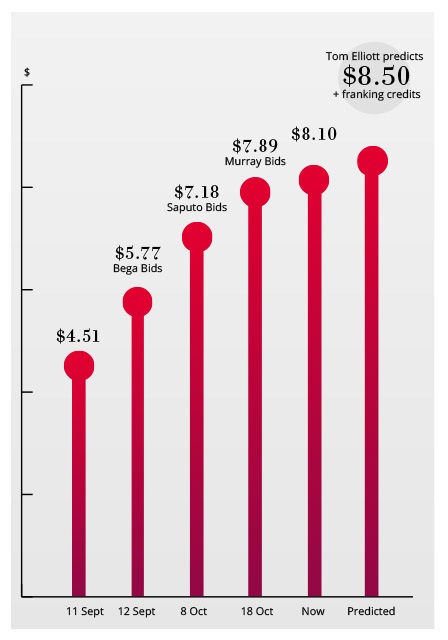

To recap the story so far: WCB was trading at $4.51 when rival dairy group Bega started the takeover action with a $2 cash bid and 1.2 of its own shares in mid-September, sending WCB’s share price up 28% to $5.77 in one day’s trade. (Eureka Report’s takeover specialist Tom Elliott named WCB as a takeover target prior to the bid … click here).

WCB shares jumped again to $7.18 early this month when Canadian good group Saputo trumped Bega with its $7 cash bid and the offer to release franking credits – worth up to an extra 56 cents a share if Saputo gets 90% approval – enticing shareholders further.

Then Murray Goulburn offered $7.50 cash – a 7% premium to Saputo’s bid – and to match the franking credit proposal on Friday last week (October 18).

Given the share price has since soared above $8 in response to the surprise move by Murray Goulburn, the market anticipates more action from the three suitors.

And, if history is any guide, WCB has further to run when multiple suitors are involved.

Perpetual portfolio manager Nathan Parkin, whose firm has a minority stake in both Bega and WCB, compares the situation to the acquisition of engineering and equipment supplier Ludowici last year, which had its shares more than triple to $10.83 amid a takeover tussle between three companies.

But who will make the next move? Analysts are divided between Saputo and Bega, with the Canadian giant desperate to expand its global reach and the much smaller Australian cheese manufacturer equally determined to pursue synergies.

Belinda Moore from RBS Morgans suggests Bega is readying itself for another bid after its annual general meeting yesterday, where its shareholders approved the initial move for Bega to issue more than 10% of its stock as part of its current offer.

“But it’s only a matter of time before deep-pockets Saputo comes out with a higher offer too,” says Moore. “It is the most efficient dairy processing asset in the country, it’s in the best region for dairy, it has a large export presence – which is very attractive.”

In contrast, Doug Picken from IG Markets thinks Murray Goulburn’s bid will stand as the highest, but it will be blocked on competition concerns by the Australian Competition and Consumer Commission, as it was three years ago, with Bega emerging as the winner on a slightly sweetened offer. He does see the potential for Saputo to lob in a higher bid, but it may be futile.

“The key problem here is that Murray and Bega have a combined shareholding of 35%, so [for Saputo] to get approval above 50% is going to be very difficult,” he said.

“We have a number of people who want to short WCB at these levels but can’t because they can’t get hold of any borrowings of the stock – it really is a one-way train at the moment.”

Regardless, a string of market observers believe the next bid will be substantially higher than $7.50 and the stock will move with it.

Senior fund manager at Pengana, Antonio Meroni, thinks the final price will be up to 10% greater than $7.50, which would mean a valuation of around $8.30 when franking credits are included.

But Moore, Topy and especially Eureka Report takeovers specialist Tom Elliott believe the bids could come in even higher.

Topy says: “I think $8, $8.20, $8.30 – around there – beyond that is too high for a company that has underperformed for the last five years.”

Elliott goes further: “It’s probably got $8.50 on it now – two more bids will see it there – with the franking credits thrown on top.”

Whatever price lands the knock-out blow, analysts urge investors to pay attention to the fast-rationalising dairy sector for more takeover action.

One of the losing aggressors in this contest, such as Bega, could end up turning into the prey.