Wall Street rules

Summary: It is time for the US to start increasing interest rates and I think rate rises will be modest. Any sharp rate rises would cause a fall in bond prices and boost the US dollar, which could snuff out the US recovery. Meanwhile, China is trying to curb steel manufacturing, but I think the curbs will be less than many expect which will help our commodity prices. In Australia, we are almost certainly going to see a further decline in interest rates, and bank depositors are turning to the share market for income. |

Key take-out: Certainly there is downside risk in our share market but that doesn't mean that you have to bail out of everything. |

Key beneficiaries: General investors. Category: Shares. |

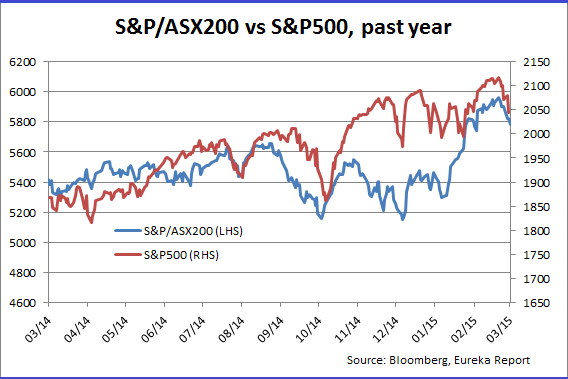

The 1 per cent fall on Wall Street mid-week and the rise in the US dollar (and fall in the Australian currency), shows the world is moving roughly as predicted in Eureka Report and many other places last year.

In the next few months we will see whether the global and local markets continue to perform in accordance with the generally agreed script and how far it goes.

Today I want to set out what the script is so that you can plot the deviations and I will plot some possible deviations of my own. I will also look at some important trends in the Australian market. We start with the US because that is where the action is.

As I and many others have been writing for some time, the forward momentum in the US is strong and a lot stronger than some expected. As a result it is now time for the Federal Reserve to start increasing American official interest rates. There are many who expect very substantial US rate rises but I think they will be modest.

If Federal Reserve chair Janet Yellen lifts rates substantially she will cause a dramatic fall in US bond prices which will catapult into problems in the US banking system.

Moreover sharp rises in US interest rates will suck the world's money into the US like a powerful vacuum cleaner and cause the American dollar to rise spectacularly. In last year's script the rising US interest rate levels would lower bond prices but this week the avalanche of money into the US was so great that bond prices rose despite the prospect of higher US interest rates.

That avalanche and rising US dollar may snuff out the US recovery – hence the falls on Wall Street. The danger is increased as significant portions of that recovery were kick started by the shale gas and oil energy boom. That boom is being curtailed as a result of the sizable fall in oil prices.

As often happens in the US, the petroleum boom was funded by some very large debt issues which are looking very sick given the fall in the oil price. They will look even sicker if the US dollar climbs steeply. So my script for the US is for interest rate rises but of a modest nature. What do I mean by modest? I would say around or below one per cent over say 18 months which is a lot less than many market analysts expect. Obviously I could be wrong but if I am wrong watch for further adverse repercussions in the market.

Over in China they are attempting to lessen their dependence on manufactured exports and increase their service industries particularly those aimed at the domestic market.

At the same time there is an enormous debate over pollution which is accelerating efforts to curb steel and many areas of manufacturing.

But these areas are often labour intensive so I think the curbs will probably be less than many expect which will help our commodity prices although the over production in iron ore and coal does not provide a very happy outlook. The world's third-largest iron ore producer, Vale, has seen its share prices fall from $US32 to $US6 over some four years. Rio Tinto and BHP shares have performed much better because they have been more aggressive on costs. Indeed, BHP was outstanding in cost management, but it is hard to see iron ore prices making much upward progress while production continues to increase.

Oil may do better but not that much better. In Europe, the game of chicken between the EU and Greece is not going to go away in the next few months.

Here in Australia our script is totally different to the US. We have high and rising unemployment and an economy that is being hit by lower commodity prices and a non-resource sector where confidence has been battered by some five years of bad government in Canberra.

Almost certainly we are going to see one interest rate fall in the next month or two and possibly more. But once the Australian dollar falls from today's levels of around US77c to US70c – as it looks set to do as the US lifts interest rates while we decrease our rates – then the Reserve Bank will become more apprehensive about interest rate falls.

Our share market has been driven by yield because as interest rates fall, more and more bank depositors are turning to the share market to get income. Just as the US market is vulnerable to a much higher exchange rate so we are vulnerable to over valuation caused by yield chasing: This is a view now being promoted by both UBS and Macquarie Bank.

In non-resource stocks during the last half year earnings rose around nine per cent which was a good performance overall but the share market responded by a similar amount and frankly I think it looks very like it has reached a peak. Certainly there is downside risk in our share market but that doesn't mean that you have to bail out of everything.

All the same be aware that the rise in our market at the start of 2015 has been substantial and if anything it raced ahead of earnings as investors sought yields.

We are seeing a number of industries where competitors have been burnt out and there are clear signs of recovery. The best example of this is appliances where Harvey Norman went through a number of years where competitors were going broke and the company itself lost some $100 million buying Clive Peeters. Gerry Harvey believes that with far fewer rivals he will be able to increase prices and profits in line with the falling Australian dollar.

The other industry where there has been a change in structure has been airlines. Neither Qantas nor Virgin is now trying to do serious damage to the other and both want to make money. That won't stop discounting but the ferocious capacity wars are over.

By contrast the supermarket industry looks set to intensify competition because Woolworths needs to lower its prices and Aldi is taking market share particularly from Woolworths but also from Coles.

We have seen substantial shorting of the Woolworths stock which indicates the market is very nervous about the standing of Australia's largest retailer and clearly the shorters believe substantial write downs are required for the Masters hardware chain.

Wesfarmers, which owns Coles and the booming Bunnings, is a magnificent company but with Woolworths and Aldi pressing harder there is an extra degree of risk, given the high price.

Banks face long term technology risk but their current environment is benign and they have become a great source of income. But they are priced way above their overseas counterparts and above the levels at which they are normally valued in Australia. The script says the lower Australian dollar should boost our shares, particularly miners. But as we saw this week given the high level of our market we are moving with Wall Street and that trend may continue.