Value Investor: Woolworths stays fresh

Woolworths’ Australian Food & Liquor division delivered a strong third quarter sales result as this division continues to take market share. A core business for WOW, Australian Food & Liquor grew sales 4.4 per cent -- significantly faster than Australia’s population growth of 1.5 per cent and marginally faster than Coles’ sales growth of 3.9 per cent over the same period.

Both WOW and Coles’ third quarter sales results suggest the majors are continuing to hold their market food retailing shares against each other but are both eating up market share from the independents with minimal interference from the Aldi and Costco rollouts.

Woolworth’s performance reflects its scale and pricing power, the ability to simultaneously reduce prices for customers and widen margins for shareholders, and a consumer staples offer that is resilient to volatility in consumer confidence.

Consumer spending in Australia has been under pressure from rising living costs, a higher household savings ratio, a soft employment market along with fears over job security and subdued wage and income growth. The effects on consumer confidence of the tough Federal Budget remain to be seen, but are unlikely to be positive.

While discretionary retailers including WOW’s Big W have struggled in a weak consumer spending environment, WOW’s core food and liquor segment remains resilient.

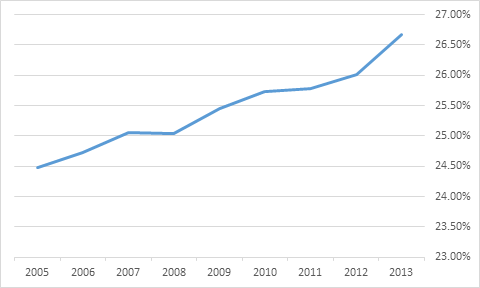

WOW possesses an impressive ability to drive prices down, achieved by cheaper buying, supply chain efficiencies, more effective promotions, reduced shrinkage, global sourcing, and the success of its private label. This has contributed to a strong history of profitability, with group gross profit margins continuously expanding since 2005.

Figure 1 – Woolworths Gross Margins

Source: Woolworths & Clime Asset Management

The gains are shared between shareholders and customers in the form of higher returns and lower prices. WOW’s ability to drive supply chain efficiencies and pass these on to customers increases its competitive appeal in the market and is one of the stock’s attractions.

WOW is committed to investment in further supply chain productivity gains. Strategic initiatives in Australian supermarkets will continue, namely supplier renegotiations, shrinkage reduction, global sourcing, private label penetration and brand relaunch.

WOW’s other businesses generally present interesting growth opportunities. Despite the late arrival of Masters to the Home Improvement industry, sales increased 29 per cent on the previous year. WOW confirmed it expects fiscal 2014 losses to be lower than last year and that the business will break-even during fiscal 2016.

WOW remains a strong cash flow generating business, which combined with the strong balance sheet means the company can self-fund its expansion and refurbishments plans. WOW plan to open a net 108 new stores Australia-wide in fiscal 2014. This includes supermarkets (46), liquor (14), Masters (18), Big W (4), petrol (19) and hotels (1).

Coles also plans to open 70 new supermarkets in the next three years, while smaller competitors Aldi and Metcash are together expected to open around 30 new stores.

Although the outlook for the Australian grocery market is generally positive, underpinned by approximately 1.5 per cent per annum population growth, the rapid industry-wide roll-out may dilute returns. The majors, WOW and Coles, are best placed to compete given their compelling value propositions, with Metcash likely to continue to lose market share.

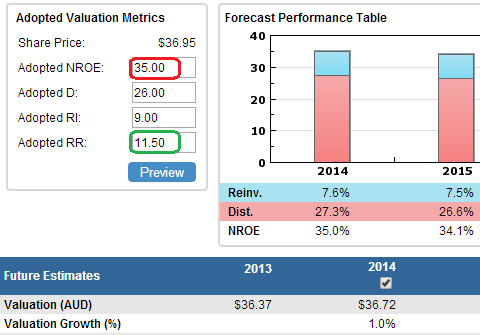

We adopt a Return on Equity of 35 per cent (red), marginally above the five-year average and broadly consistent with market expectations of another seven per cent lift in profit in fiscal year 2015. The Required Return at 11.5 per cent (green) reflects very good financial health, consistent profitability and mostly non-discretionary earnings. We derive a fiscal 2014 valuation of $36.72.

Figure: WOW Valuation

Source: www.stocksinvalue.com.au

Our thesis assumes price competition remains manageable, a little consumer price inflation returns to make cost recovery easier, margin improvement in general merchandise, and Masters breaks even on schedule.

Given the increasingly competitive supermarket environment and execution risk surrounding Masters, we would require a 10 per cent margin of safety before purchasing.

By Brian Soh and Amelia Bott of StocksInValue, with insights from John Abernethy and George Whitehouse of Clime Asset Management. StocksInValue provides valuations and quality ratings of 400 ASX-listed companies and equities research, insights and macro strategy. For a no obligation, FREE trial please visit StocksInValue.com.au or call 1300 136 225.

Disclosure: Clime Asset Management owns shares in Woolworths Ltd.