Value Investor: Weighing Wesfarmers' worth

Wesfarmers (ASX: WES) is popular, widely held by investors and owns consumer-friendly retail chains Coles, Bunnings and Kmart – but WES is also trading 47 per cent above value!

WES shares are popular with investors due to improving profitability, driven by the turnaround in Coles’ performance and strong momentum in Bunnings and Officeworks. Investors might also benefit from the possible distribution of $3 billion in proceeds from the sale of its insurance division. However, this is more than accounted for in the current price around $40 -- far above our FY14 valuation of $29.30.

The recent third quarter result showed the positive trends, when WES reported revenue growth of 4 per cent and net profit after tax rose 11 per cent.

The highlights were the continuing strong performance of Home Improvement (Bunnings), with comparable sales growth in the quarter accelerating to 9.1 per cent (from 7.2 per cent in first half fiscal 2014), and Officeworks, delivering a 7 per cent increase in sales, driven both in store and online.

Bunnings so far appears to be unaffected by the rollout of Masters stores, owned by arch rival Woolworths, and remains well placed to continue to leverage Australia’s improving residential market.

However, Coles remains the major valuation driver for WES, as it accounts for almost half of the group’s sales and 40 per cent of all operating earnings.

Although consumer spending remains under pressure with the rising cost of living and job security fears, the impact on Coles is reduced by the non-discretionary nature of supermarket retailing and the retailer’s ability to drive lower prices.

Sales growth of around 4 per cent in the quarter was solid and matched Woolworths’ performance in the quarter. The greatest risk to Coles’ earnings is a price war in supermarket retailing.

However, as covered in our article last week on Woolworths, we see the major supermarket chains holding their own against each other while taking market share from the independents, particularly IGA (owned by Metcash).

Management plans an aggressive store rollout program for Coles, with 70 new supermarkets expected to open in the next three years. With smaller competitors Aldi and Metcash planning to open 30 new supermarkets combined in the same period and Woolworths opening 46 new stores in fiscal 2014 alone, this rapid industry-wide roll-out may dilute returns.

Wesfarmers is exiting the insurance industry, after announcing in April the sale of insurance broking and premium funding subsidiaries to Arthur J. Gallagher for $1 billion.

This follows the $1.84 billion sale of Lumleys to IAG in December 2013, which progressed after the New Zealand Commerce Commission gave its approval to the deal last week. The deal still awaits approval from the Treasurer, APRA and the Reserve Bank of New Zealand.

The total proceeds from the sale of Wesfarmers’ Insurance division reach $3 billion, which equates to $2.32 per share.

The use of proceeds from the sale of the Insurance division is of key consideration for investors. The sale proceeds are significant, and options may include another capital return, a buy back or an acquisition.

There is press speculation WES is considering a $3 billion offer for Healthscope (HSP). WES has declined to confirm or deny its interest. Ownership and management of private hospitals would be a new activity for WES.

Overall, WES is a mature large business, experiencing slowing revenue and operating income growth.

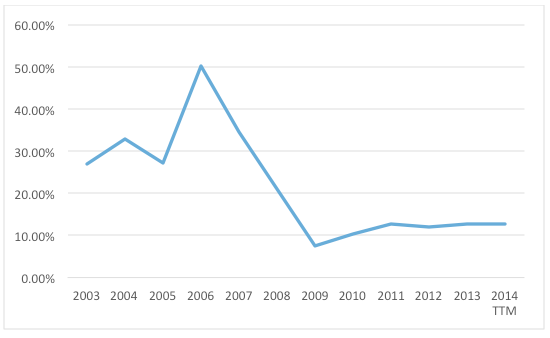

Its profitability fell after the acquisition of Coles in 2007, which, along with capital raisings in 2008 and 2009, diluted return on equity.

Figure 1 – WES Historical Return on Equity

Source: StocksInValue

This has not been helped by the poor performance of Target.

Though WES has significantly improved Coles’ profitability, there is a long way to go before WES shareholders are rewarded for their dilution in acquiring Coles.

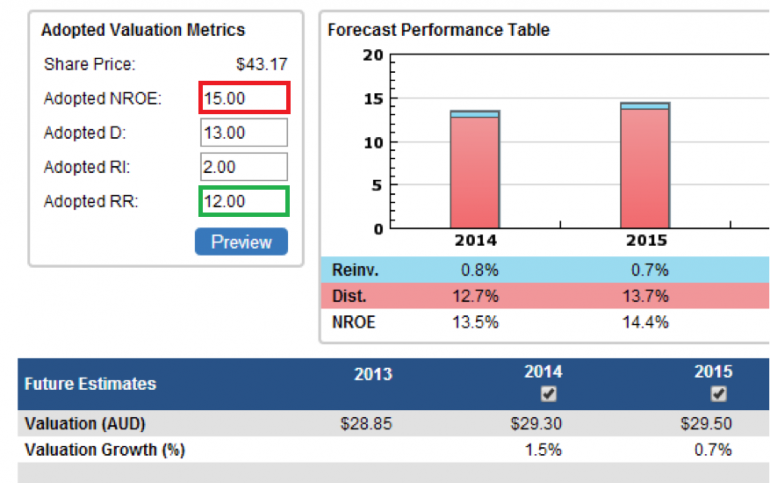

We adopt a forecast return on equity of 15 per cent (red below), above the five-year average of 12 per cent. This reflects WES’s improving profitability from the turnaround in Coles, and strong sales growth in Bunnings and Officeworks.

We adopt a low required return of 12 per cent to reflect its large market capitalisation, low gearing and consistency of group performance underpinned by the non-discretionary nature of Coles’ sales revenue.

Figure 2 – WES Future Valuation

Source: StocksInValue

Our valuation of WES for fiscal 2014 is $29.30. With the current price above $40 per share, WES is trading significantly above value.

WES’s price is somewhat supported by its dividend yield predicated on its high payout ratio and low reinvestment rate and shareholder expectations of a potential capital return from the insurance proceeds.

While the franking-enhanced dividend yield is higher than cash or fixed interest, a recovery in interest rates will likely present downside risk to the share price as income seeking investors rotate into lower-risk fixed income products.

We recommend a 10 per cent margin of safety before investing in WES.

By Brian Soh, associate analyst at StocksInValue, with insights from Adrian Ezquerro of Clime Asset Management. StocksInValue provides valuations and quality ratings of 400 ASX-listed companies and equities research, insights and macro strategy. For a no obligation FREE trial, please visit StocksInValue.com.au or call 1300 136 225.