Value Investor: Two stocks with very different outlooks

Recently we updated our valuations for Insurance Australia Group and Pacific Brands, whose shareholders have had very different experiences.

Insurance Australia Group announced a strong fiscal 2014 result, with insurance profit up 11 per cent to $1.58 billion. The result was supported by higher than expected reserve releases in a particularly low-claims environment. The insurance margin widened 110 basis points as a result to 18.3 per cent. The full-year dividend has more than doubled in two years.

The result contrasts with IAG's unimpressive historical performance.

Total shareholder return over the last 10 years was just 7 per cent per annum. This is due to volatility in returns on policyholders' and shareholders' funds, catastrophe claims, prolonged poor profitability in the commercial insurance business and the disastrous acquisitions in the UK last decade.

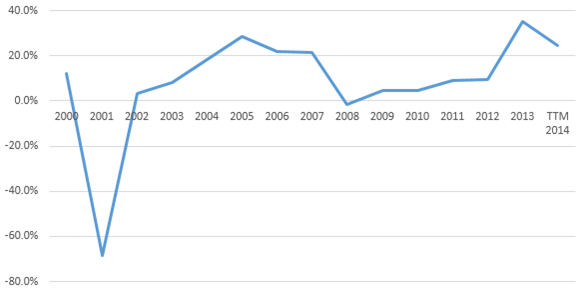

Figure 1 – IAG Historical Normalised Return on Equity

Source: StocksInValue

Return on equity (ROE) averaged just 9 per cent over this period -- several percentage points below any reasonable required return for a general insurer.

This somewhat reflects the dull and cyclical returns in the general insurance industry over the last decade, especially in commercial (SME) insurance. Barriers to the entry of foreign capital to the local commercial insurance market are not high. As companies pursue cash flow and market share, there can be bouts of underpricing for risk.

In our view, insurance experience is crucial in management in this particularly risky, specialised sector. IAG's mistakes in the UK last decade are partly attributable to the installation of a banker, Mike Hawker, as CEO. The subsequent turnaround under insurance veteran Mike Wilkins was no surprise given his record of profitable risk pricing at Promina.

Looking forward, sustainable ROE will be higher and less volatile than before, when IAG's risk pricing was not as strong, catastrophe allowances were lower, operating costs higher and UK claims volatility swamped the P&L.

Meanwhile, the integration of the Wesfarmers insurance underwriting business should boost profitability by increasing market share and scale and affording cost saving opportunities.

We increased our forecast sustainable return on equity to 21 per cent (from 20), in line with consensus, reflecting our view some of the improvements in IAG's profitability are permanent.

Along with adopting a Required Return of 13 per cent, we derive a fiscal 2014 valuation of $5.06.

The end of IAG's UK losses, its operating cost efficiencies and enhanced risk pricing are all in the share price now and while we like the stock, it is currently trading above value.

In contrast Pacific Brands (ASX:PBG) faces tough challenges to restore shareholder value.

The company manages consumer lifestyle brands in Australia and New Zealand and with its manufacturing base overseas, it sources most of its products from China. Unfortunately, Australian dollar depreciation has increased import costs.

Pacific Brands' contracts with Australian retailers are fixed, leaving it unable to pass on these increased costs. Margins fell due to increased promotional and clearance activity and a shift in Workwear sales to lower-margin channels. Along with the challenging retail environment this contributed to Pacific Brands' poor full-year result, with a reported net loss after tax of $224.5 million also depressed by impairment and restructuring costs. There was no final dividend.

In August the Workwear division, comprising King Gee and Hard Yakka, was sold to Wesfarmers. This was a sound transaction, as it was one of Pacific Brands' poorer performing divisions, being heavily affected by the mining slowdown.

While production is now on a smaller scale, it is of some concern it still retains the same leases and operating costs.

Much work lies ahead for the company's management, which continues to implement performance improvement and cost reduction initiatives. A new CEO has been appointed to restore the balance sheet, achieve a better balance between growth and costs, to increase accountability and rationalise brands.

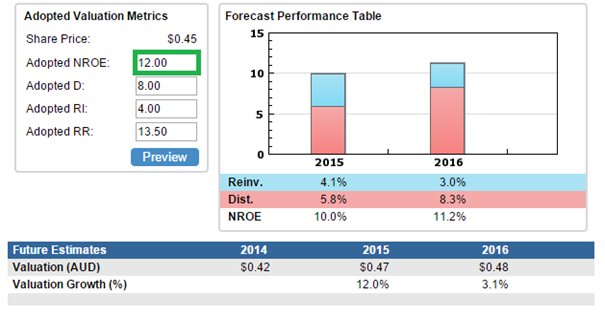

We downgraded our profitability forecasts, with forecasted ROE falling to 12 per cent from 14 per cent.

Figure 2 – PBG Future Valuation

Source: StocksInValue

We adopt a moderate required return of 13.5 per cent and derive a fiscal 2014 valuation of $0.42 rising to $0.47 in 2015.

Pacific Brands is currently trading only slightly above valuation but investors might consider this as a possible investment opportunity should a suitable margin of safety emerge.

By Brian Soh and David Walker, Equities Analysts, with insights from Alex Hughes of Clime Asset Management. StocksInValue provides valuations and quality ratings of 400 ASX-listed companies and equities research, insights and macro strategy. For a no obligation FREE trial, please visit StocksInValue.com.au or call 1300 136 225.