Value Investor: Three stocks with hidden value

The equities sell-off in the US last week was attributed to increasing concerns over European growth. It is clear that volatility is rising and a little fear is creeping in to the market. As value investors, we see this as a possible opportunity to invest in quality companies as they fall below their intrinsic value. We discuss three of these companies below.

While Seven Group Holdings (ASX: SVW) reported a 46 per cent decrease in net profit to $235 million for the full-year, the result was well flagged and reflected the decrease in new product sales for WesTrac.

Seven Group Holdings is heavily exposed to the mining sector downturn through its WesTrac business, which sold record amounts of equipment in 2011-2013. While companies defer replacement of equipment, demand remains for parts and servicing.

Now product support revenues comprise nearly half of WesTrac's revenues (versus 32 per cent in 2013).

During the year, Seven Group management acted prudently by restructuring the WesTrac business. This should preserve reasonable levels of profitability in future periods.

Over the longer term, demand for WesTrac earthmoving equipment should recover as customers replace ageing fleet with more efficient autonomous equipment. There is also some leverage to rising production volumes of iron ore.

Meanwhile, Seven Group's media assets, which comprise 35 per cent of the listed Seven West Media plus convertible notes, face structural challenges to traditional media, a subdued advertising market and low consumer confidence. The advertising market should continue to trend sideways and we do not envision a downturn.

The emerging portfolio of oil and gas interests with a mix of development and production assets should become a third earnings pillar and a platform for higher returns.

Despite the challenging environment, the market has been overly pessimistic on Seven Group with the current share price assuming return on equity and required return of 10.3 and 14 per cent respectively. This is well below and above our assumptions.

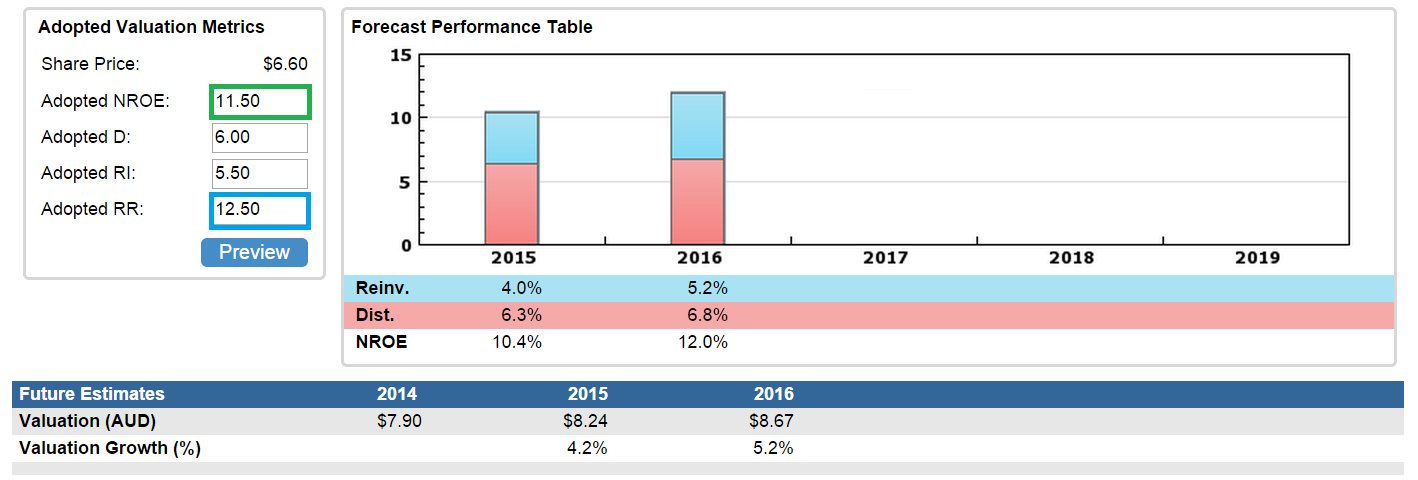

We adopt a return on equity of 11.5 per cent and a required return of 12.5 per cent (green and blue below). Our fiscal 2014 valuation is $7.90.

Figure 1 – SVW Future Valuation

Source: StocksInValue

While iron ore prices are challenging, we like BHP Billiton, with its low-cost, long-life assets diversified by commodity, region and currency. BHP offers exposure to the industrialisation and growing middle classes of China and other developing countries.

Intrinsic value growth is supported by steady volume growth after recent investment in capacity. BHP has the cashflows and balance sheet capacity to fund greenfields, brownfields or expansion through mergers and acquisitions.

Management is rational and the proposed demerger of the ex-Billiton assets should improve profitability (see here).

For the next few years, we see equity increasing via retained earnings due to a moderate payout ratio, gearing reducing and commodity prices under pressure as supply increases faster than demand (particularly iron ore). Equity is likely to increase faster than earnings, putting increasing pressure on profitability.

With an adopted ROE of 21 per cent and a RR of 12.5 per cent, we derive a fiscal 2014 valuation of $38.60.

BHP is currently trading 18 per cent below its value.

ANZ offers the best forward return of the banks. Its presence in the Asia Pacific provides greater leverage than its peers to the faster growth market of Asia and the growing middle class, but the strategy is higher risk.

Its super-regional strategy is on track, with profits sourced from the Asia Pacific now 25 per cent of group earnings.

Meanwhile, ANZ is experiencing good rates of growth in its core Australian and New Zealand operations, with its Australia division reporting a 5 per cent increase in profits for the first half of 2014.

Building on strong growth momentum in fiscal 2013, lending grew 6 per cent, with customer deposits up 7 per cent. ANZ had the strongest home loan growth of the major banks over the past year.

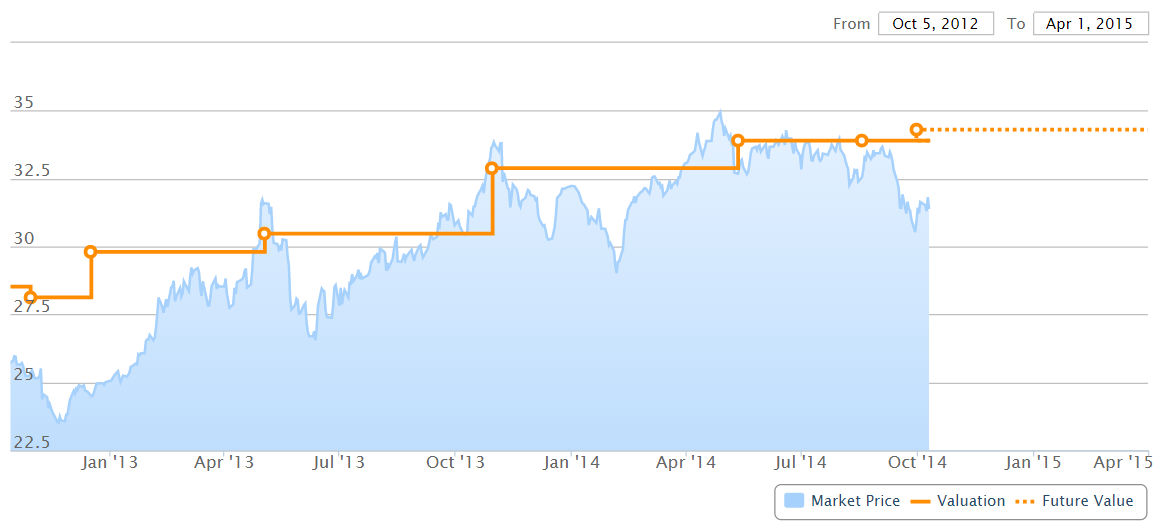

ANZ reinvests a higher proportion of earnings than other banks, so it grows intrinsic value faster. This growth and its steadily increasing share price can be seen below.

Figure 2 – ANZ Price Value Chart

Source: StocksInValue

Our adopted forecast ROE of 19.5 per cent is marginally ahead of the five-year average of 18.5 per cent, reflecting expectations of increased earnings growth in Asia and management's focus on improving returns across all divisions.

Our profit forecasts for fiscal years 2014-2016 are in line with consensus. The RR of 11.5 per cent is very low, reflecting ANZ's financial strength, large market cap and consistent returns.

We derive a fiscal 2014 valuation of $34.30.

By Brian Soh, Equities Analyst, with insights from George Whitehouse of Clime Asset Management. StocksInValue provides valuations and quality ratings of 400 ASX-listed companies and equities research, insights and macro strategy. For a no obligation FREE trial, please visit StocksInValue.com.au or call 1300 136 225.