Value Investor: The NBN and two growing telcos

The introduction of the National Broadband Network marks a transformation in the telecommunications market, with the government replacing Telstra as the monopoly network provider. This market structure is expected to increase competition among retail service providers due to lower barriers to entry.

Retail service providers with scale, a differentiated offering and/or low marginal costs will be best placed to take market share post the NBN rollout.

iiNet and TPG Telecom are Australia's second and fourth-largest internet service providers respectively, as measured by subscriber base. How will they perform as the rollout continues?

iiNet (ASX: IIN) appears to be well-positioned to capture NBN customers due to its scale, brand recognition and marketing drive.

iiNet scaled up its operations during the early stages of the NBN rollout, pursuing an aggressive strategy of growth by acquisition, all during a phase of industry ISP consolidation.

From 2009, it has added 430,000 subscribers through its acquisitions and 100,000 through organic growth. The sector remains fragmented however, and despite occupying the number two spot, its share is only 15 per cent of the market.

The latest full-year results show iiNet to be a very well-run business, with a brand built on value and high quality customer service. Revenue increased 7 per cent to $1 billion and profit rose 3 per cent to $63m.

This was a solid year driven largely by organic growth, with net new broadband customer additions of more than 40,000. Broadband sales increased 40 per cent, with products per customer also increasing to 2.3.

iiNet's high level of customer satisfaction is evident in its market-leading Net Promoter Score and low churn rates.

To date, iiNet has gained a large share of both greenfield (26 per cent) and brownfield (19 per cent) NBN customers. Management stated more than 50 per cent of NBN customers are new to iiNet, arguably an outcome of improved brand awareness and reputation.

Our adopted forecast return on equity of 26 per cent (green below) reflects a view that iiNet will leverage its scale and reputation to increase its subscriber base during the NBN rollout.

The net debt-to-equity ratio on 30 June 2014 was 83 per cent, which is high, especially for a small company. The increase in borrowings coincides with its series of acquisitions.

We adopt a required return of 12.5 per cent, reflecting the high net debt to equity ratio (red below). Our fiscal 2014 valuation is $6.31. This increases to $6.89 for fiscal 2015 (to end 30 June 2015).

Figure 1 – iiNet Future Valuation

Source: StocksInValue

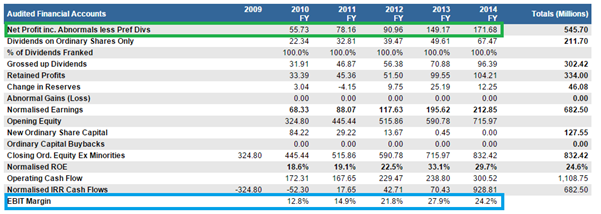

TPG Telecom (ASX: TPM) also delivered an impressive full-year result, with revenue rising 34 per cent to $971m, while net profit after tax increased 15 per cent to $172m.

This continues TPG's strong recent performance.

Since 2010, TPG has tripled its net profit (green below). This represents compounding annual growth of 25 per cent, a very strong performance.

Figure 2 – TPG's Financial Performance

Source: StocksInValue

Meanwhile, earnings margins doubled to 24.2 per cent (blue), showing the company has successfully improved its operational efficiency over time.

Since 2008, TPG has grown its broadband base from 300,000 to 748,000, doubling its share of the retail broadband market to around 12 per cent.

Controversially, TPG plans to leverage its existing network infrastructure and exploit a loophole in legislation permitting extensions of up to 1km from fibre networks installed before 2011.

TPG's initial plan is to connect 500,000 premises to its fibre-to-the-basement (FTTB) network in Sydney, Melbourne and Brisbane metropolitan areas. This coverage could be increased, with an estimated 1.8 million premises within 1km of existing networks.

However, this plan undermines the NBN market structure and the government's aim to eliminate monopoly ownership of network infrastructure by private firms.

It is difficult to project the effect of this rollout on revenues, as the government will introduce regulations to minimise the extent and profitability of these superfast broadband networks and deter competition with NBN Co.

At an operational level, TPG is an outstanding business; its record of annual subscriber growth is one of the best in the industry. The FTTB rollout could lead to a step-change increase in earnings. However, the project is, to a large extent, at the mercy of government and regulators.

We adopt a forecast ROE of 30 per cent and a required return of 11.5 per cent, the latter reflecting TPG's history of market share growth, low gearing and stable and increasing operating cash flows.

Our fiscal 2014 valuation is $4.79, rising to $5.48 in fiscal 2015. Unfortunately, TPG is trading above valuation.

By Brian Soh and Jonathan Wilson, Equities Analysts, with insights from Clime Asset Management. StocksInValue provides valuations and quality ratings of 400 ASX-listed companies and equities research, insights and macro strategy. For a no obligation FREE trial, please visit StocksInValue.com.au or call 1300 136 225.