Value Investor: Telstra rings in the profits

Telstra shares have more than doubled since mid-2010 on demand for higher-yielding equities, driven by historically low interest rates and the inclusion of the value of the National Broadband Network (NBN) payments in the share price.

The NBN remains the subject of a government review to report in September but despite some uncertainty, we remain confident the NBN cashflows are worth at least $11 billion, or $0.88 per share, with potential upside over time. The payments compensate TLS for the NBN’s use of its ducts, pits, pipes and exchanges, the loss of its copper network monopoly, universal service obligations and the retraining of TLS staff.

We identify two potential uses for the NBN cashflows. First, TLS could fund acquisitions and organic growth. There is a spectrum of risks and opportunities domestically, overseas, in media, telecommunications or technology. For the next two years or so shareholder returns should reflect TLS’s current utility nature, but looking further out the evolution of technology and moves by competitors is difficult to predict.

We would like to see TLS use some of the NBN payments to reduce gearing, which stood at a high 106 per cent, on a net debt to equity basis, on 31 December 2013. TLS’s debt levels are supported by cash flows derived from regulated monopoly assets, which somewhat mitigates the financial risk, but lower gearing would reduce shareholders’ risks out in the future, where the competitive landscape is unclear.

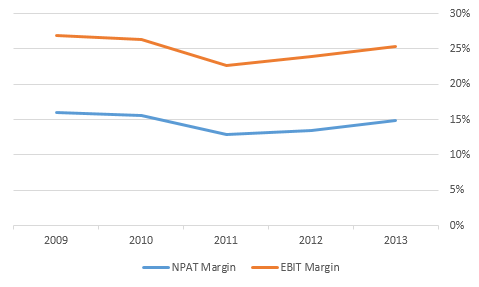

TLS is a mature but highly profitable company, with wide profit margins. To offset the effects of competition TLS needs to continually reinvest in maintaining its cost efficiency and customer appeal.

Figure 1 – TLS EBIT and Profit Margins – 2009 – 2013

Source: StocksInValue

The company operates the leading mobile network with respect to coverage, efficiency, service and speed. The market reach of the 4G mobile network has passed 85 per cent, itself is a competitive advantage given customers want broad coverage.

We expect TLS will continue to invest heavily in its mobile network as rival networks improve their own coverage and services. The company’s annual operating cashflow stream of more than $8bn provides a powerful capability to maintain the network’s technological edge – and to upgrade and expand elsewhere.

TLS took market share in the recent first half from competitors Vodafone and Optus and again achieved rapid growth in mobile customer numbers. These growth rates are unsustainable according to management, raising the question of what will offset structural decline in the traditional PSTN business.

As mobile customer growth slows, margin growth and data monetisation will need to underpin revenue and earnings growth. The explosion in data usage in recent years gives TLS the opportunity to better monetise data and increase ARPU (average revenue per user). In March the company announced new mobile plans that should shift customers to plans offering larger data allowances. Raising ARPU and expanding mobile margins are critical given industry revenue growth has stalled and handset penetration has reached maturity.

TLS also has an appealing growth outlook for the widening range of services, including cloud computing and unified communications, offered by its Network and Application Services division. The International division seeks to capitalise upon the growth in middle class populations in Asia, for example through its majority-owned and growing Chinese automotive sales website Autohome.

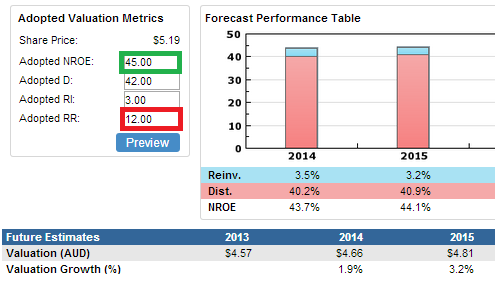

As TLS begins to lift earnings into the future, it will do so on a fairly static equity base. We expect profitability to rise in future years, driving low single-digit growth in intrinsic value.

Figure 2. Future estimates of value and expected profitability

Source: StocksInValue

We adopt a return on equity of 45 per cent (green above), ahead of the 42 per cent five year average to account for improving profitability. We adopt a very low required return of 12 per cent (red) to reflect strong cash generation, large market capitalisation, competitive advantages and the monopoly it holds over infrastructure. The high dividend payout ratio is what slows intrinsic value growth. Due to competition constraints and the company’s size, TLS will struggle to find large earnings reinvestment opportunities at an ROE of 45 per cent. A high adopted payout ratio is therefore appropriate.

We derive a fiscal 2014 valuation of $4.65 rising to $4.79 in fiscal 2015. TLS is a highly profitable company with monopoly infrastructure, earnings momentum from its mobile, NAS and International divisions, and upside from NBN cash payments. For these reasons we do not recommend a margin of safety to our valuation. We forecast a 14.5c final dividend and a 30c FY15 dividend. A purchase at our FY15 valuation would provide an attractive dividend yield of 6.2% fully franked.

By StocksInValue analysts Brian Soh and David Walker, with insights from John Abernethy and George Whitehouse of Clime Asset Management. StocksInValue provides valuations and quality ratings of 400 ASX-listed companies and equities research, insights and macro strategy. For an obligation-free, FREE trial please visit StocksInValue.com.au or call 1300 136 225.

Clime owns shares in TLS.