Value Investor: Substantial upside in Soul Pattinson

Gone are the days when Washington H. Soul Pattinson (SOL) was known as purely a chain of chemists. Since listing on the Australian Stock Exchange in 1903, it has evolved into a prominent, diversified investment house.

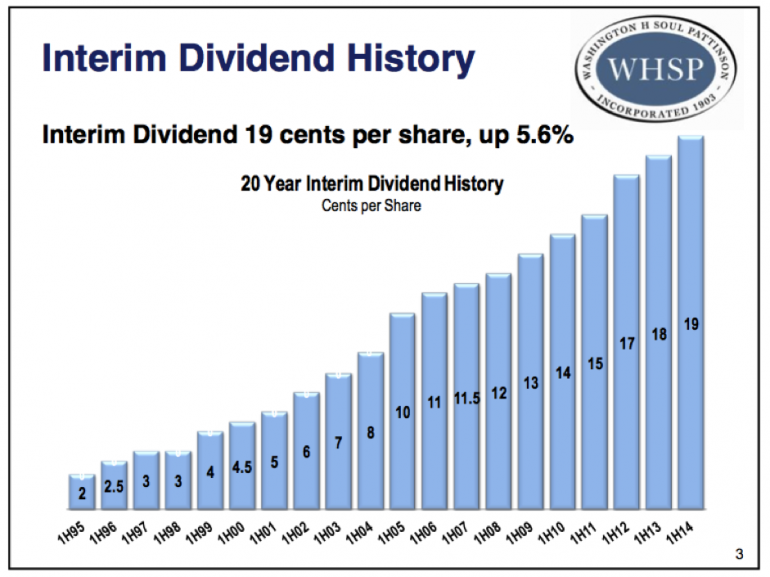

Soul Pattinson’s conservative management and diverse investment portfolio have contributed to its impressive track record of delivering consistent investor returns and a growing stream of fully franked dividends.

Figure 1. 20 year interim dividend history

Source: SOL 1H14 Presentation

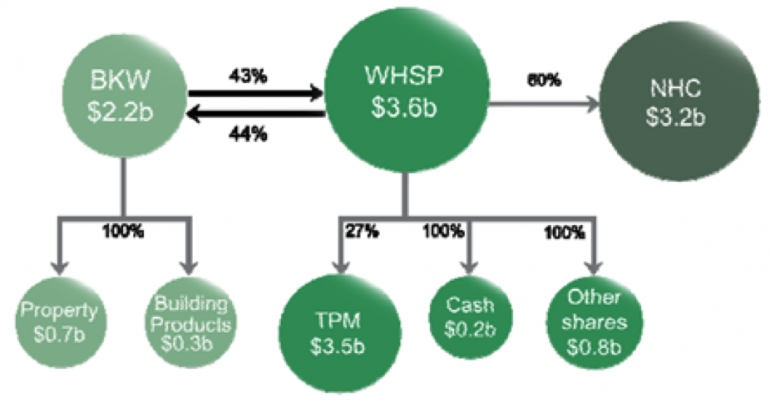

The majority of Soul Pattinson's earnings come from three sources, the listed companies - New Hope Corporation (60 per cent ownership), TPG Telecom (27 per cent ownership) and Brickworks (44 per cent ownership). As such, underlying performance is largely dependent on the performance of these entities.

Soul Pattinson's 13 per cent fall in first half 2014 revenue to $336m and a 0.7 per cent reduction in net profit after tax to $73.7m, was due to a lower contribution from New Hope Corporation (NHC), which was somewhat offset by increased contributions from Brickworks (BKW) and TPG Telecom (TPM).

New Hope’s performance was depressed by significantly lower thermal coal prices, a relatively high Australian dollar, closure of the New Oakleigh mine and increasing pressure on offsite transportation costs.

It is a challenging time for thermal coal miners, with prices at multi-year lows in an oversupplied market. Profit margins are under pressure and New Hope remains focused on the variables it can control, namely costs and productivity.

Despite a challenging operating environment, New Hope is well positioned to ride out the downturn due to its production efficiency, strong management team, diversified and quality asset portfolio and large cash balance.

New Hope has no debt and a cash balance exceeding $1.1bn. This provides flexibility to both sustain its dividend at current levels through the downturn while assessing opportunistic acquisitions. Note Soul Pattinson’s strong financial health is supported by the equity-accounted New Hope cash pile.

Brickworks’ first half result did not fully reflect the recent upturn in the housing market and associated volume increases, which we expect will boost building product revenue more potently in the second half (and likely beyond in the near term).

Looking ahead, we believe Brickworks will enjoy further operating leverage as building product volumes ramp up from the depressed levels of recent years.

TPG Telecom delivered a strong first half result. As one of the fastest growing telecommunications company in Australia, it is benefiting from its operating leverage. Controversially, TPG Telecom is developing its own fibre cable network, which will compete with the NBN. The ACCC will rule on the legality of TPG’s FTTB plan within the month.

Soul Pattinson has a unique cross shareholding arrangement with Brickworks, which was put in place over 40 years ago to protect against hostile takeovers.

Figure 2. Current BKW-SOL cross-shareholding and group structure

Source: Hunter Green

Last October, fund manager Perpetual Investments and investment banker Mark Carnegie challenged the arrangement with a proposal to remove the links between the two companies, arguing it would unlock $2.2bn in shareholder value. The proposal failed last month after the Australia Tax Office advised it would not grant capital gains tax relief, upon which the success of the proposal was dependent.

To derive Soul Pattinson’s fiscal 2014 (31/7/2014) valuation of $13.76, we adopt a return on equity of 13.5 per cent and required return of 12.5 per cent. We would recommend a low 10 per cent margin of safety, reflecting this company’s very conservative profile and below-average earnings volatility.

Soul Pattinson offers diversified leverage to ongoing coal demand, the domestic building recovery and the dynamic telecommunications market. Changes to building construction activity, coal prices, coal production, and telecommunication legislation are the most significant influences on future profitability.

The ability of Soul Pattinson and New Hope to identify and execute appropriate investment opportunities with their substantial cash holdings provide upside to future profitability.

By Amelia Bott of StocksInValue, with insights from Adrian Ezquerro and John Abernethy of Clime Asset Management. StocksInValue provides valuations and quality ratings of 400 ASX-listed companies and equities research, insights and macro strategy. For a no obligation FREE trial, please visit StocksInValue.com.au or call 1300 136 225.