Value Investor: NAB turns a corner

National Australia Bank is a chronic underperformer and this continued in its recent earnings result. Profitability over the past five years as measured by our return on equity metric was at an average of 17.5 per cent, whereas Commonwealth Bank, Westpac and ANZ have averaged 27.0, 22.3 and 20.4 per cent respectively.

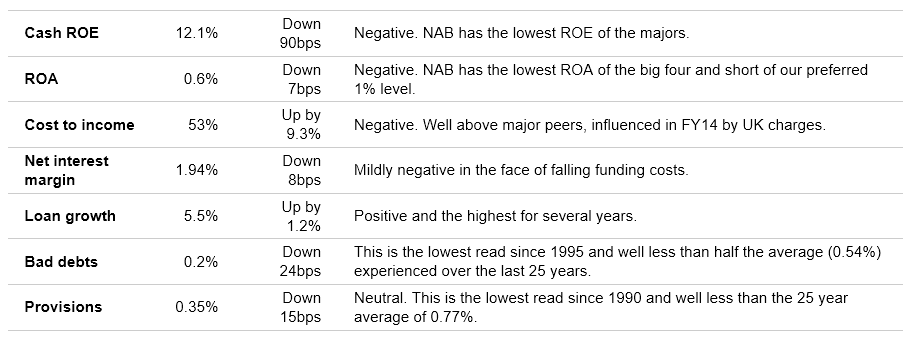

In fiscal 2014, statutory profit slipped 3 per cent to $5.29bn. While in line with pre-announcement details, key metrics were poor, particularly the declines in return on equity, return on assets and net interest margin and cost efficiency.

Figure 1. NAB key group metrics, fiscal 2014

Source: StocksInValue, Clime Asset Management (George Whitehouse)

Although loan growth increased, overall earnings were subdued by impairment and provision charges of $1.5bn against UK assets.

The UK operations have long detracted from value and the plan is to exit these legacy positions in the UK and also in the US, which would allow NAB to focus on higher-returning core businesses in Australia and New Zealand.

In July, NAB announced the partial sale (£625 million) of the NAB UK Commercial Real Estate portfolio and in October began the sale of the US-based Great Western Bank with the IPO of a 31.8 per cent stake.

New chief executive Andrew Thorburn recently expressed a desire to accelerate NAB's exit from the UK, potentially through a public sale if market conditions continue to improve. The group also plans to sell 100 per cent of the GWB business over time, also subject to market conditions.

The sale of poorly performing assets may not fetch book value and related impairment charges could affect future earnings. However, these assets account for approximately 18 per cent of group capital and a sale could release surplus capital.

Assuming sensible capital management, group ROE could improve by around 2 per cent. From a valuation perspective, we prefer to err on the side of caution and wait for evidence of execution.

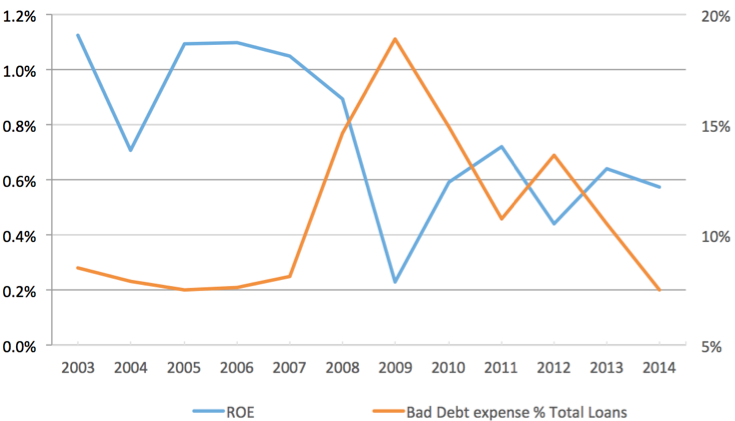

A major swing factor in bank earnings is the level of loan impairment expense and provisioning. A spike or reduction in loan impairment expense generally coincides with an opposite movement in returns, as shown in Figure 2.

Figure 2 – Loan impairment expense and return on equity (ROE)

Source: NAB, Clime Asset Management (George Whitehouse)

This was seen even in the most recent fiscal 2014 result. In NAB's core Australian banking division, a 33 per cent ($373m) decline in loan impairment expense offset a decline in revenue ($180m) and increased operating expenses (up $187m). This allowed cash earnings to finish flat on last year.

Loan impairment expense and provisioning are affected by macroeconomic conditions such as unemployment, business confidence, inflation, interest rates, and property prices -- factors that affect a borrower's ability to service and repay loans.

After peaking at the height of the GFC in 2009, bad debts and provisioning as proportions of total loans have since trended downward to near-historic lows, which has driven most of the earnings, dividend and value growth over this period.

Loan impairment expense is unlikely to reduce much further, and certainly not at the same rate of the last five years. This means banking income must accelerate to meet shareholder expectations of rising dividends.

Ideally, interest rates will remain low, sustaining favourable conditions in credit quality. The bearish case is that unemployment rises or residential property prices fall. In an extreme scenario, an economic slowdown or domestic recession could lead to much higher bad and doubtful debt charges, which could wipe out around a year's earnings.

Overall, the outlook for NAB remains positive. Despite a potential slowing of growth in mortgage lending, higher credit growth in the Australian business banking segment is expected over the coming year.

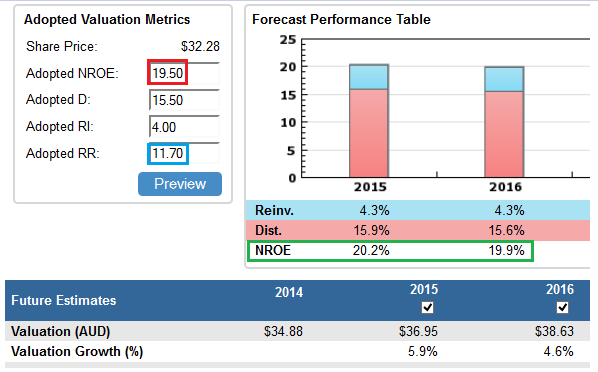

Our adopted return on equity of 19.5 per cent, in the red box in the chart below, is marginally below consensus forecasts (green box), reflecting our more conservative view on the outlook given historically low provisioning and bad debt expense ratios are set to revert over time.

The required return of 11.7 per cent (blue box) is low, reflecting NAB's financial strength, large market capitalisation and predictability of earnings.

We derive a fiscal 2014 (30 September 2014) valuation of $34.88, rising to $36.95 in fiscal 2015.

Despite our caution surrounding historically low provisioning and bad debts expense ratios, NAB is investment grade and is currently trading below value.

By Brian Soh and Jonathan Wilson, Equities Analysts, with insights from George Whitehouse and Stephen Wood of Clime Asset Management. StocksInValue provides valuations and quality ratings of 400 ASX-listed companies and equities research, insights and macro strategy. For a no obligation FREE trial, please visit StocksInValue.com.au or call 1300 136 225.

Clime owns shares in NAB.