Value Investor: Macquarie a black box for investors?

The market is pricing in a more positive outlook on Macquarie Group (ASX: MQG) than can currently be justified.

Last week’s third quarter operational briefing triggered a three per cent drop in the share price on the day. MQG reported subdued client activity for some capital market facing businesses, with their contribution to net profit down on the previous corresponding period but up on the prior quarter, and there was no change to the overall outlook of the operating divisions. Management held its guidance, expecting FY14 net profit from the operating groups to be up on FY13.

This was disappointing for the market, which had priced in an upgrade to earnings guidance or at least a more upbeat assessment by management of activity and the future outlook.

Despite the three per cent dip on the day, the share price recovered, reaching as high as $56.33 this week. At this price, the market is assuming a Normalised Return on Equity (NROE) of 17.2 per cent and a Required Return (RR) of 8.2 per cent, figures that cannot be justified on the current market outlook and given the inherent risks in MQG’s business.

Since the GFC, activity in equity capital markets and mergers and acquisitions (M&A) has been subdued, dampening business volumes for MQG. The annuity style businesses (fund management, banking and financial services and corporate and asset finance) have performed well, while the capital market-facing businesses (securities, mergers and acquisitions, fixed income, currencies, commodities) continues to experience patchy activity.

MQG remains largely a play on investor confidence, with its capital facing divisions performing best in rising equity markets.

There have been some positive signs for activity in businesses, like MQG, leveraged to the equity market with a modest economic recovery in the US and Europe reducing global investor risk aversion. Also, historically low Australian interest rates have stimulated the local equity market and triggered a rush of IPOs.

However, the future performance of MQG will be substantially affected by global capital movements, US economic data and how investors react to the tapering of quantitative easing. These will affect investor confidence, IPO and M&A volumes, funds under management levels and trading activity.

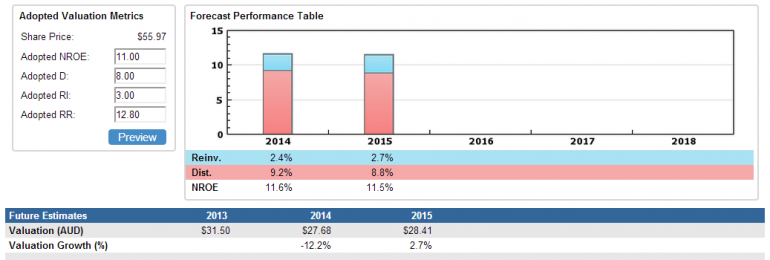

In our view, equity market activity and levels are currently low to mid-cycle. We have adopted a Normalised Return on Equity of 11 per cent, slightly below consensus but considerably lower than the 17.2 per cent priced by the market. Investors would need a particularly bullish view of markets to upgrade from our NROE and in our view the market is pricing in a very bullish outlook.

Figure 1. MQG Valuation Metrics

Source: www.stocksinvalue.com.au

Compared with other large companies, MQG’s operations and accounts lack transparency. MQG, with its six business units, operate and integrate with each other in ways that are not always visible to external stakeholders, such as shareholders. The company could be likened to six black boxes interacting with each other. The operations, capital management and financial statements of an investment bank are complex and can be difficult to understand, making it harder to foresee any earnings downgrades.

In addition, investment banks are riskier than commercial banks, with exposure to volatile, unpredictable asset markets, generally more aggressive growth strategies, and funding of deals that are a higher proportion of capital than commercial bank loans.

Hence we derive a required return (RR) of 12.8 per cent, significantly higher than the 8.2 per cent priced by the market. While at a premium to our RR of 11.5-11.7 per cent for the major banks this is still low, as MQG remains a sound institution with competent directors and management, and APRA-regulated commercial banking operations.

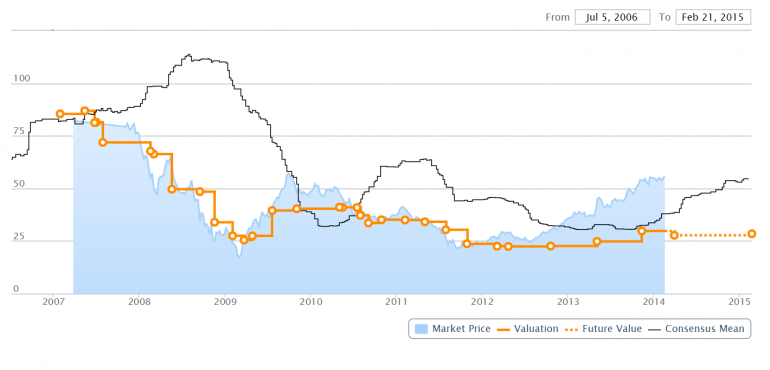

Figure 2. MQG Price Value Chart

Source: www.stocksinvalue.com.au

We would require a discount to value or margin of safety of 5-10 per cent before buying a major commercial bank, but a higher 10-15 per cent discount for an investment bank reflecting the greater risks and volatility in the business and the lesser transparency.

MQG trades at a significant premium to our $31.50 valuation and is currently not worthy of investment consideration.

Brian Soh is an associate analyst at StocksInValue, a joint venture between Clime Investment Management, a value fund manager, and Eureka Report. StocksInValue provides valuations and quality ratings of 400 ASX-listed companies and equities research, insights and macro strategy. For an obligation free, FREE trial please visit www.stocksinvalue.com.au or call 1300 136 225.