Value Investor: Is it time to buy banks for yield?

Australian government bond yields have fallen to record lows on weaker commodity prices, below-trend domestic growth, controlled domestic inflationary pressures and the influence of minimal global bond yields. Income-oriented investors have been forced to seek yield in riskier assets like equities.

A Canstar comparison reveals the best term deposit rates are 3.10-4.20 per cent per annum for terms between one month and five years. This is pretax. After tax and inflation, yields are negative to near zero. So, the purchasing power of deposits will deteriorate -- a serious problem for self-funded retirees.

Telstra is rallying because yield hunters are treating the stock as a proxy for fixed interest given its liquidity and safe dividends secured by the future stream of NBN payments from the federal government. Telstra shares are trading at their highest in 13.5 years and the fiscal 2015 dividend yield had fallen from over 6 per cent to 4.8 per cent at the time of writing.

Investors are asking if now is the time to commit more funds to banks as yield plays, as they have historically paid consistent growing dividends and have not lately rallied as strongly as Telstra. Indeed, major bank share prices, with the exception of Commonwealth Bank, have trended lower recently.

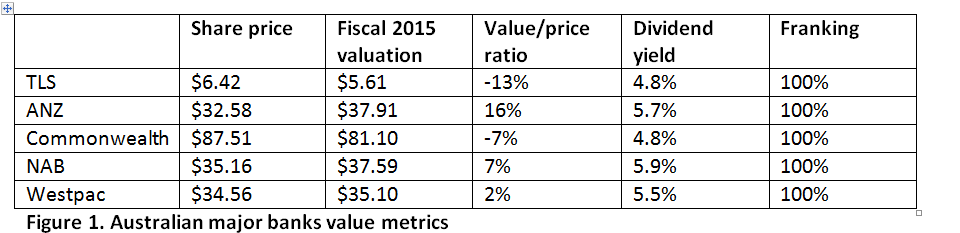

Westpac, ANZ and NAB are currently in value and offer higher yields than Telstra (see Figure 1 below). The question investors need to ask is: will bank dividends continue to rise? Yields are not to be taken for granted; they reflect assumptions about earnings and payout ratios.

Source: StocksInValue

Our bank reviews late last year highlighted headwinds facing all Australian banks, namely the recommendation of the Financial System Inquiry for banks to hold more capital, and the return of loan impairment expense to long-term averages following the current period of exceptional credit quality. These remain a risk to bank dividends.

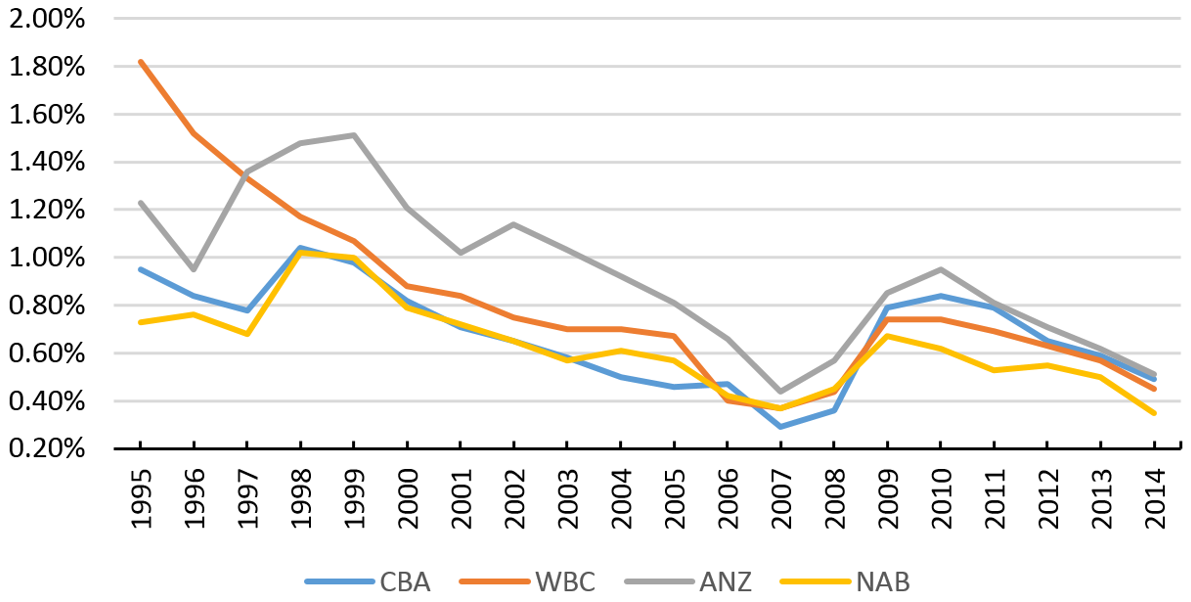

Loan impairments expense as a percentage of total loans is at historic lows across the sector though poised to gradually normalise to historical averages. The speed at which this happens depends on interest rates and general economic and financial conditions. Loan impairment expense and provisioning are the major swing factors in bank earnings: a rising impairment expense ratio generally coincides with falling profitability and vice versa.

Figure 2 – Australian major banks loan provisions (percentage of total assets)

Source: Annual reports, Clime Asset Management

Some commentators predict loan impairments will sharply detract from bank earnings in 2015. We disagree and see this as more a medium-term concern. A material rise in loan impairments requires a surge in unemployment and business failures and/or a spike in interest rates.

We forecast unemployment to rise to 6.5 per cent over the year ahead from 6.1 per cent in December, consistent with our forecast for below-trend GDP growth. This is not enough of a deterioration to cause a sharp rise in loan impairments.

We think the Reserve Bank will lower the cash rate by 50 basis points to 2.00 per cent over the year ahead because, in the absence of fiscal stimulus and/or further Australian dollar depreciation to boost inflation and GDP growth, the RBA will come under increasing pressure to reduce borrowing costs to offset the forces restraining GDP and employment growth.

A lowered cash rate would support credit quality, reducing the likelihood of higher loan impairments, and partly offset the effects of our forecast moderate rise in unemployment. In our view credit quality in 2015 looks broadly similar to last year.

So we see modest growth in major bank dividends this year, with a fairly high level of confidence, given growth in lending seen in recent RBA data. Interest income will be driven by last year's strong loan growth at Commonwealth Bank (loan growth of 7.4 per cent), Westpac (8.2 per cent), ANZ (11.2 per cent) and NAB (5.5 per cent).

Funding costs should remain low as a lower cash rate anchors the yield curve and price competition for deposits remains subdued, reflecting steadier lending growth. Wholesale funding rates are also very low, with quantitative easing in Japan and Europe and sustained ultra-low interest rates in the US.

With low interest rates, borrowers are better able to repay loans, so a consequence of slower loan growth could be stalling or even declining loan balances. We see banking system lending growth levelling out this half, resulting in slower growth in total loans on bank balance sheets this year and slower growth in net interest income next year. By then, loan impairments could have begun to tick higher.

So while we expect another year of bank dividend growth in 2015, 2016 looks like a slower year for bank dividends.

By Brian Soh and Jonathan Wilson, Equities Analysts, with insights from Stephen Wood of Clime Asset Management. StocksInValue provides valuations and quality ratings of 400 ASX-listed companies and equities research, insights and macro strategy. For a no obligation FREE trial, please visit StocksInValue.com.au or call 1300 136 225.

Disclosure: Clime owns shares in TLS, CBA, WBC, ANZ and NAB.