Value Investor: Four blue chips that delivered this earnings season

Reporting season rolls on, and widely held favourites such as Commonwealth Bank, Telstra, BHP Billiton and Rio Tinto have all reported full year or half-year results. Let us take a closer look at these stocks and the wider trends so far.

Telstra’s pleasing headline result for fiscal 2014 saw revenue up 1.2 per cent to $26.3 billion and after-tax profits increasing 12 per cent to $4.28bn. This was driven by further growth in new mobile subscribers off the back of network differentiation and increased customer service. With the addition of 937,000 subscribers over the period, Telstra now holds 54 per cent of the mobile market.

Fixed line revenues declined, which is an ongoing structural change across the telecommunications industry. Positively, revenue from the National Broadband Network is starting to flow, with Telstra receiving $640 million in the period.

Telstra also announced a $1bn share buyback, motivated by recent asset sales, with a positive response from the market. The off-market buyback will comprise a capital component of $2.33 and a fully franked dividend. This is likely attractive to many shareholders and we expect the offer to be well received. The risk is receiving a heavily diluted buyback offer and we think shareholders may be better off selling some of their holdings into a hyped up market.

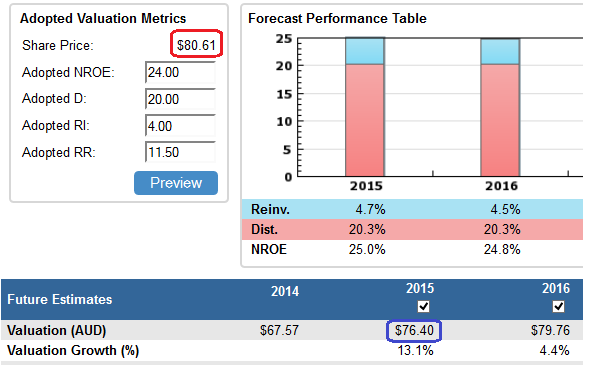

Commonwealth Bank of Australia performed solidly once again in favourable banking conditions. Earnings per share grew 11.7 per cent over the year, with equity per share growth of 8.09 per cent outperforming the 6.23 per cent increase in dividends per share. We are pleased when a bank can grow its earnings faster than equity as this represents increasing profitability.

The currently low interest rate environment is contributing to peak-of-cycle credit quality conditions, with bad debts declining to a historical low of just 0.15 per cent of loans. Overall, while this was a strong result from a strong bank, CBA remains somewhat expensive and trades above our fiscal 2015 valuation.

Figure 1 – CBA Future Valuation

Source: StocksInValue

A central theme so far has been capital management, with share prices moving in response to distributions to shareholders. Yield-seeking investors have been forced into equities by low or negative real yields on traditional sources of retirement income, like term deposits, hence the market’s keen interest in the size and timing of dividends, special dividends and capital returns.

BHP Billiton shares sold off 4 per cent after expectations for a larger dividend and/or a buyback were not met. This was despite a solid result, with a 23 per cent increase in after-tax profits. Clearly, there was a good degree of market disappointment over the lack of an extra distribution to shareholders.

Within mining in particular, free cash flow has been surging, with rising production and falling capital expenditure levels. Rio Tinto delivered a 15 per cent increase in the interim dividend to $US96c.

For iron ore miners such as BHP and Rio, the benefits of cost reductions and iron ore production growth have been offset by lower iron ore prices. However, the majors are gaining market share as uneconomic higher cost producers exit the industry.

By increasing production, the majors are compressing prices and placing the market in a state of oversupply. With their continuing confidence in iron ore demand from China, BHP and Rio are prepared to accept lower margins in the near term and benefit from higher market shares in the long run.

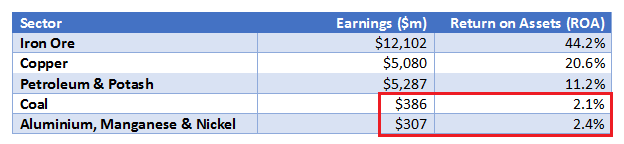

Meanwhile, BHP also announced an intention to demerge a group of assets into a separately listed vehicle, with the aim of focusing BHP on its core assets. The demerged vehicle will house the aluminium, thermal coal, manganese, nickel and silver assets -- essentially the assets that are poor performers at present.

Although the proposal was met with a largely negative reaction by the market, after our analysis on return on assets (below), we see the demerger as a sound move for BHP over the medium term.

Figure 2 – Return on Assets analysis: BHP divisions

Source: StocksInValue

Reporting season so far has delivered generally positive news, with the ASX closing at its highest since the GFC last week. Overall, there has been a positive tone to changes to our valuations post-results. Out of sixteen companies we reviewed last week, only three valuations were downgraded and only modestly. The other three remained unchanged and the valuations of ten companies were upgraded.

By Brian Soh, with insights from George Whitehouse of Clime Asset Management. StocksInValue provides valuations and quality ratings of 400 ASX-listed companies and equities research, insights and macro strategy. For a no obligation FREE trial, please visit StocksInValue.com.au or call 1300 136 225.