Value Investor: Budget winners and losers

The budget headlines were all about tough spending cuts, particularly in healthcare, education and reduced welfare and family benefits. However, our analysis of the budget sees four clear winners in the ASX.

McMillan Shakespeare: POSITIVE

Heading into the budget, McMillan Shakespeare (ASX: MMS) was a wildcard. Would the government keep its promise to retain the FBT exemption for novated leases?

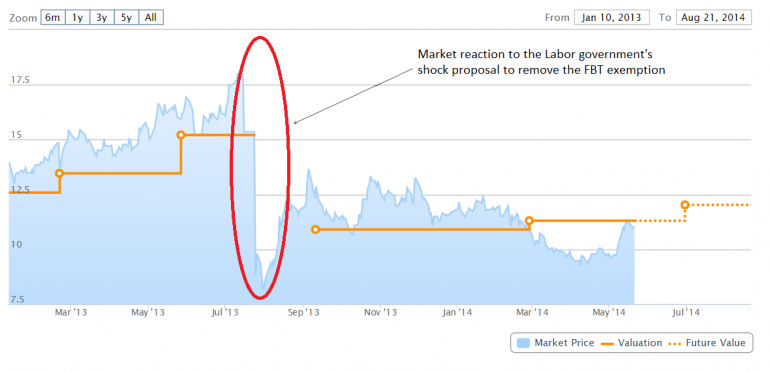

Figure 1 – MMS Price-Value chart

Source: StocksInValue

In the end, the budget was benign to MMS, with no regulatory change. However, this does not mean the government could not cancel or alter the FBT arrangements in between budgets, as Labor had proposed. Our views on the stock assume no legislative or regulatory change – note the shares are in value.

Telstra Corp: POSITIVE

Telstra (ASX: TLS) also benefited with an upgraded $24.3 billion of government investment in the NBN by 2017-18, with yearly spending doubling between now and 2016-17. Some of this (our guess is 20-30 per cent) will be a cash flow compensating Telstra for the loss of its copper monopoly and use of its pits, ducts and pipes.

Management was coy about how the company will spend its growing war chest, but the half-cent increase in the interim dividend announced in February sends a clear message: this board is more confident about the NBN payments than before. It looks like the budget figures were public confirmation of what the board knew months ago.

Infrastructure stocks: POSITIVE

The headline infrastructure spending will benefit both larger stocks (Leighton Holdings, Lend Lease, Adelaide Brighton, Boral and BlueScope Steel) and smaller contractors and suppliers. The main projects funded in the budget are roads, benefiting civil engineering contractors who in turn consume construction aggregates and steel.

However, the forecasts for infrastructure spending are rubbery. An $11.6 billion infrastructure growth package is expected to kick-start more than $58 billion of new projects but the package includes a $5 billion fund to reward state governments that privatise assets and reinvest the proceeds in new infrastructure projects.

It remains to be seen how many new projects the package will eventually fund. In the end, most new infrastructure funding will have to come from the states, which face the loss of $80 billion in education and health funding.

The overall effect of the increased federal infrastructure spending remains positive, but is likely to be a more gradual impact on the sector.

The resources sector: POSITIVE

The resources sector was an overall winner, with large miners spared $440 million in minerals resource rent tax payments and their share of the carbon tax, if this is passed by the Senate.

The mining industry will continue to benefit from an exemption from diesel excise, as will the agriculture, transport and logistics sectors. All other businesses will pay the increased fuel tax excise.

However, the budget forecasts a fall in iron ore prices to $US90 per tonne by June 2016 from the current price of $US103. If realised, this would clearly impact companies like Rio Tinto, Fortescue Metals and Mineral Resources.

Healthcare stocks: NEUTRAL/NEGATIVE

The introduction of the co-payment for GP visits, pathology and diagnostic imaging affects healthcare stocks, such as Sonic Healthcare and Primary Healthcare. However, the overall impact is fairly neutral, with the providers effectively receiving $2 per service, which should offset any declines in volume.

The pause in indexation of some Medicare schedule fees and the income thresholds for the Medicare levy surcharge and the private health insurance rebate increases the out-of-pocket cost of private health insurance and could cause volume declines for Ramsay Health Care.

Retail stocks: NEGATIVE – but not as much as you may think

The tough budget has however depressed consumer confidence, which was already falling in response to earlier mass job losses at iconic companies and expectations of a tough budget. Budget leaks saw households rightly fear cuts to pensions and family payments, and increases in medical, fuel and education costs.

| |

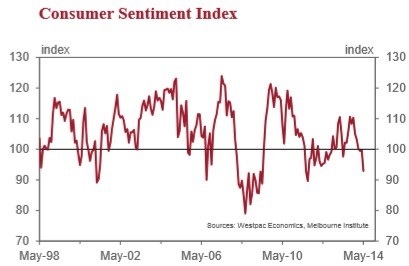

Figure 2 – Westpac Melbourne Institute Index of Consumer Sentiment

Source: Westpac Melbourne Institute

This is reflected in the Westpac Melbourne Institute Index of Consumer Sentiment, which fell 6.8 per cent to 92.9 points, the lowest level in over two and half years.

Looking at the household sector as a whole, the budget impact is manageable because it isn’t front-loaded and instead increases over the forward estimates. Including the rise in the Medicare levy, the drag on households in fiscal 2015 is around $5 billion or just 0.5 per cent of household disposable income.

The effects on individual retailers are ambiguous. For example, value retailers could face customers constrained by adverse budget changes, but value is also attractive for cash-strapped consumers.

The short-term effects of the cuts and higher taxes in the budget are most likely to depress the spending confidence of households affected. In the long-term however, the greatest influences on the household sector as a whole remain household income growth, the household saving rate, CPI inflation, the unemployment rate and perceptions of job security.

By Brian Soh and David Walker of StocksInValue, with insights from John Abernethy of Clime Asset Management. StocksInValue provides valuations and quality ratings of 400 ASX-listed companies and equities research, insights and macro strategy. For a no obligation FREE trial, please visit StocksInValue.com.au or call 1300 136 225.

Disclosure: Clime owns shares in BHP, MMS and TLS. David Walker owns shares in BHP, MIN and RIO.