Value Investor: Betting on Crown's long game

When we last reviewed Crown Resorts (ASX:CWN) in October, the share price was around $13.50. In December, Crown started falling, dropping to a low of $11.74 just two weeks ago. This continued the general downtrend that started in January 2014, when the shares were at $18.00.

Crown has since rebounded, trading around $13.86. What's driving the volatility?

Figure 1 – CWN Price Chart with daily volumes traded

Source: StocksInValue

The falls largely reflect the market's anxiety over its Macau-based joint venture, Melco Crown, which contributes close to half of Crown's total revenues.

Crown's 33 per cent stake in Melco is currently affected by structural change in the Macau market. The Chinese government's anti-corruption campaign is driving government officials from the highly lucrative VIP segment.

Uncertainties in Macau remain and stabilisation will take time. In the near term, there is potential for further downgrades and share price declines. We maintain the same view as in October, however, that Crown has an interesting long-term future.

Crown's Australian operations in Melbourne and Perth enjoy local monopolies, which lend themselves to reasonably consistent earnings and cash flows. Both are centrally located and have favourable licence agreements with their respective state governments.

Last year, the Victorian Government extended Crown Melbourne's casino licence from 2033 to 2050. The new licence also gives the business the opportunity to grow revenues by removing the uncompetitive VIP “Super-tax” and increasing gaming placements.

Despite continuing debate around gambling laws, Crown's position in Australia will likely remain fairly uninterrupted by government, as Crown casinos are a source of significant additional tax revenue and Crown resorts employ approximately 15,000 people.

In Australia, Crown plans to undertake $960 million in capital expenditure programs at existing locations over the next three years, including the development of Crown Melbourne ($208m) and Crown Perth ($753m on Crown Towers, opening 2016). Also in the pipeline is the huge $1.5 billion Crown Sydney development.

Crown's overseas operations expanded with the official opening this week of the City of Dreams Manila, with a Las Vegas casino development also in the works. Due diligence is also underway for potential projects in Japan and Brisbane, though the new Queensland government has not yet clarified its position on new casinos. A previously approved new casino in Sri Lanka was blocked by the new government there.

Total capex to 2019 is expected to be around $3bn. Assuming operating cashflows and dividends remain steady, Crown will require approximately $1.7bn in additional capital to fund these developments. The most likely outcome is operating cashflows trend higher as new venues open and the balance of the funding comes from temporarily higher debt.

There is some risk Crown has overextended itself. This must be monitored.

Macau is a Special Administrative Region of China and the only jurisdiction where gambling is legal. Beijing's anti-corruption drive is the main cause of Macau's steep downturn over the last year.

In 2013, a US Congressional Executive Commission on China estimated total money laundering in Macau at $US200bn each year. This is around 20 per cent of the US $1 trillion that flowed through the VIP segment last year.

The anti-corruption campaign is mainly focused on civil servants and the Chinese elite. We think that once it is complete, the VIP market will resume growth. The breach of capital controls -- citizens are limited to taking 20,000 yuan (US $3,300) out of the country each day -- to fund VIP and mass-market gambling is broader and more difficult to contain.

We therefore see the contraction in Macau as temporary and restricted mainly to a portion, largely civil servants, of VIP gaming revenues. The crackdown will likely have broader effects, such as deterring legitimate VIPs for a time, and also a smaller proportional reduction in mass-market revenues.

Rising per capita income and GDP growth should continue to drive the VIP and mass-market segments. Additionally, room occupancy rates have remained elevated at near 90 per cent through the year, suggesting the contraction is almost entirely VIP-related and there is a shortage of rooms. Market recovery will be helped as a further 14,000 rooms are added over the next three years -- around a 50 per cent increase on current levels.

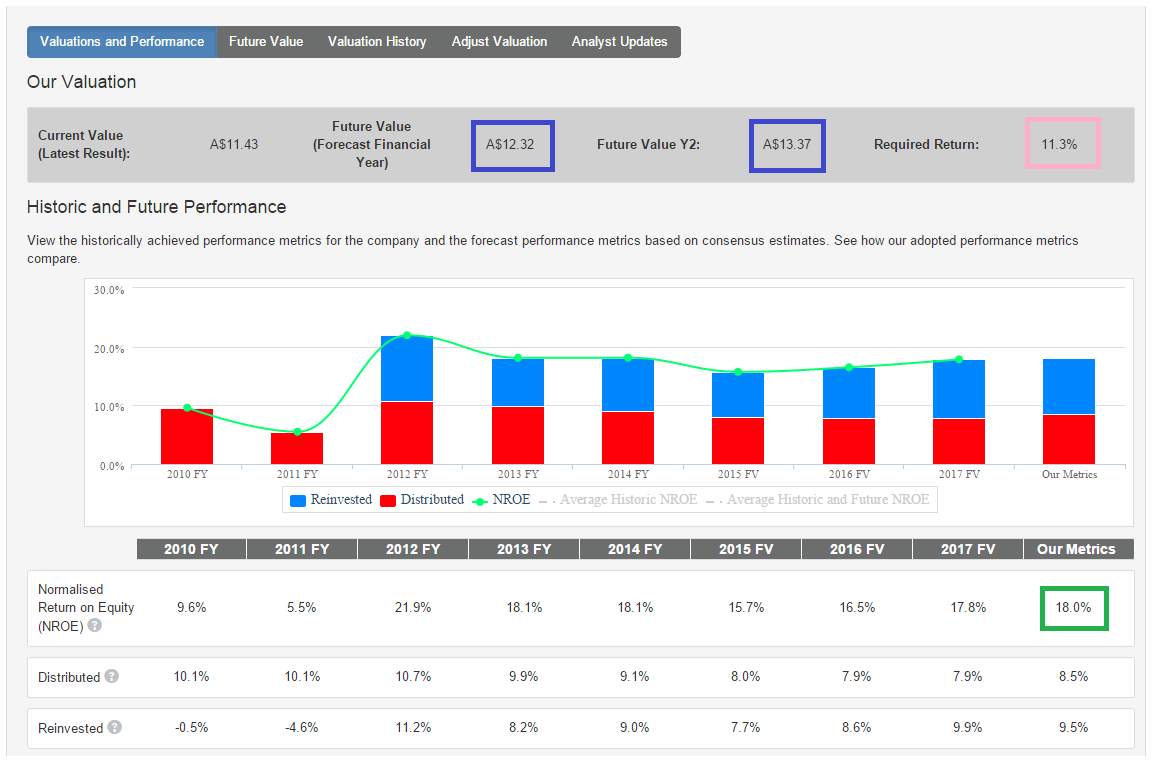

We have looked through this Macau downturn by adopting in our valuation a return on equity of 18 per cent (green below), which is above consensus in coming years. Our required return (pink) of 11.3 per cent is low, reflecting a strong competitive position and a healthy balance sheet with moderate gearing, supported by steadily increasing cash flows.

Figure 2. CWN adopted valuation metrics and future value

Using our adopted metrics, we derive a fiscal 2015 (30 June 2015) valuation of $12.32 and fiscal 2016 valuation of $13.37 (blue above).

The recent share price rally is the market punting this is the bottom. No one knows if it actually is. January Macau gaming table data declined again but at a slower rate than in December. Given the share price has now risen above our fiscal 2016 valuation, we think the market was overly pessimistic and is moving towards adopting our view on profitability. Long-term the cleanup in Macau should ensure a more sustainable industry.

Our assumptions remain unchanged since December. With our view that the contraction in Macau is temporary and expectation that growth will resume in the medium term, we continue to hold a positive long-term outlook for Crown.

Disclosure: Our fund partner Clime Asset Management owns shares in CWN.

By Brian Soh and Jonathan Wilson, Equities Analysts. StocksInValue provides valuations and quality ratings of 400 ASX-listed companies and equities research, insights and macro strategy. For a no obligation FREE trial, please visit StocksInValue.com.au or call 1300 136 225.