Value Investor: A tough time for Seven

Seven Group Holdings (SVW) holds strong positions in industrial services and the media, however the near-term remains challenging. The company is heavily exposed to structural challenges in media and the mining sector downturn through its WesTrac business.

WesTrac, a Caterpillar construction and mining equipment dealer, is dependent on macroeconomic factors beyond its control. These include iron ore and coal export prices. Low and/or volatile commodity prices impact the rate of production and expansion of the iron ore and coal industries and demand for capital equipment.

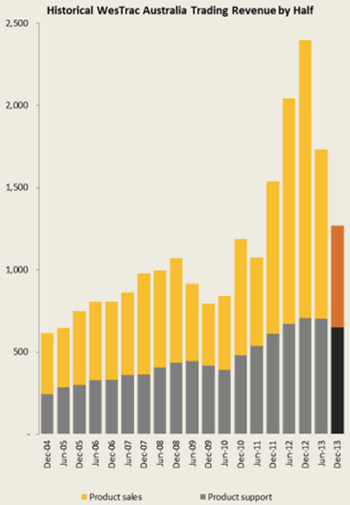

2013 was a year of unprecedented levels of new equipment sales. The peak in new equipment sales between 2011 and 2013 was an aberration, and first half fiscal 2014 saw the volume of new resource projects decline, resulting in a normalisation of capital equipment demand.

Figure 1. WesTrac Australia revenue

Source: Seven Group Holdings 1H14 Results Presentation

With the iron ore price down 30 per cent this year and coal prices weak in an oversupplied market, expenditure on contract mining equipment is unlikely to grow and may fall further.

Positively, WesTrac’s parts and product support revenue stream is somewhat more stable and recurring. As the business sold record amounts of equipment in 2011-2013, this should see continued demand for parts and servicing, as companies defer replacement of equipment and the high levels of deliveries enter maintenance phase.

In the context of a mining sector downturn, Seven Group Holdings is focused on the variables it can control. It has proactively managed its cost base by restructuring and reducing WesTrac’s headcount.

Seven Group Holdings owns 35 per cent of Seven West Media (SWM), which is currently facing a tough operating environment with structural challenges in traditional media, a subdued advertising market and low consumer confidence.

The profitability of Seven West Media is largely determined by advertising trends. Around 80 per cent of the group’s revenue is derived from advertising, which is subject to cyclical and structural impacts and ratings performance.

Seven West Media management expects the advertising market to remain subdued with low-single to mid-single digit growth in television, continued decline in newspapers, and a reduced rate of decline in magazines.

Seven Group Holdings’ large cash balance of $525 million and undrawn debt facilities of over $1 billion support the company’s ability to execute on its share buyback, and fund potential acquisitions. In December 2013, it announced an on-market share buyback of up to 11.9 million shares, approximately 3.86 per cent of all ordinary shares.

At its annual general meeting and interim results, Seven Group Holdings spoke to the potential for merger and acquisition activity to diversify the group. Management said it is pursuing and evaluating a range of potential investment opportunities in the industrial services, food, energy and water industries.

Seven Group Holdings’ offer to acquire financially stressed oil and gas company, Nexus Energy (ASX:NXS) for 2 cents per share was rejected in June by Nexus shareholders.

Seven Group Holdings said it is interested in buying additional Caterpillar dealerships and is in discussions with Caterpillar. This makes strategic sense given the revenue and cost synergies.

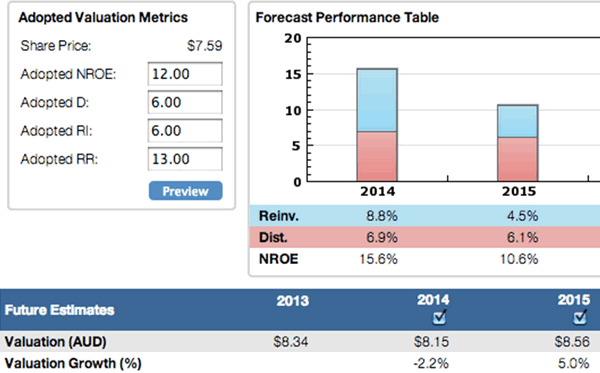

We adopt a forecast sustainable return on equity of 12 per cent and a required return of 13 per cent to derive a fiscal 2015 valuation of $8.56. Strategically sound acquisitions, the buyback, and an eventual recovery in the mining cycle, should trigger a recovery in long-term profitability.

We recommend purchasing the stock at a 20 per cent discount to value to account for adverse commodity price volatility impacting mining activity.

Figure 2. Future Value and adopted variables

Source: www.StocksInValue.com.au

By Amelia Bott of StocksInValue, with insights from Adrian Ezquerro of Clime Asset Management. StocksInValue provides valuations and quality ratings of 400 ASX-listed companies and equities research, insights and macro strategy. For a no obligation FREE trial, please visit StocksInValue.com.au or call 1300 136 225.