Urgent debt lessons from a forgotten framework

I was delighted to see, in Paul Krugman’s post – 'What Janet Yellen – And Everyone Else – Got Wrong', a title almost the same as mine – that he now identifies 'the debt overhang' as the reason this economic downturn has persisted for so long.

The best explanation, I think, lies in the debt overhang. For the most part, even those who correctly diagnosed a housing bubble failed to notice or at least to acknowledge the importance of the sharp rise in household debt that accompanied the bubble. And I would argue that this debt overhang has held back spending even though financial markets are operating more or less normally again. In short, getting the bubble right, while no small thing, wasn’t enough; Yellen (and many other people, myself included) underestimated the fragility of the financial system, but also the importance of household debt.

This is progress: economists are starting to acknowledge the importance of private debt in macroeconomics. There’s just one feature of his post I’ll quibble with: the proposition that “Yellen and Everyone Else” got this wrong before the crisis. There was at least one economist who did get it right, and who did so long before the crisis erupted.

Arthur Cecil Pigou

If you haven’t heard of Pigou recently – or perhaps at all – that’s because he’s dead. He died in March 1959. But, in many ways, he died a lot earlier when – despite their personal friendship – Keynes used Pigou as his foil in The General Theory. Pigou published The Theory of Unemployment in 1933, and Keynes used it extensively as the proof that – as an explanation of the Great Depression – conventional economics had nothing to offer:

Professor Pigou's Theory of Unemployment seems to me to get out of the classical theory all that can be got out of it; with the result that the book becomes a striking demonstration that this theory has nothing to offer, when it is applied to the problem of what determines the volume of actual employment as a whole.

Ouch. There was much more besides, so much so that even Hicks complained about it – and dumped on Pigou even more in the process.

"Mr Keynes takes as typical of 'Classical economics' the later writings of Professor Pigou, particularly The Theory of Unemployment," he said. "Now The Theory of Unemployment is a fairly new book, and an exceedingly difficult book; so that it is safe to say that it has not yet made much impression on the ordinary teaching of economics. To most people its doctrines seem quite as strange and novel as the doctrines of Mr Keynes himself; so that to be told that he has believed these things himself leaves the ordinary economist quite bewildered."

Double ouch. Pigou was thus not only overshadowed but also derided by two giants of 20th century economics, so it’s little wonder that he has largely disappeared from the modern macroeconomic canon (except for the 'Pigou Effect', of which I’ll write more anon). I have to thank Nathan Tankus for the Talmudic Scholarship that has cast Pigou in a more favourable light. As part of the study we’re doing of the dynamics of debt here at the Fields Institute in Toronto, Nathan discovered that just before the Great Depression, Pigou developed a monetary theory that predicted that if the level of private debt fell from a great height, the economy would go down with it.

His argument drew a clear distinction between borrowing from the public and borrowing from banks. Borrowing from the public simply transferred existing spending power from one person to another. These were “pure redistributions” as Bernanke later put it that don’t create any additional spending power, and can largely be ignored. But not so borrowing from banks:

"But their borrowings from banks are different. Businessmen are able to achieve extra borrowings of this type because the banks are ready, in response to offers of higher interest, to allow the ratio of their reserves to their liabilities to decrease," he said. "The ability to make these extra borrowings enables businessmen to enlarge the stream of floating capital available to them in good times more than they would have been able to do so in the absence of such ability… In other words, modern practice in banking renders the supply of floating capital … more elastic in response to given variations (whether warranted or not) in their outlook."

That’s in the good times. In the bad – when businessmen (and households) are paying their debt down – the same process works in reverse: When businessmen’s expectations become gloomy the same twofold influences comes into play to push prices down.

Pigou thus expected to see a strong relationship between change in the rate of credit creation and economic activity, as he stated in his chapter outline (see Figure 1):

Figure 1: Chapter 13 outline: "There is a close relationship between fluctuations in the amount of credit creations and fluctuations in employment."

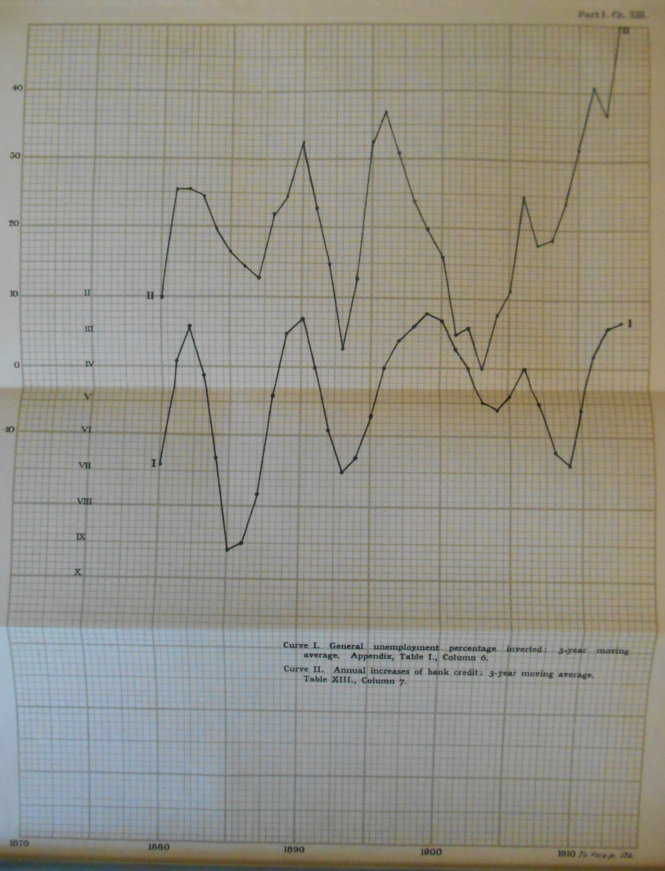

He made this explicit in a quaint (but somehow familiar) graph which plotted the rate of change of bank debt against the level of unemployment (see Figure 2).

Figure 2: Pigou's graph of change in bank debt against the unemployment rate from 1800 till 1920.

In his description of the table from which this graph was derived, Pigou noted that “a minus sign appears only three times” in the change in debt calculation (three times in 40 years), and he observed that “bad times differ from good, not in that the former witness creations, and the latter destructions, of credit, but that the former witness larger, and the latter smaller, creations”. Writing in 1927 and using English data, Pigou had no inkling that the debt-creation numbers were about to go seriously negative for the US, ushering in the Great Depression. But in the spirit of an earlier Krugman blog ('Non-prophet Economics'), that “we should first of all be evaluating models, not individuals… we’re looking for the right economic framework, not the dismal Nostradamus”, then Pigou clearly gave us the right framework, two years before the Great Depression began.

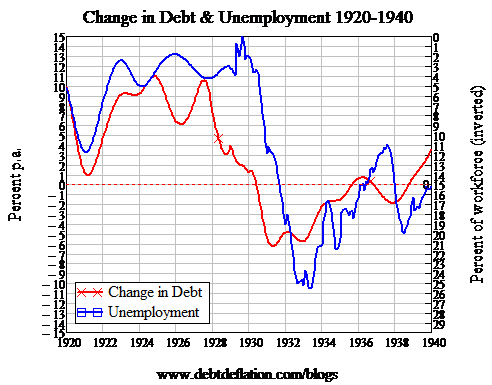

Figure 3: Pigou's chart with data for the US from 1925-1940: Correlation coefficient = -0.78

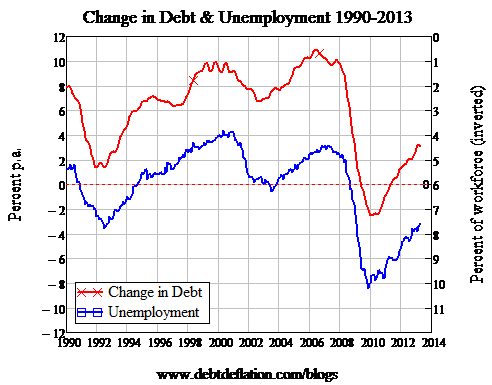

Clearly however, we didn’t use the right framework – either back then, or today when the correlation between change in private debt and the level of unemployment from 1990 till now is a whopping -0.96 (see Figure 4).

Figure 4: Pigou's chart with data for the US from 1990-2013: Correlation coefficient = -0.96

Nathan’s discovery that the person Keynes painted as the arch-Neoclassical in fact had a very non-orthodox vision of the role of banks – looking from today’s perspective – raises some interesting Talmudic questions. Why was Pigou’s framework not applied at the time, when it clearly fitted the data? Why did this accurate model disappear from the economic literature (except in underground inhabited by Joseph Schumpeter, Irving Fisher and Hyman Minsky)? And why was it replaced by one in which the role of banks (and debt and money) in macroeconomics was ignored? I’ll delve into this in more detail in a future post, but it appears that the culprit could be… John Maynard Keynes.

Steve Keen is author of Debunking Economics and the blog Debtwatch and developer of the Minsky software program.