Unpicking Europe's patchwork recovery

The fragile recovery in the eurozone faltered overnight, with September quarter GDP growth highlighting how little momentum there is in most eurozone economies.

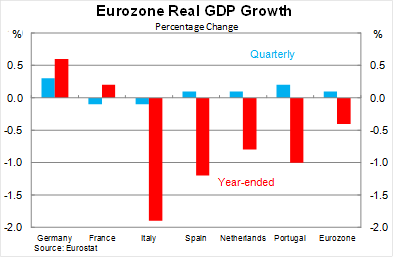

According to Eurostat, eurozone real GDP rose by 0.1 per cent in the September quarter, slightly below market expectations, to be 0.4 per cent lower over the year. It follows growth of 0.3 per cent in the June quarter, a result that was supported by unusually strong construction growth following particularly poor weather earlier in the year.

Growth in two of the bloc’s three biggest economies, France and Italy, contracted by 0.1 per cent in the September quarter. For Italy it was the ninth consecutive quarterly decline in activity, while in France it was a setback following growth of 0.5 per cent in the June quarter.

Meanwhile, growth in the region’s biggest economy, Germany, slowed to just 0.3 per cent in the quarter, to be 0.6 per cent higher over the year. These three countries account for around two-thirds of eurozone GDP.

The data was a sobering reminder of how fragile the eurozone recovery is and how unlikely that is to change any time soon. With the unemployment rate at a record 12.2 per cent, household consumption will remain subdued well into 2014 and perhaps even 2015. This is amplified by the fact that many eurozone countries are still trying to rebalance their economies by improving their international and eurozone competitiveness by reducing relative wages. An export-led recovery will not gain much traction until further improvements are made.

German policy makers will feel vindicated with Germany’s growth reflecting domestic demand, following a fall in net exports. This comes not long after the US Treasury criticised the German government, saying that they had not done enough to support demand both domestically and through the eurozone. I addressed this in an article a couple of weeks ago (Germany is the self-centred Euro king, November 5).

On Wednesday, the European Union announced an in-depth review of the Germany economy, saying that it will examine whether the country should be doing more to boost domestic consumption and investment to support the broader eurozone economy. They should, but given the review is non-binding I doubt it will have much effect on German policy.

Within Germany this issue has been framed as one of jealousy of Germany’s exports; that Germany has been too successful. But that misses the central point that the US Treasury is arguing that the German economy is not doing well enough, which continues to be supported by subdued GDP growth. The German government can and should do more but have instead chosen not to, the result is weaker growth and higher unemployment within Germany. Hardly something to be jealous about.

On the periphery there were a variety of results. Spain is down 1.2 per cent over the year, while the Netherlands is down 0.8 per cent. Hungary bucked the trend, expanding by 1.6 per cent, while Latvia and Romania are rising strongly with around 4 per cent annual growth. The economic problems in Cyprus persist, with that economy down 5.7 per cent over the year.

The eurozone GDP data comes a day after the Bank of England (BoE) released their Inflation Report for November (Clearing skies over England’s economy, November 14). As if we needed more evidence, the pace of the UK recovery highlights the importance of a floating exchange rate and independent monetary policy during an economic downturn. The UK economy shared many characteristics of some of the weaker eurozone countries such as high levels of public and private debt, deleveraging and fiscal austerity. However, with greater and more flexible policy options – and without the need of a painful internal devaluation – they have managed to recover at a far quicker pace than their eurozone cousins. The outlook for England is a lot brighter than for most European economies, including Germany.

For Australia, the September quarter GDP data for the eurozone does not change things a great deal. Continued weakness throughout the region was widely expected and will persist for some time.