Unlocking the wealth of Australia's self-managed funds

We are accustomed to being surprised by what is happening in superannuation but the latest superannuation projections have taken my breath away. The trends are exciting but require fundamental rethinking of how superannuation must be harnessed to maximise benefits to retirees and the community.

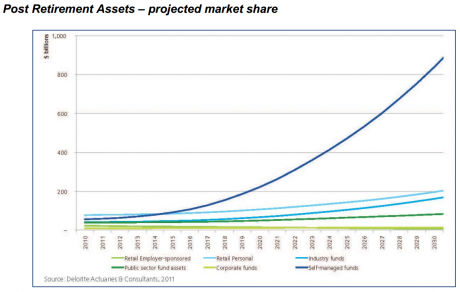

Projecting forward just six years -- by 2020 -- the retirement funding managed by self-managed superannuation funds is set to double from $100 billion to $200bn. Then by 2024 -- just 10 years away -- the self-managed pension paying pool will double again to $400bn and by 2030 self-managed funds will be managing $800bn in pension-generating retirement savings.

Remember, this is not the total money in superannuation but just those funds actually financing people’s retirement. These staggering figures come from Deloitte Actuaries and the Australian Tax Office and are contained in the SMSF Professionals’ Association report to the Financial System Inquiry.

These incredible growth rates come about first because people are moving into retirement at an increasing rate of knots and an increasing percentage are choosing to fund the pension phase of their retirement via a self-managed fund (it’s now 50 per cent but the swing to self-managed funds is accelerating and is projected to rise to 60 per cent of superannuation-funded retirees).

Meanwhile, as the above graph shows, industry and retail funds have been decimated and have become minor players in this market. The total public relations mess the Commonwealth Bank is making of financial planning will give self-managed funds a further boost.

On the performance front, a series of surveys now confirms -- the latest came from the National Australia Bank -- that self-managed funds are beating or equaling the highly paid professional funds, measured over the last eight years. Far from being a danger to retirement, the funds are run by well educated people who know what they are about. And when they don’t know, they seek advice.

Aghast at what is happening to their ‘growth’ market, the big institutions lobby Canberra day and night for more restrictions on self-managed funds. The funds don’t need more restrictions -- it’s the big institutions that have the governance gaps. The SMSF Professionals’ Association has set out how we can harness this movement to benefit both the self-managed funds and the community.

For those in retirement, well structured infrastructure can be a wonderful investment but at the moment to participate in most projects you need to be a wholesale investor.

Normally that requires a superannuation fund of $10 million. The SMSF Professionals’ Association says the wholesale category threshold should be reduced from $10m to $1m and parcels of infrastructure should be made smaller to tap the growth market.

For the most part self-managed funds are ‘sticky’ investors but in the retirement phase they do need revenue for pensions, so sometimes it is necessary to sell securities to meet pension requirements. Accordingly, a secondary infrastructure market needs to be established.

The lowering of the wholesale fund limit could also be used for self-managed funds to participate in the corporate bond market and perhaps loans for houses.

Australia is going to need funding for infrastructure but the current rules make it hard for most self-managed funds to participate. Given their stranglehold on retirement pensions, that makes no sense. The SMSF Professionals’ Association’s proposed changes are not difficult to implement and make sense but most institutions will oppose them rather than work on low-cost products to service the market.