Unlisted property realm carries a warning

| Summary: In the hunt for higher yield, investors are turning to assets including unlisted property trusts and syndicates. They’re easy to enter, but often hard to exit, and ASIC’s top official has warned that investors hunting for yield need to be very careful when considering higher-risk investments. |

| Key take-out: Liquidity is a major impediment to investment in the unlisted arena, and those wanting to withdraw can face serious obstacles. |

Key beneficiaries: General investors. Category: Property. |

The alarm bells are sounding. The hunters could become the haunted.

Last week, Australian Securities and Investments Commission head Greg Medcraft warned that in the great hunt for yield, investors could end up getting burnt.

Lowering rates, as the Reserve Bank did again last week, is designed to encourage investment in riskier assets. But Medcraft fears we may be laying the ground for another financial crisis, with people being lured into products they don’t understand or that are inappropriate for their needs.

As a veteran of the property securitisation businesses, Medcraft would have intimate experience from the other side.

In the past 12 months there has been a notable increase in appetite for unlisted property trusts and property syndicates, many of which promise attractive yields and the potential for capital growth.

With dimming memories of the debacle surrounding the near collapse of Centro, which ran more than 20 property syndicates, the demise of the Gold Coast-based Octaviar (formerly MFS) along with the financial woes of other debenture funds such as City Pacific, the lure of attractive yields once again is proving fertile ground for those looking to raise funds.

The stunning performance of the listed real estate investment trusts (REITS) during the past year has also helped unshackle investor restraint when it comes to the smaller unlisted end of the market.

Australians have a natural appetite for real estate, often incorrectly viewing it as a safe haven.

Combine that with an alarming lack of transparency, the illiquid nature and the almost universal failure among most investors to understand the increased risk profile associated with unlisted ventures, and Medcraft’s fears are well grounded.

Unlisted League Tables

While information on this end of the industry generally has been scant, the Property Council of Australia in conjunction with IPD compiles a monthly performance league table of unlisted funds and property syndicates.

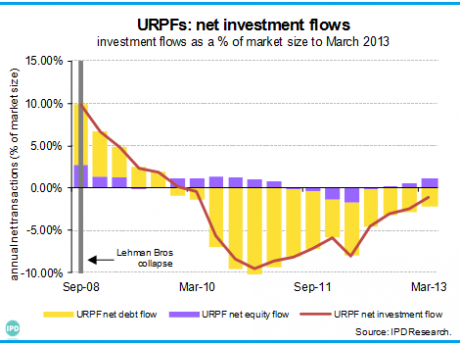

According to IPD managing director, Anthony De Francesco, anecdotal evidence of inflows into unlisted retail property funds and property syndicates now has been backed up by hard evidence in the most recent two quarters. Equity is replacing debt.

IPD monitors 21 organisations that issue a range of unlisted trusts and syndicates, mixing industry heavyweights such as Stockland, Federation (the renamed Centro), Charter Hall and Cromwell with a host of lesser-known entities.

At the moment, confidentiality prohibits IPD from releasing a full performance table. But it does detail the top five performing funds and syndicates during the past 12 months, which from next month will be expanded to the top 10. And it compiles a list of average performances for each sector.

Sentinel Property Group has four funds in the top five, while Perth-based Mair Group makes up the other entrant with a syndicate owning a single building in Cottesloe.

Top Five Performing Funds (Total % Return Performance annualised March 2013) | ||||

Manager | Fund | 1 yr | 2 yr | 3 yr |

Sentinel Property Group | Sentinel Office Trust No.1 Inala | 55.6 | - | - |

Sentinel Property Group | Morningside Trust | 39.4 | 25.2 | 32.7 |

Sentinel Property Group | Banyo Industrial Trust | 38.8 | - | - |

Mair Group | 525 Stirling Hwy Cottesloe Syndicate | 33.4 | 21.4 | 17.6 |

Sentinel Property Group | Mackay Retail Trust | 26.4 | 21.3 | - |

Source: PCA IPD Unlisted Retail Monthly Property Fund Index | ||||

De Francesco warns that unlisted trusts and syndicates generally operate with lower-quality assets. The risk profile is higher and there is a huge divergence in the performance of individual funds.

“Many investors are looking at income security and they are looking for a strong yield, sometimes without realising they are investing in a low-quality asset,” he says.

He advises potential entrants into the unlisted realm to look for management that is active and that has a well- defined strategy such as buying B grade assets and improving them, either for sale or higher rental yields.

For those investing in property syndicates that hold just one building, De Francesco advises that it is essential to look at the security of the income stream. That means ensuring the tenant is a well-known group and to check its credit rating.

Just like performance, entry prices vary wildly on these investments. At the lower end, minimum investment can be as little as $10,000 while other funds target only high net worth individuals with a minimum of $100,000.

Liquidity often is cited as a major impediment to investment in the unlisted arena. Given no secondary market exists for such investments, those wanting to withdraw can face serious obstacles. Some funds allow for investors to exit early, on the proviso that they find a replacement investor.

Comparative Performance

Post fee total returns for property syndicates have managed reasonable returns in recent years. After a drubbing in the wake of the financial crisis, the five-year average registers a loss of 0.2%. But in the past three years, returns have averaged 9.5%, and 6.3% in the past 12 months.

Unlisted retail funds have performed marginally better over the five year period, slightly in the black with a 0.2% gain, rising to 6.3% return over three years and 7.5% in the past 12 months.

Compared with almost any other asset class, however, the unlisted funds trail the field.

Bonds have performed the best during the past five years, but have slipped into the red in recent months. But the spectacular performance of equities in the past 12 months has overshadowed everything, with the listed REITs bouncing back from the near apocalypse of the financial crisis.

In the past 12 months, equities have advanced more than 20% while REITs have gained a spectacular 30.6%. Over the five-year period, however, REITs still rank last with a 3% decline.

Listed v Unlisted Fund Performance (Total % Return) | |||||

Asset Class | 1 mth | 3 mth | 12mth | 3yr | 5yr |

Equities | -2.3 | 7.7 | 20.6 | 4.6 | 3.4 |

REITs | -2.9 | 4.6 | 30.6 | 10.6 | -3.0 |

Bonds | -0.3 | -0.5 | 9.2 | 11.7 | 9.8 |

Unlisted retail prop | 0.8 | 2.2 | 7.4 | 7.5 | 0.2 |

Property Syndicates | 1.2 | 2.1 | 6.3 | 9.5 | -0.2 |

Source: PCA IPD Unlisted Retail Monthly Property Index March 2013 | |||||

Warnings

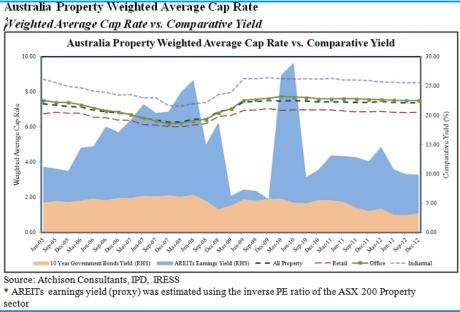

The plunge back into the realm of the unlisted has occurred right at the time that some experts are questioning whether the commercial property market has been overbought.

Cromwell Property chief, Paul Weightman, last week warned of a bubble in the Australian market claiming that offshore funds had been flooding into commercial property, boosting values without a corresponding response from fundamentals such as rental yields.

Office and retail rental growth, particularly in the eastern states, was difficult to see, he said.

Weightman said the company would be offloading assets to reduce debt levels, a move Cromwell hasn’t undertaken since 2006, just before the commercial property market nosedived.

Although the Property Council of Australia recently indicated absorption of CBD office rental space was the lowest since mid-2009, and less than half the 20-year average, not everyone agrees with Weightman’s doomsday scenario.

The potential exists – as it always does – if prices move too much higher without fundamental income support.

If there is a price correction, however, recent history suggests that higher-quality assets retain income and recover quicker.