Turbines sprout in India, Brazil

India's wind market is becoming increasingly interesting, predominantly due to the reinstatement of accelerated depreciation in May 2014. Local firm Welspun Renewables Energy said on 12 January it would invest $1.3bn* to build 500MW of wind and 600MW of solar projects in Gujarat. The company has some 300MW of wind capacity under development, together with 447MW of PV.

The following day, SunEdison said it would develop 5GW of wind and solar projects in the south Indian state of Karnataka – the US company's first foray into the Asian country. Of the total, 1.5GW of renewable power projects will be developed by end-2016. Two days later, Mytrah Energy announced plans to invest $150m in two onshore wind farms in India. The local renewable energy developer is also watching the solar industry closely, though the returns from solar do not currently match those from wind.

In the Indian wind sector, bankers want to reduce uncertainties, and therefore prefer the turnkey business model. In contrast, independent power producers mostly prefer a deal involving supply and installation with operations and maintenance, and equity investors opt for turbine-only agreements or contracts with supply and installation but without operations and maintenance. These were the results of our recent survey of players in the Indian wind industry.

The wind sector in Brazil is also flourishing, with financing deals surging 83% last year to $2.5bn. In December alone, the country's development bank approved BRL 1.7bn ($649m) in loans for 22 wind farms, totalling 590MW of capacity. Indeed, a record volume of wind capacity (2.7GW) came online in 2014, after overcoming transmission delays. One stumbling block, says the H2 2014 Brazil Market Outlook, has been turbine availability, with developers ruling out manufacturers for a range of reasons. One of the ‘survivor' manufacturers – General Electric – announced last week that it had agreed to supply 346MW of wind turbines worth $491m to Brazilian developer Casa dos Ventos.

Despite these challenges, wind farms have been coming online: France's Voltalia started on 15 January a 30MW plant in northeast Brazil. The Terral wind farm is the second phase of a wider project that will see another 10 3MW turbines come online this month and next.

Elsewhere in Latin America, Eletrobras announced on 14 January it had begun operations at its 65MW wind farm in Uruguay – the utility's first project to generate power outside Brazil. The Artilleros started with three turbines, with the remaining 27 to begin next month. On the same day, Acciona opened its first wind farm in Chile as part of its plans to build 255MW of renewables capacity in the country, with investment of $470m. The new 45MW wind plant in Canela uses the Spanish company's own turbines.

Outside wind, marine energy may have had a turbulent end to 2014, with Siemens abandoning ship on its tidal power business, Marine Current Turbines, and the UK's Pelamis Wave Power saying it had run out of money. Yet, 2015 is likely to be a decisive year in marine energy, according to the H1 2015 wave and tidal update: pilot wave arrays in Australia and Sweden are due to be fully built out, and the tidal range industry will be keeping close watch on the UK in spring to see whether the government okays the proposed 320MW lagoon in Swansea Bay, with a price tag of $1.3bn.

*All dollar figures in USD.

EU carbon

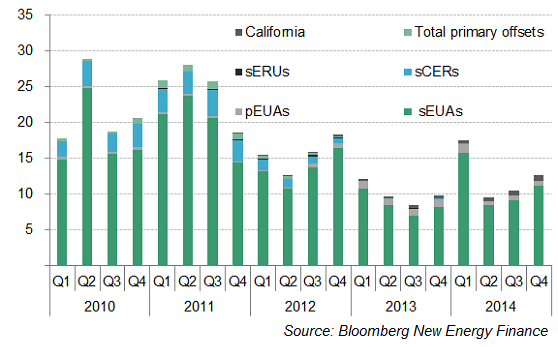

In the carbon markets, European emission allowances climbed 6.3% last week to end Friday's session at €7.13/t. Looking at 2014 as a whole, trading value across the world's carbon markets climbed 25% to €50bn, though volumes dipped 12%, according to the 2014 Carbon Market Quarterly. The primary driver behind the drop was the arrival of auction curbs in the largest carbon market – the EU ETS – as reduced auctions likely reduced secondary trading churn. However, the total value surged last year, thanks in part to the 43% rise in the Dec-15 EUA price.

GRAPH OF THE WEEK: Value of global carbon markets increased by 25% to €50bn in 2014. In Q4, the value rose 20% from 3Q to €12.6bn.

Source: BNEF

Originally published by Bloomberg New Energy Finance. Reproduced with permission.