Transmission access: Putting renewables on an equal footing

Friday's article outlined some serious issues with the proposed Optional Firm Access model, particularly related to the transition process proposed by the Australian Energy Market Commission. These issues could ultimately prove more problematic for renewables over the long-term than the removal of the RET.

Today’s article outlines some better alternatives that could meet the AEMC’s requirements, and remove or minimise the problems identified with the OFA transition.

Option 1 – Auction all access

A sensible alternative to gifting the existing shared network to incumbent generators would be to auction it, with generators who wish to purchase firm access doing so in a competitive process. This could be done gradually over time, with appropriate firm access contract durations, to ensure minimal market shock and allow new entrants to progressively participate in the auction process.

This could actually closely mirror the AEMC’s proposed process. The AEMC is proposing progressive auctioning of the network, as it’s made available when transitional access is gradually scaled downwards (as illustrated in Figure 1 of Friday's article). This alternative proposal would involve the same auctions, but simply start from a place of nobody being allocated any free transitional access (rather than everyone being allocated free transitional access), such that the un-auctioned proportion of the network remains unallocated, rather than gifted to incumbents. Arguably, this is more similar to the present system (where no generator has firm access), and so could further reduce market shock.

Minimising free allocation, and maximising auctioning, was one of the key learnings from the creation of carbon markets. Although carbon markets are not perfectly analogous to markets for network access, it appears that there are significant parallels, and that valuable lessons can be drawn from the extensive analysis in this area.

However, the terms of reference provided to the AEMC specifies an initial allocation of transitional access. If this is considered necessary, the following alternative transition process (Option 2) could be applied, and still remove or minimise the above listed issues.

Option 2 – Scaled transitional access for new entrants

This second alternative approach would initially be identical to the originally proposed method. The amount of access required to provide all market participants with 100 per cent access would be determined, and then scaled downwards to the existing network capacity available. This would then be ramped downwards gradually over time.

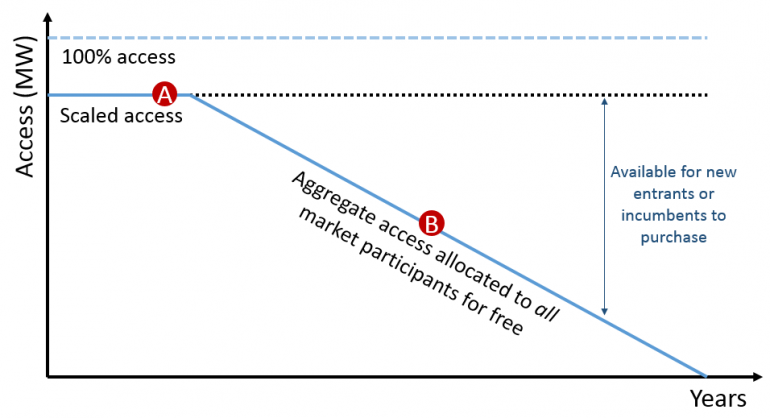

Importantly, access would continue to decrease until it reaches zero at some future date, as illustrated in Figure 1. This would be the same date for all market participants, minimising rent seeking behaviour. If a generator retires before that date, they would be allowed to sell their remaining transitional access (reducing over time), thus removing barriers to exit.

Figure 1: Alternative Transition Process – Scaled access for new entrants

Most significantly, under this approach, any new entrant during the transition period would also be allocated transitional access, on an equal footing with incumbents at that time. Incumbents at the relevant network locations would have their transitional access scaled back accordingly, so that the total access allocated at that location reflects the proportion of transitional access available to all market participants at that time.

For example, if a new entrant enters the market at point A (shown in Figure 1), the proportion of scaled access available to every market participant at the relevant location would be scaled downwards (in a manner analogous to the original scaling process), such that the new entrant receives the same amount of firm access as if they had been present in the market from the beginning.

Similarly, if a new entrant enters the market at point B (shown in Figure 1), they would be allocated the same proportion of free transitional access as all other market participants at that location at that time, and all incumbents at that location would have their access scaled downwards so that the total allocation of transitional access remains at ~50 per cent of the total existing access for the network (in this example).

Over the long term, this approach approximates the level of network access that incumbents could have expected when they invested. Access is provided for free initially, but new entrants can erode this access, as they would in the present system. It could be argued that this approach actually still provides greater certainty of network access over time for incumbents compared with the present system, since the sharing of network access upon the entry of a new entrant will be calculated in a more predictable fashion, rather than based upon the nuances of very small differences in constraint equation coefficients.

New entrants and incumbents alike would be able to purchase further access beyond the freely allocated amount if desired. This will be gradually made available to the market over time as the allocation of transitional access decreases.

This approach removes or minimises the issues described in Friday's article, including:

– Removing barriers to entry and exit

– Minimising incentives for rent seeking behaviour

– Removing the competitive disadvantage for new entrants, ensuring that new entrants are on an equal footing with incumbents

– Minimising windfall gains for incumbents

– Allowing low carbon transition policies to work effectively in alignment with, rather than in opposition to, the OFA transition

The Centre for Energy and Environmental Markets’s working paper outlines these issues and proposed alternatives in more detail. Those in the renewables industry are encouraged to engage with the AEMC in this design process, to help ensure that a successful transition to OFA is achieved.

*This is article is the final part of a two-part series. Part one – Transmission access: More deadly than the RET Review? – was published Friday.

Dr Jenny Riesz is a research associate at the Centre for Energy and Environmental Markets (CEEM), at the University of New South Wales. http://jenny.riesz.com.au/