Transforming BHP

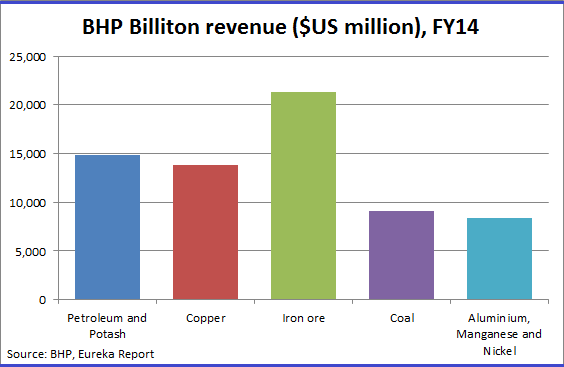

Summary: BHP Billiton is reducing costs and becoming more productive as the iron ore boom turns to weakness. The miner’s copper, oil and gas and potash operations are also set to reap rewards. The leaner BHP will be profitable despite low prices. |

Key take-out: BHP is focused on maximising returns rather than growth. The company hopes to offer a yield of about 5% over the next decade. |

Key beneficiaries: General investors. Category: Shares. |

A remarkable figure crossed my desk during the week – there are some 7.5 million superannuation beneficiaries who are shareholders in BHP Billiton. That is an incredible number and while a great many are in institutional funds it also means that a large number of self-managed funds in Australia also have BHP shares as one of their key-long term investment pillars. Most self-managed funds will also have a few bank shares, Telstra, perhaps Australian Foundation Investment Company (AFIC) or Argo and a few other assorted stocks.

And so today I am not passing judgment on whether BHP is good or bad buying in the short term but given that so many Eureka Report readers will have BHP as one of their pillar stocks let me explain what the company is trying to do because the BHP of 2014 is vastly different from the BHP of two years ago. Indeed I have been watching BHP for half a century and I have never seen The Big Australian acting in this way. Most of BHP’s messages are directed towards institutions so very few of those 7.5 million superannuation holders understand what is really going on. Let us look at what BHP is trying to do with its core portfolio. We will come to the planned spin-off, currently called Newco, later.

The price of iron ore has fallen from $US130 to around $US80. BHP costs are probably between $US45 and $US50 a tonne so there is still a huge profit margin. BHP believes that its marginal costs are so low that it can increase its iron ore output and still make huge sums.

During the boom in iron ore the word “productivity” was not in the BHP dictionary. The company was all about producing as much as it could as quickly as it could. BHP became very inefficient.

BHP CEO Andrew Mackenzie is about changing the culture of the company and making productivity a key word. He announced an incredible $10 billion in cost cuts over three years and my guess is that he can double the $10 billion although the last $5 billion or so may need changes in the industrial relations act. Mackenzie’s aim is to take BHP from being one of the most inefficient miners in the world to be as good a miner as there is in the world.

Mackenzie and his directors believe that to a large extent the fall in price of iron ore and other metals can be offset by much lower costs, higher throughput and, of course, a lower Australian dollar. BHP quotes its results in US dollars but any fall in our currency helps. The current weakness in iron ore is due to a serious excess in supply. But over time that will pass – or at least that is the BHP view, although a decade or so down the track China will boost its scrap output, which will reduce the attractions of the iron ore market.

The long-term problem for iron ore is that it is a plentiful material. This abundance of potential supply is not the case with copper so BHP sees the long-term copper market as very different to iron ore. As countries move into greater urbanisation they tend to use more copper. In particular as copper usage in manufacturing is increasing, goods become far more energy efficient. Copper will be part of the process by which we reduce carbon emissions.

Copper is much harder to find than iron ore and some of the new mines are much lower grade. But BHP has a succession of copper expansions in Chile and other parts of South America and Peru. BHP believes it can increase its copper production over time and because the output rises are, for the most part, “brown field” (existing) expansions they will be very efficient.

BHP’s great prize is of course Olympic Dam, the giant copper, uranium and gold mine in South Australia. The original BHP plan at Olympic Dam was to erect a giant open cut mine and ship concentrates to Darwin. The problem was that BHP had to dig for about six years without any revenue and the concentrates that were planned to be shipped to Darwin had too high a uranium content so were too dangerous to shift. They also required a specialised smelter in China.

The new plan at Olympic Dam is to increase production via the current underground mine and to first leach the uranium and some copper from the ore. Then, a second leaching process will take out the remaining copper. BHP is currently erecting a large trial plant to discover whether this process can work. If it does, Olympic Dam output increases could be much closer than was originally thought.

BHP has been investing heavily in oil and gas in the US and looks to gain much greater cash rewards in coming years. In the US BHP has huge gas reserves and strong oil reserves and, at least at current prices, it will produce excellent returns. And if there is a Middle Eastern blow up oil should rise sharply in price. Not that I want that to happen but a BHP investment is a part of a risk hedge.

And finally with potash, demand is rising because the world needs more food. Demand needs to continue to increase so that the current excess capacity in the industry is absorbed. BHP’s plan is to erect a shaft and other facilities in Canada so that when potash prices rise it can open a mine in two or three years and take advantage of the high prices. No one knows exactly when that will happen but the current guess is that it will take place in five to 10 years. In other words, whereas copper, oil and gas have a shorter term and higher reward horizon, potash is longer term.

And then there is coal. At the moment the outlook for coal is not good but there is substantial scope in cost cuts and if carbon storage ever becomes a reality coal will have a new lease of life.

The BHP of old was all about looking for new projects. Today’s BHP wants to concentrate more on being a much lower cost miner. While the company will look for more copper and oil, the BHP strategy is about maximising returns rather than growth.

The company hopes that over a 10-year period it will provide shareholders a dividend/buyback return that yields about 5%, compared with a 12-month trailing yield of 3.7%. The leaner BHP will be able to be very profitable in a low price environment and will be able to make large sums should prices for one of its key products jump.

And then of course there is Newco, the spin-off soon to be listed in Australia and South Africa, which contains nickel, aluminium, manganese, coal, zinc and silver (see The BHP Split). Analysts believe Newco is worth in the vicinity of $15 billion. BHP shareholders will get Newco shares on a one for one basis and they will probably be worth in the vicinity of $2.50 per share.

BHP hopes to maintain its dividends even though Newco has been exited. And Newco will probably announce that it will pay out 50% or 60% of its profits in dividends. Probably the two most exciting mines inside that group are one of the world’s largest silver mines, Cannington in northwest Queensland, and the Groote Eylandt manganese operation in the Northern Territory. The company looks to make substantial returns from its mines and does not have major investment requirements for its cash, at least at this stage.