Tough times for value investors

Summary: Value investors are finding it harder to select good value stocks because share prices have risen too far. The Australian banks represent wonderful value on a pure income basis but the growth bonanza in Australian banking is over. The banks no longer offer the sort of value that value investors are looking for, and other stocks are similar. |

Key take-out: Historically when value fund managers fail to find value it is the first sign the market is headed for a correction, but given the amount of global liquidity, that correction might be a long way off. |

Key beneficiaries: General investors. Category: Value investing. |

Last week I was yarning to a close observer of the way global investment managers are thinking and acting.

He explained to me that in London and New York many so called “value” investors are having a hard time while many of the aggressive hedge funds were doing well. “Value” fund managers search the lists for companies that they believe have been overlooked by the market and represent good value.

Increasingly these managers are finding it harder and harder to select stocks they believe represent good value because the share prices have risen too far. As a result many “value” funds have closed their funds to new investors because they simply don't believe they can find profitable avenues to invest new money.

Closing a fund requires a particular discipline by managers because the larger the fund the larger the fees that accrue to those managers. The “value” managers are taking a longer term view and believe that if they take money at the current values they could expose the funds to significant losses and of course some very unhappy clients. So they are gradually running down their funds and becoming more liquid – despite the low rates. Their existing clients have of course done very well. I think we are seeing similar fears among many Australian value managers.

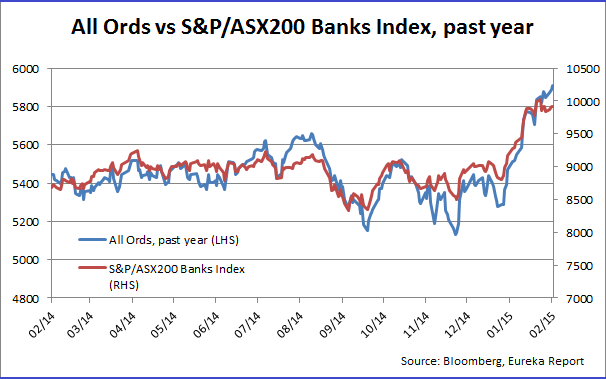

When you move to the overall Australian market in, say, bank shares, the yields they offer are very favourable when compared to the long-term bond rate of around 2 per cent. So on a pure income basis the banks represent wonderful value. Then you look at the price earnings ratios and they too are not out of line with long-term averages given current interest rates.

Then you look at the likelihood of growth in the banks – the latest reports from our big banks indicate that the best of our banks, CBA, is enjoying revenue growth while costs and margins are holding but the story in the other banks is not as good. For example while NAB's revenue is growing so are its costs and its margins are barely holding. ANZ margins are falling reflecting higher costs and steady revenue growth. In other words the growth bonanza in Australian banking is over and so you can argue the price earnings ratios are a little on the high side.

Accordingly if you were a “value” investor looking at our banks you would conclude that at least on an earnings basis while there is not a disaster ahead there is not the sort of value these sort of investors are looking for. This was not the case a year or so ago. I have chosen the banks because all four made reports in the last two weeks but a similar situation applies across the market. And what we are experiencing in Australia is even worse overseas. Central bankers have forced investors into equities to gain yield but in the process have distorted stock market patterns and created greater than normal risk. Of course if global economies take off and economic growth and profit growth resume then value will be restored to the market. Australian investors do need to realise that the nervousness many have in the current market is being duplicated in London and New York by some of the best investment houses.

Meanwhile traders who pick the market trends are having a wonderful time with the large amounts of liquidity in the system and the sharp gyrations in currencies, bonds and other securities.

In Australia overseas hedge funds often play our market by taking major short positions – currently one of the biggest short positions on our market is Woolworths where almost a month's turnover has been shorted.

Clearly the shorters believe that Woolworths is sitting on a very nasty set of write downs of the Masters venture and is not doing as well against Wesfarmers-owned Coles as it would like.

If Woolworths starts to prove those shorters wrong – and the recent eBay deal gave them a fright – they will have to cover their short positions and then you will see a very sharp rise in the Woolworths share price as the shorters scramble to buy back. (Shorters in Australia borrow stock from our big superannuation funds and then sell onto the market that borrowed stock which they do not own. At some point they have to return the stock and hope the share price falls so they make money on the buy back. One day our sleepy regulators will stop superannuation fund managers lending stocks to the disadvantage of their clients.)

Historically when value fund managers fail to find value it is the first sign that the market is headed for a correction but given the amount of liquidity in global markets that correction might be a long way off and will require a major adverse event to trigger it.