Top fund managers: PIMCO EQT Wholesale Global Credit Fund

Summary: The PIMCO EQT Wholesale Global Credit Fund offers retail investors access to hundreds of global corporate bonds. The portfolio managers look at company fundamentals, liquidity and valuation when making investment decisions. The fund sees the best investment opportunities now in the global financial sector, where the position of the bond holder is improving as institutions raise more common equity. |

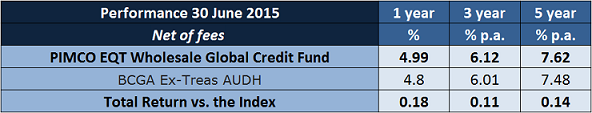

Key take-out: The fund pays quarterly distributions and has returned 7.62 per cent annualised over the past five years. |

Key beneficiaries: General investors. Category: Fixed interest. |

If you've ever thought about buying bonds for your portfolio, you might have been deterred by the minimum amount you have to shell out to own just one. A portfolio manager specialising in bonds can afford you access to the bond market and also help you achieve a suitable level of diversification.

PIMCO EQT Wholesale Global Credit Fund offers access to hundreds of global corporate bonds which, because they are thought to be riskier investments than government bonds, typically offer higher returns. This is the third year in a row Australia has had interest rates below 3 per cent, so the fund's return of 7.62 per cent every year for five years has been a better investment than having cash in the bank.

PIMCO Head of Portfolio Management Australia, Robert Mead, says the fund is finding good value in financial companies. Globally, bank shares have come under scrutiny over the amount of money regulators are forcing them to raise. Mead believes bond holders of financial institutions will be in a better position.

Mead also tells readers not to listen to some of the fearmongering around the Fed raising interest rates. He believes a slow rise is okay because bond funds have different positions maturing regularly – which you reinvest at higher yields – equalling a higher return over time.

PIMCO Head of Portfolio Management Australia Robert Mead: Source: PIMCO

DD: What does the fund invest in?

RM: It's largely invested in corporate bonds, available in global currencies from all countries around the world. There's at least 200 positions in the portfolio, so we have somewhere in the vicinity of that sort of number of issuers. But the same company will issue securities in all the different currencies and maturities, so very often there will be more than one individual security per company.

The majority of the sort of more structured type credit the fund has is in US mortgage-backed securities and in a fairly small way Australian RMBS, but they are very high quality. Sometimes people typically refer to a core bond portfolio as just an Australian bond portfolio and others would refer to global government bonds. This one is slightly different in the sense that you're getting exposure to the global universe, so we can own government bonds in here as well, but the predominant allocation is to corporate and financial institutions' bonds.

How do you work out the kind of investments that you prefer? Is it based on value?

Yes, one hundred per cent. The portfolio is benchmarked against a globally representative benchmark of basically investment grade credit. So there's an inherent underlying beta in terms of the portfolio's initial allocation which will be reflective of what's available in the global credit market. And then it's all valuation based from there.

When you're building a corporate bond portfolio such as this one, you really look at three distinct factors: the fundamentals of the company or the security; the technical things in the market, like demand and supply, liquidity, etcetera; and then finally the valuation. So when you tick all those and say the fundamentals of the investment are compelling, the technical is supportive and the security is relatively cheap, then that would be the way to decide if a particular investment opportunity should be included in the portfolio. If there are question marks then it really comes down to saying unless you're being paid additional credit spread in order to justify the investment, then it doesn't make it into the portfolio.

As a bond manager, do you buy and sell frequently?

One of the great things about the bond market is the investment universe changes every day. So in the equity market the only time the investment universe really changes is if a company has IPO-ed or there's a merger and acquisition. Whereas in the bond market, every single day new companies issue bonds and some bonds mature, so the universe shifts tremendously.

As an active bond portfolio manager, that's obviously a huge opportunity to make decisions constantly around what you currently own versus what's available in the secondary market and then what becomes available in the primary market through new corporate bond issues. So across a whole lot of different spectrums, we actively manage the portfolio, first of all across the individual issuer that we own, then across the industry, the sector, the country, the currency and importantly, we also actively manage the interest rate exposure.

How do you manage currency?

As a first step, everything is hedged back to Australian dollars, but then we can actively manage currency positions as a return source. But we limit those positions to the maximum plus or minus 10 per cent versus fully hedged.

Have you done anything to position the fund for when the Fed raises rates?

We think the Fed will start to normalise interest rates over the coming three months to six months and that will be a very gradual process whereby they ease off zero and then move into a sort of a very gradual and moderate interest rate cycle. But to that extent we're not defensive in any significant way around the potential for interest rates to move a lot higher. If you look at the forward markets, they're already largely pricing the potential for increases in interest rates.

So rather than listening to some of the fear mongering around interest rates going up it's much better to just do the arithmetic. You'll find the analysis says that a slow rise in interest rates actually works out to be a much better thing. Because bond funds have so many different positions that are maturing on such a regular basis, you're reinvesting those maturities at high yields and over time it ends up being a higher return.

Where do you currently see the best investment opportunities?

By far the number one at the moment for us is within the global financial sector, which we think is uniquely positioned because regulators are forcing financial institutions to build more loss-absorbing capital.

Within our own market the requirements from APRA on the Aussie majors to raise more capital has essentially resulted in the transferring of wealth from the bank equity holder to the bank creditor. This push is happening globally, with the position of the bond holder within the financial sector gradually improving as the institutions de-risk and they raise more and more common equity. So that's by far our preferred position – one of the larger overweights we would run in the portfolio. As regulators continue to focus on capital requirements this theme should continue for many more years.

The position of the bond holder will continue to be elevated in the capital structure as banks are forced by regulators to continue to raise more and more equity below the bond holder in the capital structure and the spreads are still attractive.

What do you have little to no investments in at the moment?

The sector that we have less exposure in is the high yield space – which are those below investment grade, anything that's rated BB or below. That's an area that's reasonably crowded in terms of its investor base and the yields and the spreads in that sector have been quite tight. We're cautious of sectors that are subject to M&A [merger and acquisition] activity – like media – as almost by definition, M&A transactions are often associated with an increase in leverage.

What areas of the global economy do you see strengthening?

Clearly the US is on an improving path versus most other parts of the developed world and that's largely reflected in the underlying growth rates in GDP terms. Europe is also doing decently well. The nice thing about the world at the moment is there are virtually no places actually that you'd be forecasting anything like a recession. That's obviously positive for the underlying economies but also positive for the corporate sector to the extent that if there's underlying economic growth the demand for product is maintained from those large developed market sectors.

Do you return income or income and growth to investors?

It's managed for total return, but because of the nature of the structure of the fund, over the course of a financial year we expect to distribute the entire total return in the form of distributions. So it's both capital growth and income return, and we pay this quarterly.

Interest rates are at around zero around the world. What kind of return can investors expect?

The yield to maturity hedged to Australian dollars for the fund was 5.8 per cent at the end of August. This measure assumes market yields remaining constant, but we consider this to be a reasonable measure of the fund's long-term absolute return potential.

Looking at the total return versus the index, after fees you've returned 14 basis points ahead of the benchmark every year over five years. Do you have a particular goal in mind?

Essentially we want to make sure investors earn above benchmark returns after paying all the fees over the long haul, that's definitely the target. It's close to impossible for any individual investor to build a large and diversified portfolio to access this universe; the only real way of accessing it actively is via a manager. So our target is to generate returns that are over and above all of the retail fees that would be payable on the fund. Over the long term we'd be targeting somewhere in the ballpark of between 50 to 125 basis points after all fees. It's slightly below that at the moment over five years, but we're still generating a seven and a half per cent return. If you go out to seven years or 10 years, you'd see high double digit to low triple digits in terms of basis points above benchmark.

Daniella D'Ambrosio is a writer at brightday. The PIMCO EQT Wholesale Global Credit Fund is available on the brightday platform, which allows a minimum investment of $1,000 in managed funds.