Top fund managers: Lazard Global Listed Infrastructure Fund

Summary: Lazard Global Listed Infrastructure Fund looks for monopoly-like assets with inflation protection. The fund only invests in developed economies and has a significant weighting to toll roads. Although the fund cautions that investors shouldn't expect the returns of the past five years to be repeated over the next five years, portfolio manager Warryn Robertson believes the fund is better placed to have investors' money than some ETF-type funds, given some assets look expensive. |

Key take-out: All the portfolio managers plus Robertson's parents are investors in the fund, so the managers have skin in the game. |

Key beneficiaries: General investors. Category: Shares. |

We like managers that have skin in the game, but in the case of Warryn Robertson – portfolio manager/analyst of Lazard Global Listed Infrastructure Fund – his parents are also investors in his fund, so we know he's also trying to do the best he can to avoid the wrath of his family.

Being a value fund, Lazard is always on the lookout for assets priced cheaply. The beauty of only investing in listed companies means it can always sell stock if something gets too expensive – unlike funds that invest in unlisted companies or assets directly.

Around a third of the fund is invested in toll roads, most of which are listed in Europe. And despite the fiscal issues in the eurozone, people are still going about their daily lives and paying their tolls – it's certainly helped the fund return 20 per cent pa over the past five years.

It was clear from speaking with Robertson that he is working hard to adjust investor expectations when it comes to returns for the next five years. Listed infrastructure companies have risen strongly, making it harder to find those cheap assets. As an example, the fund manager believes US utilities – the preferred assets – are expensive at the moment, shrinking the available investment opportunities.

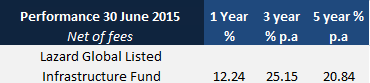

Lazard Global Listed Infrastructure Fund performance

The fund has a benchmark return goal of CPI 5 per cent.

Lazard Asset Management portfolio manager/analyst Warryn Robertson. Source: Lazard

DD: How do you choose what the fund invests in?

WR: We invest in stocks that own infrastructure investments, but it's a certain type of infrastructure that we focus on. Out of about 400 stocks we come up with a list of about 95 to 100 that we think are what we call Preferred Infrastructure. They are monopoly-like assets which we believe have explicit or implicit inflation protection often with regulated returns, which means they produce more predictable profits, distributions and dividends for investors over the long term.

The types of assets we invest in have more predictable demand profiles; such as toll roads, airports, distribution utilities, gas pipelines, satellites and mobile phone towers. After defining our Preferred Infrastructure universe of stocks, we focus on value – what we think is most attractively priced – and look to block out the noise. If the noise creates a buying and/or a selling opportunity, that's what we take advantage of and that's how we think we can make money. One of the benefits of investing in listed infrastructure is if our view changes, for instance if the management of a particular company has done something we think is not in the best interests of investors, we can sell the stock.

You currently have 60 per cent European exposure. What are you thinking in terms of your geographic allocation? Any thoughts on Asia?

We only invest in developed economies, not emerging ones, so in terms of Asia the exposures are somewhat limited. The rationale behind that is the key risks investors bear when they make an investment in the infrastructure asset class are political and regulatory risks. We don't believe you are compensated with an appropriate level of return for these risks in some of the emerging market nations. Our Preferred Infrastructure universe is in the developed nations of the OECD, such as the United States, Germany, France, United Kingdom or Australia. But the vast majority of those available investment opportunities are in US utilities, which we believe as a sector is currently more expensive.

Frankly, I think people have thrown the baby out with the bathwater in Europe. People are worried about Greece. They're worried about what's going to happen with the euro. What we know is that we see people who go about their daily lives that still turn up and pay their tolls, turn the lights on at home and we think many of those businesses are currently offering investors good returns.

At 30 per cent you have significantly more in toll roads than other sectors. Do you see yourself remaining at that weighting in the near term?

We're happy with the positions that we have in toll roads today. Some of the most attractive names we can invest in are in the large cap, European toll road space. The two biggest positions today are Atlantia – Italy's largest toll road operator – and Vinci, the owner of the largest toll road in France. Just because of the quirks of history, toll roads are only found in the listed space in Europe and in Australia, not in the US. So the difference there is that, as I said, we don't see a lot of opportunities in the US and so that's another reason why I think our toll road exposure is a little bit higher than some other managers.

The toll roads we tend to buy have been around collecting tolls for some time, in some cases decades. The big risk is in the early construction and ramp up phase when it's very hard to know how much traffic is going to be driving along the toll road. We prefer to own them once that's happened.

What's the difference between Australian and global infrastructure assets in terms of dividend yield and growth profile?

If you look at some of the Australian assets, such as Transurban, Duet Group, Spark Infrastructure, Sydney Airport, they're some of the highest ‘quality' infrastructure assets we can invest in. They do a really good job at identifying what are the key and critical components of Preferred Infrastructure. But they also tend to have more leverage in their balance sheets and capital structures, and management run the business to pay out a higher proportion of their free cash flow in terms of dividends. So if Sydney Airport earns $100 of free cash flow and it pays out $100 in a dividend, then if Sydney ever needs to raise more money, for say the second Sydney Airport or to expand a terminal building, it either has to go to banks and borrow more money or undertake some form of equity issue.

If you go elsewhere in the globe, you obviously get a breadth in terms of geography, but you also get different types of assets that you can own, which gives you more opportunity to find value. The other key difference is that, for example, if they earn $100 of free cash flow, most overseas companies pay out $60 to $70 in dividends and they retain $30 to $40 for the growth capex. There's nothing wrong with what the Australian companies are doing; it's just different. It's why the Australian ones will typically have higher dividend yields, but it's also why they'll come cap in hand every couple of years wanting rights issues or placements help expand the business. Whereas those in Europe and in the US have capital reserves to use for growth capex. It's the same asset, but a different way of managing the financial structure.

In a recent note you said you don't think you're going to do as well as you have done in recent times. Do you invest in the fund?

All of the portfolio managers are invested in the fund. Plus, my parents are investors in the fund and actually have been for about nine and a bit years. There is no better alignment than when I have to turn up at Christmas and explain if I haven't done a good job.

If you think about the type of assets that our fund owns and the shape of investment returns that we want to deliver to our clients, it is that predictable form of income they can receive which is growing. We have made 20 per cent per annum over the last five years, but that shouldn't be something investors think they're going to achieve over the next five years. I believe it's going to be a little bit harder in current investment markets.

But having said that, we believe our portfolio is much better placed to have investors' money than many other areas of the equity markets, particularly on a risk return trade off, and especially when you compare now some of the ETF-type funds that exist within the infrastructure space. If we're right and the US is more expensive, it will be a very poor investment decision to go and buy an infrastructure ETF or indexed ETF, because you are buying 50 per cent of the US utilities which I previously mentioned we believe are expensive.

Daniella D'Ambrosio is a writer at brightday. The Lazard Global Listed Infrastructure Fund is available on the brightday platform, which allows a minimum investment of $1,000 in managed funds.