Top fund managers: Bennelong Concentrated Australian Equities Fund

Summary: Fund manager Bennelong Australian Equity Partners offers a concentrated fund focused on companies set to deliver on the market's earnings expectations. The fund takes a bottom-up approach but also favours companies with structural tailwinds, and has a considerable healthcare exposure due to the ageing population. |

Key take-out: The fund managers invest in the fund and still think equities are a good place to invest. They say valuations are reasonable, but many companies are structurally challenged, so it pays to be selective. |

Key beneficiaries: General investors. Category: Shares. |

Just months before Lehman Brothers crashed in 2008, Paul Cuddy and Mark East left their joint roles as Director and Co-Head of Australian Equities for ING Investment Management – where they were responsible for over $10 billion in FUM – to start their own fund management business.

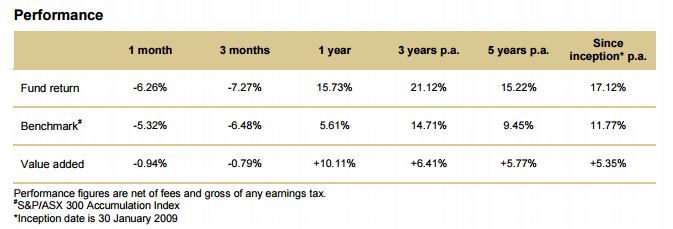

Paul is now CEO of Bennelong Australian Equity Partners (BAEP), while Mark as CIO looks after management of the Australian Equities Fund (core) and its concentrated and ex-20 (stocks outside Australia's biggest 20 companies) equivalents. The core and ex-20 funds have respectively returned 11.8 per cent and 13 per cent annualised over 5 years, while the concentrated fund – a selection of the team's best picks from the S&P/ASX 300 – has delivered over 15 per cent annualised over the same time frame.

Bennelong Concentrated Australian Equities Fund, performance to June 30, 2015.

Mark says concentrated funds have gained a reputation for being high risk, but he thinks theirs has a good track record and at $48 million FUM – so different to his days at ING – Mark's surprised there's not more demand for it.

He sees value in Australian equities but has the view that many companies in Australia are structurally challenged, making the case for investing with a fund manager that decides what to buy for you. And as Mark says, he's personally and emotionally invested in the journey.

Chief Investment Officer of Bennelong Concentrated Australian Equities Fund, Mark East. Source: Supplied

DD: What are the common features of the companies the concentrated fund invests in?

ME: We only invest in high quality companies we think have got good growth prospects and those we think are going to deliver on the market's earnings expectations. So earnings risk, both up and down, is a big focus for us in our analysis and what we do. It's really about investing in companies that we think have good management teams, have a strong balance sheet, generate high risk earnings and also have opportunities out there. We tend to favour companies with structural tailwinds as well.

An example would be the ageing population in Australia, so we've got a fairly large healthcare exposure in our portfolio, and a big exposure to the hospital sector. We're largely bottom up investors, so we invest on a stock-by-stock basis, but we are mindful of economic conditions and macro thematics and those sorts of things can influence the structure of the portfolio and the size of the positions. But we'll never buy a stock for some macro reason, to get exposure to some macro thematic because our view is if you do that, you risk blowing up on a stock specific type basis.

The concentrated fund has about $48 million FUM at the moment. Are you looking to increase this amount?

We've been looking to increase that and think we can manage a lot more in that fund. But I mean, we're not arrogant or anything in any way, but the fund has got a good track record and it sort of surprises me that there's not more demand for it. But, just generally what I hear is there just doesn't seem to be huge demand for concentrated funds.

One point I guess I'd make is we are very selective about what we invest in. You know, companies have got to jump through a lot of hurdles from a quality point of view, so even in our core fund we wouldn't have more than 40 stocks. We just couldn't find enough high quality investments to invest in much more than that.

We've got another fund, the ex-20 Fund, which invest in the ASX 300 less the top 20, so there's been a lot of demand for that from retail investors because a lot of them already own a lot of those top 20 stocks like the banks and Telstra and BHP. So it's a way of getting exposure to the market without doubling up on those sorts of stocks.

What's the investment goal for the fund and does it have a high watermark?

The goal is to outperform the ASX 300 by over four per cent per year over rolling three year periods. We do have a high watermark and the performance fee only kicks in after a two per cent hurdle.

Investors who want capital growth would probably go for this sort of fund. Concentrated funds get a reputation for being high risk, but I guess I see it as a sort of select group of high quality companies, so I think having that real quality bias sort of reduces the risk of a concentrated portfolio.

You've said you are currently overweight in the health care and gaming & leisure sectors. Do you see a lot more growth in companies like Ramsay and Echo?

With the ageing population I think the boom in healthcare seen globally will continue. I haven't got the exact numbers, but I think healthcare spend really kicks when you're over 70 and the bubble of that ageing population hasn't really hit that space yet. So we still think the outlook there is favourable.

We still own Ramsay and we think that's got a number of years of strong earnings growth ahead of it. It's got those sorts of ageing population structural tailwinds here in Australia we spoke of and the public sector is under a bit of funding pressure, so it's increasingly looking to the private sector to step into the healthcare space.

From a gaming point of view, gaming spend in Australia has been pretty resilient. We're seeing reasonable gaming spending, especially in Queensland and New South Wales, so we've still got some exposure via Echo and Aristocrat for that space.

We generally hold companies for fairly long periods unless something in their story changes. As an example we've held Ramsay for over five years now and we've been in business for seven – so we've owned Ramsay for most of that time.

Do you personally invest in the fund?

We all invest in the fund. But we're also all equity holders in Bennelong, the business, and I guess from my point of view, I'm emotionally invested. I know it's people's money that we're managing, so I think that's just as important.

There's been a lot of commentary about the Australian market and how it might perform over the next five years. How do you see it panning out, especially in financials, which you're currently underweight in?

We still think equities are a good place to invest. They've sort of pulled back a bit, so valuations are reasonable. But in the Australian market there are a lot of companies that are structurally challenged, so you've got to be really selective about where you invest.

We think the outlook for the banks is pretty reasonable. It's got 5-6 per cent yields with probably mid-single digit earnings growth, so it's a reasonable return. The concentrated fund is underweight financials and that probably more so reflects some of the other opportunities that we've found elsewhere outside the financial sector, so we've basically used financials to fund them.

In terms of volatility, we're normally fully invested, but we may adjust cash levels if we're concerned about the outlook for the market. But generally I think investing in high quality companies will hold us in pretty good stead.

Daniella D'Ambrosio is a writer at brightday. The Bennelong Concentrated Australian Equities Fund and the core and ex-20 equivalents are available on the brightday platform, which allows a minimum investment of $1,000 in managed funds.