Top floor traps: What's really holding business back

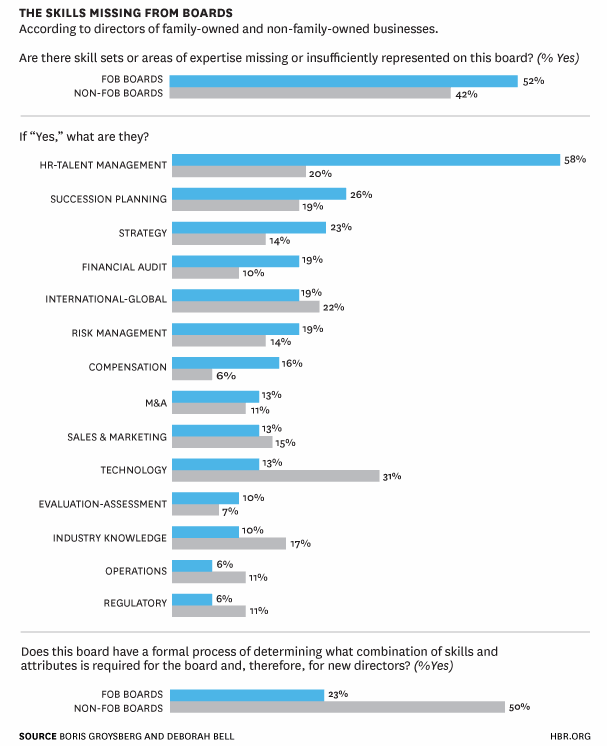

Family business boards are lacking key skills and non-family businesses are way out in front, according to Harvard Business Review research.

Succession management, attracting talent, strategy, financial audit, risk management, compensation, mergers and acquisitions and self-assessment are all stumbling points according to the American data.

Now, the family business owners might say it’s their money on the line; they can do what they want. But Harvard Business School professor Boris Groysberg and Deborah Bell say that family business boards have to lift their game at governance if they want their business to survive. They suggest it might explain why 70 per cent of family businesses only last one generation.

Their study, published in the Harvard Business Review, compared directors on the boards of family-owned versus non-family-owned businesses. On the surface, there were few differences. A similar number of them held degrees: 75 per cent of family business directors and 77 per cent of non-family business directors. There was also little difference in the amount of experience they had, having served on: 5.8 and 6.0 boards each respectively. They were also serving on the same number of boards (3.0).

Closer examination of the data, however, revealed significant gaps.

One of the biggest was in succession planning. Only 41 per cent of family business directors said their boards had an effective CEO succession planning process, versus 56 per cent of non-family business directors.

The most telling finding was that 63 per cent of family business directors said CEO succession was not discussed regularly at the board level. In addition, only 29 per cent of family business directors said their boards had an effective succession planning process in place for directors.

Family business directors were more likely to nominate innovation as their top challenge. They were also more concerned about the rising cost of materials and commodities, debt levels and supply chain risk.

Talent

Attracting and retaining top talent, was the biggest challenge for directors on both family-owned and non-family business boards. There were nine dimensions in talent management: attracting top talent; hiring top talent; assessing talent; developing talent; rewarding talent; retaining talent; firing; aligning talent strategy with business strategy; and leveraging diversity in the company’s workforce.

Significantly, directors from family business boards rated their companies lower than directors on non-family business boards in eight of these nine dimensions. The only one where they came out evenly was on effective firing practices.

The biggest differences were in attracting and retaining talent. Family business boards rated themselves at just 8 per cent when it came to attracting talent, versus 18 per cent for non-family business directors. They rated themselves at 9 per cent for hiring top talent, compared with 15 per cent for non-family businesses. That makes the family business a more insular proposition.

Diversity

Family business boards trailed behind non-family boards on diversity. Less than a third (32 per cent) of family business directors said that a diverse representation on their board was a priority, compared with nearly half the directors (49 per cent) from non-family businesses. Similarly, only 25 per cent of family business boards saw diversity as a strategic priority versus 39 per cent of non-family business boards.

When it came to implementing diversity, only 17 per cent of directors on family business boards said they had adopted measures that successfully advanced diversity on the board, significantly less than the 41 per cent of non-family directors.

Lucio Dana, who runs the company directors course for Family Business Australia, says one of the issues highlighted in the study is that directors of family businesses often include the owners.

Their attitude, he says, is that they own the company and so they can do what they want. If they want to keep it insular, and if they don’t really care about succession management, they have the power to run things their way.

“Often they don’t understand that a director is a position under the company’s code, it’s an onerous position and you’ve got huge responsibilities,” Mr Dana says.

But that, he says, is the case with people who set up the company.

“It is their money after all that is at risk, and it is their businesses they are managing... For them there is a lot at stake and they act accordingly, even conservatively, and without making too much noise.

“They do as they consider appropriate in the circumstances without too much accountability in terms of governance mechanisms such as boards with independent directors,” he says.

Dana says the effective boards are set up by the succeeding generations. “When I run the course, the first generation people come along because they want to anticipate what happens next, but usually the ones that are really keen are second third and fourth generations,” he says.

But then as Groysberg and Bell might say, many of the companies mightn’t last that long.