Too soon to call a rate rise

The cash rate remained at 2.5 per cent in October -- the fourteenth consecutive meeting without a rate move -- and the Reserve Bank of Australia (RBA) has yet again signalled a period of stability. But despite the almost universal agreement among banking economists that rates will rise next year don’t be fooled, the outlook remains as uncertain today as it was at the beginning of this year.

The Australian economy continues to face a number of headwinds -- which if anything have only exacerbated in the past few months -- and it remains unclear whether the non-mining sector is capable of rebounding sufficiently.

At the centre of the debate are two economic shocks. We know they are going to happen -- it’s already begun -- but there remains uncertainty surrounding their size and persistence. I am talking of course about the collapse in mining investment and the decline in the terms-of-trade.

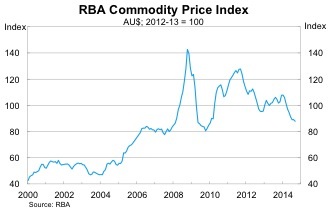

The mining sector finds itself in a precarious position. Iron ore prices have declined by over 40 per cent this year -- with the RBA’s Commodity Price Index down over 18 per cent -- with prices now posing an existential threat to many junior producers.

That may actually be good news for major producers such as BHP Billiton and Rio Tinto -- less competition equals a higher market share -- but lower prices will also convince some resource companies to either delay or cancel investment projects.

The collapse in mining investment -- based on expectations from the ABS’ Capex Survey -- appeared manageable in the June quarter but since then prices and activity have deteriorated more rapidly than the resource sector anticipated. Expect investment intentions to be downgraded for the 2014-15 and 2015-16 financial years.

The terms-of-trade is falling more quickly than most analysts expected and is beginning to flow through to business profits and household incomes. The household sector is already plagued by negative real wages -- which combined with a falling exchange rate -- has cut into their purchasing power.

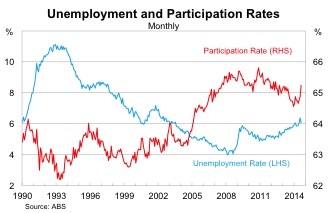

Australian households are feeling poor and their plight has hardly been helped by a rising unemployment rate. The labour market has been plagued by an unusual amount of volatility in recent months but most complementary indicators suggest that if there has been any improvement it has only been minor.

Softer commodity prices will also leave behind some collateral damage -- particularly for the federal budget. Lower iron ore prices and the associated decline in the terms-of-trade have taken a bite out of nominal GDP growth and that equals a downgrade to tax revenue.

Federal Treasurer Joe Hockey must either accept higher deficits over the forward-estimates or prepare the electorate for a bout of austerity.

With these headwinds in place, why are banking economists so adamant that rates will rise next year? Either they are downplaying the terms-of-trade decline or they have bought into the notion that house prices are the only thing that matters.

House prices matter a great deal to the health of the Australian economy but from a monetary policy perspective they are just another indicator and certainly less important than the unemployment or inflation rates.

The RBA is set to take steps to ensure that property prices don’t hijack monetary policy and not a moment too soon. Higher interest rates would curb property investment but macroprudential policies can achieve the same thing without slowing the broader economy.

Once you remove the threat of an overheated housing market why would you raise rates? Do private sector economists really believe that the RBA wants to increase the dollar and compromise the recovery? Do they think the RBA will try to undermine the residential construction boom?

The Australian economy remains tentatively poised and faces a number of considerable challenges. Interest rates are supporting activity, particularly residential construction, but it remains unclear whether the RBA has done enough to boost the non-mining and export industries.

Based on the available information, the almost universal belief that rates will rise next year appears somewhat fanciful. Sure it could happen but there is so much uncertainty surrounding the mining sector that we could just as easily find ourselves with lower rates this time next year.