Too broad to fail: can the G20 outcomes really bring about meaningful change?

Australia held its first G20 meeting over the weekend, and as you may have already read the world’s leading economies have agreed on one thing: growth.

Over the next five years all 20 member countries have vowed to bolster their GDP by 2 per cent over the next five years.

Growth was the major theme of this event but it would be a mistake to believe that the G20 is all about GDP. Over the years, all of the member countries have pledged themselves to a number of other noble, albeit lofty goals. Though, Alan Kohler noted this morning, each G20 meeting tend to see countries talk out a range of new commitments rather than revisit old ones.

Perhaps they should revisit past commitments. As Mike Callaghan, Australia's G20 Finance Deputy wrote in The Lowy Interpreter a core weakness of the G20 is that member countries struggle to work together. The last time the G20 penned a plan for growth in 2010, it failed to be implemented due to individual national interests. It turns out this isn’t the only ambitious G20 goal that is being stymied by countries failing to pull together and act.

So what is the G20's track record?

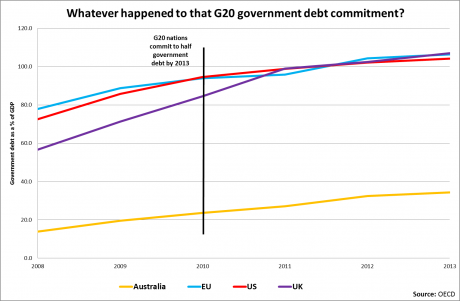

Goal: Halve government debt by 2013

Well, it’s not going down anytime soon.

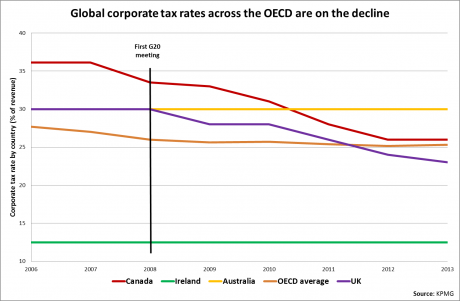

Goal: Work together to plug tax evasion and corporate profit shifting strategies

Last year’s financial secrecy index revealed that developed countries are encouraging corporate tax evasion through existing loopholes in their laws.

Also, as a whole, global corporate tax rates across the OECD are declining, which seems to indicate that countries' way around profit shifting is to drop corporate tax rates.

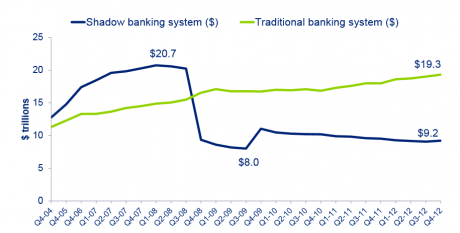

Goal: Regulate shadow banking

Shadow banking has declined under regulation across various countries.

(Source: Deloitte)

The biggest drop in shadow banking is a direct result of the GFC, that being said the scale of shadow banking has remained relatively static since.

Back in 2009, the group took aim at bailouts for companies that are simply ‘too big to fail’. It seems the same point could be argued of some of the outcomes from the G20 meetings. In some cases, they're so broad they're likely to succeed by default rather than by any real effort from the member countries.

Is the G20 a waste of time? Do national interests override any meaningful outcomes from the meeting? Let us know in the comments below.

Follow @HarrisonPolites on Twitter.