Tinkering with education will tear through Australia's social fabric

Few reforms proposed in the federal budget will have the same magnitude of long-term effects as university fee deregulation. By shifting the costs and incentives for university students, the reforms could fundamentally change Australia’s social fabric, with significant implications for career choice.

Education is arguably the most important personal investment any of us will make. But as with other investments, education is associated with considerable risks and costs. Prospective students looking to undertake higher education must weigh the benefits (higher salary, greater career advancement) against the costs (university loans, loss of leisure, forgone earnings).

In the May budget, the federal government proposed to deregulate university fees. Currently student loans are indexed against the inflation rate, which over the past decade has increased by around 2.7 per cent annually. From 2016, students will be charged the 10-year government bond rate up to a maximum of 6 per cent annually (currently around 3.6 per cent).

In addition, student fees will also be uncapped, with demand and supply determining the fees offered to students. This remains the greatest source of uncertainty, though it seems reasonable to assume that fees will increase the most among degrees that offer the greatest returns -- particularly at the most highly regarded institutions.

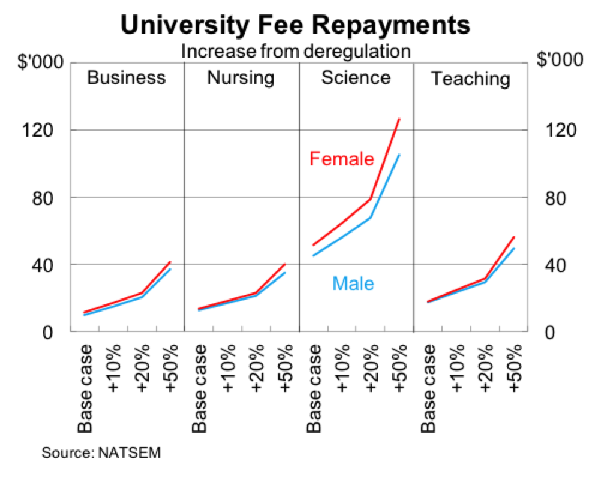

The National Centre for Social and Economic Modelling (NATSEM) at the University of Canberra has done some modelling on the likely effects of university fee deregulation. These results are discussed further by Ben Phillips at The Conversation. They assume that the 10-year government bond rate will be 5 per cent -- which implies a normalisation of rates from their current level of 3.6 per cent.

Their modelling shows that the effect of deregulation is likely to be felt most strongly for those pursuing science degrees and those in lower-paying occupations such as teaching and nursing. Those pursuing business degrees take a hit but to a far lesser extent given their higher earning capacity.

The graph below shows the estimated increase in repayments based on a number of scenarios. The first is the base case, which assumes that the university is happy to simply recover the cost of the government’s planned funding reduction. The other three scenarios show how the repayments change as universities increase their fees by 10, 20 or 50 per cent above the level necessary to recover costs.

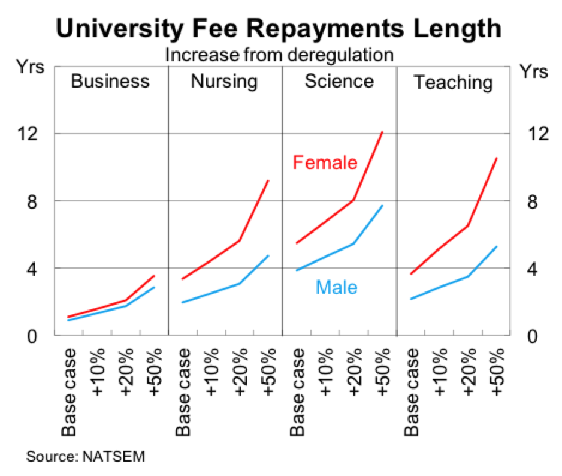

One thing worth emphasising is that fee deregulation is going to disproportionately hurt females since they tend to repay their student loans over a longer period. That is true of the current HELP system, although the effects are largely negligible in most cases. In the absence of lower fees for women, some females may be discouraged from entering university.

As a result of higher indexation, the average repayment length will increase across all degrees. This is pushed higher again if fees increase. Note that the graph below is the increase in the repayment length rather than the total repayment length.

In practice the fee structure resulting from deregulation will not be uniform across disciplines. For example, the fee structure for science degrees is questionable simply because a repayment increase that large would render the degree itself highly unattractive owing to the relatively low return on science degrees in Australia.

But in all likelihood fees will increase across a majority of degrees, which will attract talent towards those degrees which offer the highest return on their investment. That means more commerce and law majors -- so we should brace ourselves for even more investment bankers and lawyers.

As a result, these deregulations have the potential to fundamentally change Australia’s social fabric. Potentially we could be looking at a shortage of nurses and teachers – hardly ideal given our ageing population and the important role teachers play in society. Whether this proves problematic will largely depend on how responsive wages and university fees are to changes in demand and supply.

But these deregulations are also set to have a broader effect on economic activity. Higher student loans will directly affect household spending but there may also be unattended consequences for the housing market.

Income-contingent student loans do not have the risk of other lending -- the only way to default in Australia is by passing away -- but these loans nevertheless reduce your non-HELP lending capacity. This could have a significant effect on the housing market and it’s difficult to see how younger Australians can afford present housing prices once they are saddled with significantly higher student debt.

I wonder how state governments feel about this? It should be a big concern since they rely disproportionately on high house prices and stamp duty to balance their budgets.

The scenarios presented by NATSEM provide some important insight into the impact that university fee deregulation could have on student loans and repayments. But the effect of deregulation will not be uniform and there is considerable uncertainty surrounding the eventual response by universities. Nevertheless, it is widely accepted that fees will increase significantly in 2016.

By embracing a market model, deregulation will probably direct students towards degrees that offer the highest return on investment. In practice, this could mean a shortage of teachers and nurses -- which does not bode well for our ageing population. But the impact of these deregulations will spread beyond career choice and also affect spending patterns and the housing sector.